Instructions For Completing Form Est-1 - Application For Estate Tax Waiver

ADVERTISEMENT

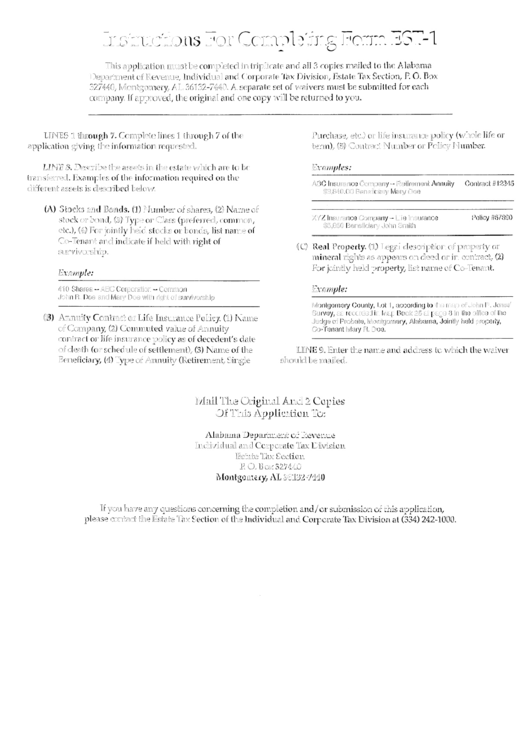

Instructions For Completing Form EST-1

This application must be completed in triplicate and all 3 copies mailed to the Alabama

Department of Revenue, Individual and Corporate Tax Division, Estate Tax Section, P. O. Box

327440, Montgomery, AL 36132-7440. A separate set of waivers must be submitted for each

company. If approved, the original and one copy will be returned to you.

LINES I t h r o u g h 7. Complete lines 1 through 7 of the

Purchase, etc.) or life insurance policy (whole life or

application giving the information requested.

term), (5) Contract N u m b e r or Policy Number.

LINE

Examples:

8. Describe the assets in the estate which are to be

transferred. Examples of the information required on the

ABC Insurance Company - Retirement Annuity

Contract #12345

different assets is described below:

$3,840.00 Beneficiary Mary Doe

(A) Stocks and Bonds. (1) N u m b e r of shares, (2) Name of

XYZ Insurance Company - Life Insurance

Policy #67890

stock or bond, (3) Type or Class (preferred, common,

$5,850 Beneficiary John Smith

etc.), (4) For jointly held stocks or bonds, list name of

Co-Tenant and indicate if held with right of

(C)

Real Property. (1) Legal description of property or

survivorship.

mineral rights as appears on deed or in contract, (2)

For jointly held property, list name of Co-Tenant.

Example:

Example:

410 Shares - ABC Corporation - Common

John R. Doe and Mary Doe with right of survivorship

Montgomery County, Lot 1, according to the map of John P. Jones'

Survey, as recorded in Map Book 25 at page 8 in the office of the

(U)

Annuity Contract or Life Insurance Policy. (1) Name

Judge of Probate, Montgomery, Alabama, Jointly held property,

of Company, (2) C o m m u t e d value of Annuity

Co-Tenant Mary R. Doe.

contract or life insurance policy as of decedent's date

of death (or schedule of settlement), (3) Name of the

LINE 9. Enter the name and address to which the waiver

Beneficiary, (4) Type of Annuity (Retirement, Single

should be mailed.

Mail The Original And 2 Copies

Of This Application To:

Alabama Department of Revenue

Individual and Corporate Tax Division

Estate Tax Section

P. O. Box 327440

Montgomery, AL 36132-7440

If you have any questions concerning the completion a n d / o r submission of this application,

please contact the Estate Tax Section of the Individual and Corporate Tax Division at (334) 242-1000.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2