Quarterly Report - Short-Term Rental - County Of York Virginia

ADVERTISEMENT

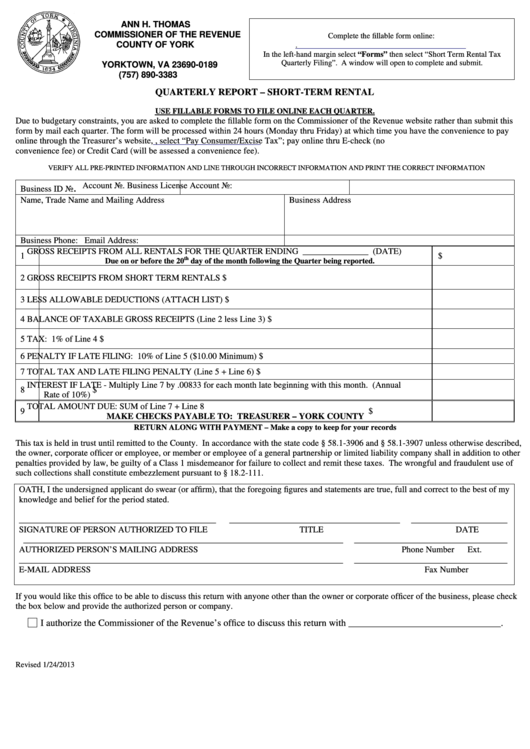

ANN H. THOMAS

COMMISSIONER OF THE REVENUE

Complete the fillable form online:

COUNTY OF YORK

P.O. BOX 189

In the left-hand margin select “Forms” then select “Short Term Rental Tax

Quarterly Filing”. A window will open to complete and submit.

YORKTOWN, VA 23690-0189

(757) 890-3383

QUARTERLY REPORT – SHORT-TERM RENTAL

USE FILLABLE FORMS TO FILE ONLINE EACH QUARTER.

Due to budgetary constraints, you are asked to complete the fillable form on the Commissioner of the Revenue website rather than submit this

form by mail each quarter. The form will be processed within 24 hours (Monday thru Friday) at which time you have the convenience to pay

online through the Treasurer’s website, , select “Pay Consumer/Excise Tax”; pay online thru E-check (no

convenience fee) or Credit Card (will be assessed a convenience fee).

VERIFY ALL PRE-PRINTED INFORMATION AND LINE THROUGH INCORRECT INFORMATION AND PRINT THE CORRECT INFORMATION

Account No.

Business License Account No:

.

Business ID No

Name, Trade Name and Mailing Address

Business Address

Business Phone:

Email Address:

GROSS RECEIPTS FROM ALL RENTALS FOR THE QUARTER ENDING _______________ (DATE)

1

$

th

Due on or before the 20

day of the month following the Quarter being reported.

2

GROSS RECEIPTS FROM SHORT TERM RENTALS

$

3

LESS ALLOWABLE DEDUCTIONS (ATTACH LIST)

$

4

BALANCE OF TAXABLE GROSS RECEIPTS (Line 2 less Line 3)

$

5

TAX: 1% of Line 4

$

6

PENALTY IF LATE FILING: 10% of Line 5 ($10.00 Minimum)

$

7

TOTAL TAX AND LATE FILING PENALTY (Line 5 + Line 6)

$

INTEREST IF LATE - Multiply Line 7 by .00833 for each month late beginning with this month. (Annual

8

$

Rate of 10%)

TOTAL AMOUNT DUE: SUM of Line 7 + Line 8

9

$

MAKE CHECKS PAYABLE TO: TREASURER – YORK COUNTY

RETURN ALONG WITH PAYMENT – Make a copy to keep for your records

This tax is held in trust until remitted to the County. In accordance with the state code § 58.1-3906 and § 58.1-3907 unless otherwise described,

the owner, corporate officer or employee, or member or employee of a general partnership or limited liability company shall in addition to other

penalties provided by law, be guilty of a Class 1 misdemeanor for failure to collect and remit these taxes. The wrongful and fraudulent use of

such collections shall constitute embezzlement pursuant to § 18.2-111.

OATH, I the undersigned applicant do swear (or affirm), that the foregoing figures and statements are true, full and correct to the best of my

knowledge and belief for the period stated.

_____________________________________________

_______________________________________

______________________

SIGNATURE OF PERSON AUTHORIZED TO FILE

TITLE

DATE

_________________________________________________________________________

___________________________________

AUTHORIZED PERSON’S MAILING ADDRESS

Phone Number

Ext.

__________________________________________________________________________

___________________________________

E-MAIL ADDRESS

Fax Number

If you would like this office to be able to discuss this return with anyone other than the owner or corporate officer of the business, please check

the box below and provide the authorized person or company.

I authorize the Commissioner of the Revenue’s office to discuss this return with ________________________________.

Revised 1/24/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1