Form 1 - Loan Submission Summary (Lss)

ADVERTISEMENT

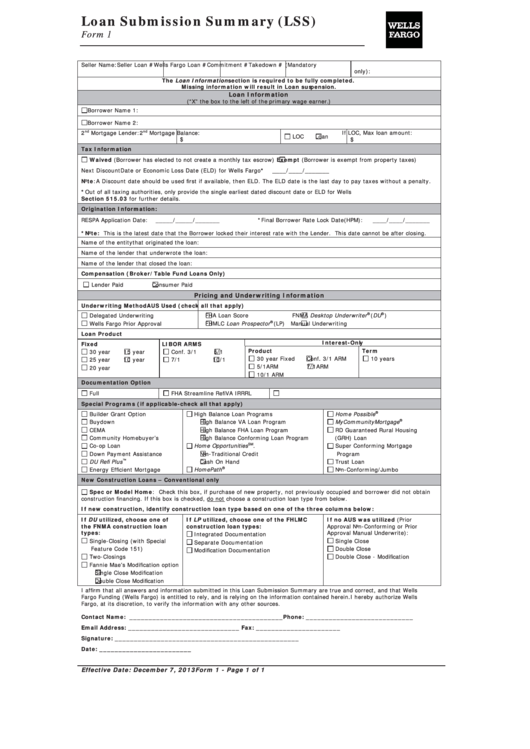

Loan Submission Summary (LSS)

Form 1

Seller Name:

Seller Loan #

Wells Fargo Loan #

Commitment #

Takedown # (Mandatory

only):

The Loan Information section is required to be fully completed.

Missing information will result in Loan suspension.

Loan Information

(“X” the box to the left of the primary wage earner.)

Borrower Name 1:

Borrower Name 2:

nd

nd

2

Mortgage Lender:

2

Mortgage Balance:

If LOC, Max loan amount:

LOC

Loan

$

$

Tax Information

Waived (Borrower has elected to not create a monthly tax escrow)

Exempt (Borrower is exempt from property taxes)

Next Discount Date or Economic Loss Date (ELD) for Wells Fargo*

____/____/_______

Note: A Discount date should be used first if available, then ELD. The ELD date is the last day to pay taxes without a penalty.

*Out of all taxing authorities, only provide the single earliest dated discount date or ELD for Wells Fargo. See Seller Guide

Section 515.03 for further details.

Origination Information:

RESPA Application Date:

_____/_____/_______

*Final Borrower Rate Lock Date (HPM):

____/____/_______

*Note: This is the latest date that the Borrower locked their interest rate with the Lender. This date cannot be after closing.

Name of the entity that originated the loan:

Name of the lender that underwrote the loan:

Name of the lender that closed the loan:

Compensation (Broker/Table Fund Loans Only)

Lender Paid

Consumer Paid

Pricing and Underwriting Information

Underwriting Method

AUS Used (check all that apply)

®

®

Delegated Underwriting

FHA Loan Score

FNMA Desktop Underwriter

(DU

)

Wells Fargo Prior Approval

FHMLC Loan Prospector

®

(LP)

Manual Underwriting

Loan Product

Interest-Only

Fixed

LIBOR ARMS

Product

Term

30 year

15 year

Conf. 3/1

5/1

30 year Fixed

Conf. 3/1 ARM

10 years

25 year

10 year

7/1

10/1

5/1ARM

7/1ARM

20 year

10/1 ARM

Documentation Option

Full

FHA Streamline Refi

VA IRRRL

Special Programs (if applicable-check all that apply)

®

Builder Grant Option

High Balance Loan Programs

Home Possible

Buydown

High Balance VA Loan Program

MyCommunityMortgage

®

CEMA

High Balance FHA Loan Program

RD Guaranteed Rural Housing

Community Homebuyer’s

High Balance Conforming Loan Program

(GRH) Loan

Co-op Loan

Home Opportunities

SM

.

Super Conforming Mortgage

Down Payment Assistance

Non-Traditional Credit

Program

TM

DU Refi Plus

Cash On Hand

Trust Loan

®

Energy Efficient Mortgage

HomePath

Non-Conforming/Jumbo

New Construction Loans – Conventional only

Spec or Model Home: Check this box, if purchase of new property, not previously occupied and borrower did not obtain

construction financing. If this box is checked, do not choose a construction loan type from below.

If new construction, identify construction loan type based on one of the three columns below:

If DU utilized, choose one of

If LP utilized, choose one of the FHLMC

If no AUS was utilized (Prior

the FNMA construction loan

construction loan types:

Approval Non-Conforming or Prior

types:

Approval Manual Underwrite):

Integrated Documentation

Single-Closing (with Special

Single Close

Separate Documentation

Feature Code 151)

Double Close

Modification Documentation

Two-Closings

Double Close - Modification

Fannie Mae’s Modification option

Single Close Modification

Double Close Modification

I affirm that all answers and information submitted in this Loan Submission Summary are true and correct, and that Wells

Fargo Funding (Wells Fargo) is entitled to rely, and is relying on the information contained herein. I hereby authorize Wells

Fargo, at its discretion, to verify the information with any other sources.

Contact Name: ________________________________________ Phone: ____________________________

Email Address: _____________________________ Fax: ______________________

Signature: ________________________________________________

Date: ________________________

Effective Date: December 7, 2013

Form 1 - Page 1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1