Instructions For Form 2210 - Underpayment Of Estimated Tax By Individuals, Estates And Trusts

ADVERTISEMENT

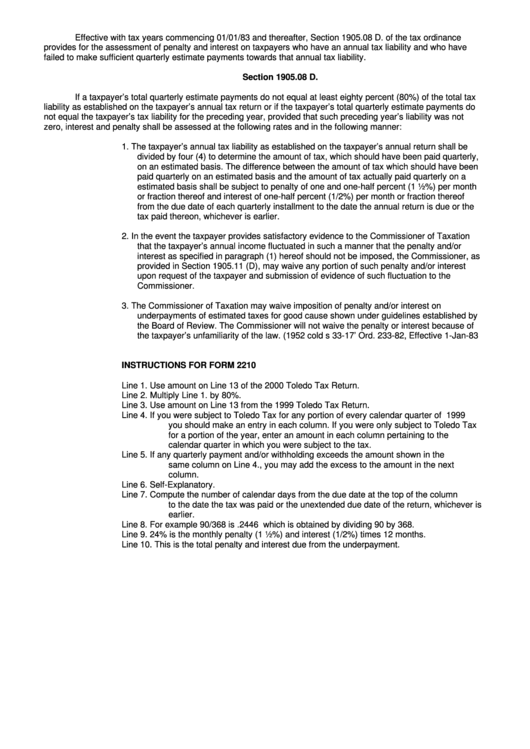

Effective with tax years commencing 01/01/83 and thereafter, Section 1905.08 D. of the tax ordinance

provides for the assessment of penalty and interest on taxpayers who have an annual tax liability and who have

failed to make sufficient quarterly estimate payments towards that annual tax liability.

Section 1905.08 D.

If a taxpayer’s total quarterly estimate payments do not equal at least eighty percent (80%) of the total tax

liability as established on the taxpayer’s annual tax return or if the taxpayer’s total quarterly estimate payments do

not equal the taxpayer’s tax liability for the preceding year, provided that such preceding year’s liability was not

zero, interest and penalty shall be assessed at the following rates and in the following manner:

1. The taxpayer’s annual tax liability as established on the taxpayer’s annual return shall be

divided by four (4) to determine the amount of tax, which should have been paid quarterly,

on an estimated basis. The difference between the amount of tax which should have been

paid quarterly on an estimated basis and the amount of tax actually paid quarterly on a

estimated basis shall be subject to penalty of one and one-half percent (1 ½%) per month

or fraction thereof and interest of one-half percent (1/2%) per month or fraction thereof

from the due date of each quarterly installment to the date the annual return is due or the

tax paid thereon, whichever is earlier.

2. In the event the taxpayer provides satisfactory evidence to the Commissioner of Taxation

that the taxpayer’s annual income fluctuated in such a manner that the penalty and/or

interest as specified in paragraph (1) hereof should not be imposed, the Commissioner, as

provided in Section 1905.11 (D), may waive any portion of such penalty and/or interest

upon request of the taxpayer and submission of evidence of such fluctuation to the

Commissioner.

3. The Commissioner of Taxation may waive imposition of penalty and/or interest on

underpayments of estimated taxes for good cause shown under guidelines established by

the Board of Review. The Commissioner will not waive the penalty or interest because of

the taxpayer’s unfamiliarity of the law. (1952 cold s 33-17’ Ord. 233-82, Effective 1-Jan-83

INSTRUCTIONS FOR FORM 2210

Line 1.

Use amount on Line 13 of the 2000 Toledo Tax Return.

Line 2.

Multiply Line 1. by 80%.

Line 3.

Use amount on Line 13 from the 1999 Toledo Tax Return.

Line 4.

If you were subject to Toledo Tax for any portion of every calendar quarter of 1999

you should make an entry in each column. If you were only subject to Toledo Tax

for a portion of the year, enter an amount in each column pertaining to the

calendar quarter in which you were subject to the tax.

Line 5.

If any quarterly payment and/or withholding exceeds the amount shown in the

same column on Line 4., you may add the excess to the amount in the next

column.

Line 6.

Self-Explanatory.

Line 7.

Compute the number of calendar days from the due date at the top of the column

to the date the tax was paid or the unextended due date of the return, whichever is

earlier.

Line 8.

For example 90/368 is .2446 which is obtained by dividing 90 by 368.

Line 9.

24% is the monthly penalty (1 ½%) and interest (1/2%) times 12 months.

Line 10.

This is the total penalty and interest due from the underpayment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1