NEBRASKA SCHEDULE

NEBRASKA SCHEDULE

NEBRASKA SCHEDULE

NEBRASKA SCHEDULE

NEBRASKA SCHEDULE III

III

III

III — Computation of Net Taxable Sales and

— Computation of Net Taxable Sales and

— Computation of Net Taxable Sales and

— Computation of Net Taxable Sales and

— Computation of Net Taxable Sales and

III

FORM

FORM

FORM

FORM

FORM

Nebraska Consumer’s Use Tax

Nebraska Consumer’s Use Tax

Nebraska Consumer’s Use Tax

Nebraska Consumer’s Use Tax

Nebraska Consumer’s Use Tax

10

10

10

nebraska

10

10

• Print your name, I.D. number, and tax period on worksheet

• Print your name, I.D. number, and tax period on worksheet

• Print your name, I.D. number, and tax period on worksheet

• Print your name, I.D. number, and tax period on worksheet

• Print your name, I.D. number, and tax period on worksheet

department

of revenue

• Attach to Form 10

• Attach to Form 10

• Attach to Form 10

• Attach to Form 10

• Attach to Form 10

Name as Shown on Form 10

Nebraska I.D. Number

Tax Period

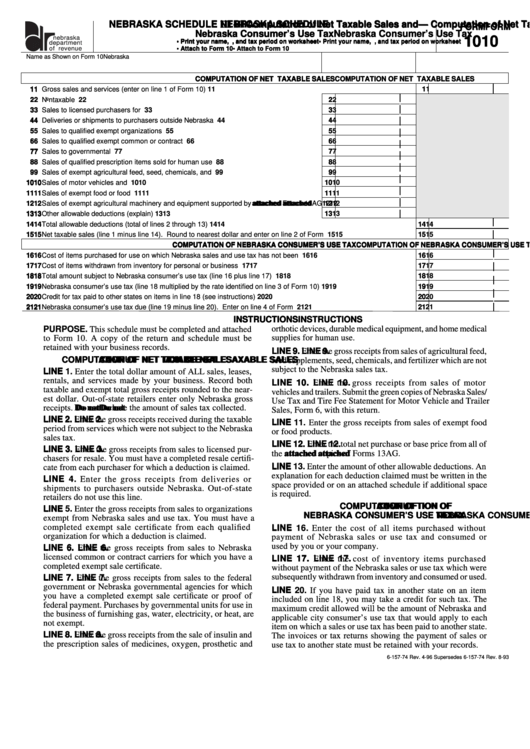

COMPUTATION OF NET TAXABLE SALES

COMPUTATION OF NET TAXABLE SALES

COMPUTATION OF NET TAXABLE SALES

COMPUTATION OF NET TAXABLE SALES

COMPUTATION OF NET TAXABLE SALES

1 1 1 1 1

Gross sales and services (enter on line 1 of Form 10) ............................................................................................................

1 1 1 1 1

2 2 2 2 2

Nontaxable services ...............................................................................................................

2 2 2 2 2

3 3 3 3 3

3 3 3 3 3

Sales to licensed purchasers for resale .................................................................................

4 4 4 4 4

Deliveries or shipments to purchasers outside Nebraska ......................................................

4 4 4 4 4

5 5 5 5 5

Sales to qualified exempt organizations .................................................................................

5 5 5 5 5

6 6 6 6 6

Sales to qualified exempt common or contract carriers .........................................................

6 6 6 6 6

7 7 7 7 7

Sales to governmental agencies .............................................................................................

7 7 7 7 7

8 8 8 8 8

Sales of qualified prescription items sold for human use .......................................................

8 8 8 8 8

9 9 9 9 9

9 9 9 9 9

Sales of exempt agricultural feed, seed, chemicals, and fertilizer .........................................

10

10

10

Sales of motor vehicles and trailers ........................................................................................ 10

10

10

10

10

10

10

11

11

11

11

11

Sales of exempt food or food products ................................................................................... 11

11

11

11

11

12

12

12

12

12

Sales of exempt agricultural machinery and equipment supported by attached

attached

attached

attached

attached Forms 13AG 12

12

12

12

12

13

13

13

13

13

Other allowable deductions (explain) ..................................................................................... 13

13

13

13

13

14

14

14

14

14

14

14

Total allowable deductions (total of lines 2 through 13) ........................................................................................................... 14

14

14

15

15

15

Net taxable sales (line 1 minus line 14). Round to nearest dollar and enter on line 2 of Form 10 ......................................... 15

15

15

15

15

15

15

COMPUTATION OF NEBRASKA CONSUMER’S USE TAX

COMPUTATION OF NEBRASKA CONSUMER’S USE TAX

COMPUTATION OF NEBRASKA CONSUMER’S USE TAX

COMPUTATION OF NEBRASKA CONSUMER’S USE TAX

COMPUTATION OF NEBRASKA CONSUMER’S USE TAX

16

16

16

16

16

Cost of items purchased for use on which Nebraska sales and use tax has not been paid .................................................... 16

16

16

16

16

17

17

17

17

17

Cost of items withdrawn from inventory for personal or business use ..................................................................................... 17

17

17

17

17

18

18

18

18

18

18

18

Total amount subject to Nebraska consumer’s use tax (line 16 plus line 17) .......................................................................... 18

18

18

19

19

19

19

19

19

19

Nebraska consumer’s use tax (line 18 multiplied by the rate identified on line 3 of Form 10) ................................................. 19

19

19

20

20

20

Credit for tax paid to other states on items in line 18 (see instructions) .................................................................................. 20

20

20

20

20

20

20

21

21

21

21

21

Nebraska consumer’s use tax due (line 19 minus line 20). Enter on line 4 of Form 10 .......................................................... 21

21

21

21

21

INSTRUCTIONS

INSTRUCTIONS

INSTRUCTIONS

INSTRUCTIONS

INSTRUCTIONS

PURPOSE.

PURPOSE.

PURPOSE.

PURPOSE.

PURPOSE. This schedule must be completed and attached

orthotic devices, durable medical equipment, and home medical

supplies for human use.

to Form 10. A copy of the return and schedule must be

retained with your business records.

LINE 9.

LINE 9.

LINE 9.

LINE 9.

LINE 9. Enter the gross receipts from sales of agricultural feed,

COMPUT

COMPUT

COMPUTA A A A A TION OF NET

TION OF NET

TION OF NET T T T T T AXABLE SALES

TION OF NET

AXABLE SALES

AXABLE SALES

AXABLE SALES

COMPUT

COMPUT

TION OF NET

AXABLE SALES

feed supplements, seed, chemicals, and fertilizer which are not

subject to the Nebraska sales tax.

LINE 1.

LINE 1.

LINE 1.

LINE 1.

LINE 1. Enter the total dollar amount of ALL sales, leases,

rentals, and services made by your business. Record both

LINE 10.

LINE 10.

LINE 10.

LINE 10.

LINE 10. Enter the gross receipts from sales of motor

taxable and exempt total gross receipts rounded to the near-

vehicles and trailers. Submit the green copies of Nebraska Sales/

est dollar. Out-of-state retailers enter only Nebraska gross

Use Tax and Tire Fee Statement for Motor Vehicle and Trailer

Do not

Do not

receipts. Do not

Do not

Do not include the amount of sales tax collected.

Sales, Form 6, with this return.

LINE 2.

LINE 2.

LINE 2. Enter the gross receipts received during the taxable

LINE 2.

LINE 2.

LINE 11.

LINE 11.

LINE 11.

LINE 11.

LINE 11. Enter the gross receipts from sales of exempt food

period from services which were not subject to the Nebraska

or food products.

sales tax.

LINE 12.

LINE 12.

LINE 12. Enter the total net purchase or base price from all of

LINE 12.

LINE 12.

LINE 3.

LINE 3.

LINE 3.

LINE 3.

LINE 3. Enter the gross receipts from sales to licensed pur-

the attached

attached

attached copies of Forms 13AG.

attached

attached

chasers for resale. You must have a completed resale certifi-

LINE 13.

LINE 13.

LINE 13. Enter the amount of other allowable deductions. An

LINE 13.

LINE 13.

cate from each purchaser for which a deduction is claimed.

explanation for each deduction claimed must be written in the

LINE 4.

LINE 4.

LINE 4. Enter the gross receipts from deliveries or

LINE 4.

LINE 4.

space provided or on an attached schedule if additional space

shipments to purchasers outside Nebraska. Out-of-state

is required.

retailers do not use this line.

COMPUT

COMPUT

COMPUTA A A A A TION OF

COMPUT

COMPUT

TION OF

TION OF

TION OF

TION OF

LINE 5.

LINE 5.

LINE 5.

LINE 5.

LINE 5. Enter the gross receipts from sales to organizations

NEBRASKA CONSUMER’S USE

NEBRASKA CONSUMER’S USE

NEBRASKA CONSUMER’S USE T T T T T AX

AX

AX

NEBRASKA CONSUMER’S USE

NEBRASKA CONSUMER’S USE

AX

AX

exempt from Nebraska sales and use tax. You must have a

completed exempt sale certificate from each qualified

LINE 16.

LINE 16.

LINE 16.

LINE 16.

LINE 16. Enter the cost of all items purchased without

organization for which a deduction is claimed.

payment of Nebraska sales or use tax and consumed or

used by you or your company.

LINE 6.

LINE 6.

LINE 6. Enter the gross receipts from sales to Nebraska

LINE 6.

LINE 6.

licensed common or contract carriers for which you have a

LINE 17.

LINE 17.

LINE 17.

LINE 17.

LINE 17. Enter the cost of inventory items purchased

completed exempt sale certificate.

without payment of the Nebraska sales or use tax which were

subsequently withdrawn from inventory and consumed or used.

LINE 7.

LINE 7.

LINE 7.

LINE 7.

LINE 7. Enter the gross receipts from sales to the federal

government or Nebraska governmental agencies for which

LINE 20.

LINE 20.

LINE 20.

LINE 20.

LINE 20. If you have paid tax in another state on an item

you have a completed exempt sale certificate or proof of

included on line 18, you may take a credit for such tax. The

federal payment. Purchases by governmental units for use in

maximum credit allowed will be the amount of Nebraska and

the business of furnishing gas, water, electricity, or heat, are

applicable city consumer’s use tax that would apply to each

not exempt.

item on which a sales or use tax has been paid to another state.

LINE 8.

LINE 8.

LINE 8.

LINE 8.

LINE 8. Enter the gross receipts from the sale of insulin and

The invoices or tax returns showing the payment of sales or

the prescription sales of medicines, oxygen, prosthetic and

use tax to another state must be retained with your records.

6-157-74 Rev. 4-96 Supersedes 6-157-74 Rev. 8-93

1

1