Form Tc200 - Valid Only With Application Or Form Tc159 - Addendum To Application For Correction - 2004

ADVERTISEMENT

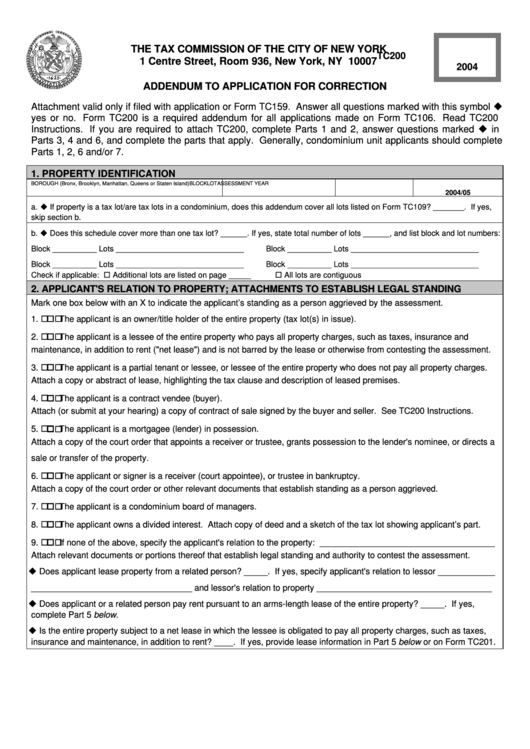

THE TAX COMMISSION OF THE CITY OF NEW YORK

TC200

1 Centre Street, Room 936, New York, NY 10007

2004

ADDENDUM TO APPLICATION FOR CORRECTION

Attachment valid only if filed with application or Form TC159. Answer all questions marked with this symbol

yes or no. Form TC200 is a required addendum for all applications made on Form TC106. Read TC200

Instructions. If you are required to attach TC200, complete Parts 1 and 2, answer questions marked

in

Parts 3, 4 and 6, and complete the parts that apply. Generally, condominium unit applicants should complete

Parts 1, 2, 6 and/or 7.

1. PROPERTY IDENTIFICATION

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

ASSESSMENT YEAR

2004/05

a.

If property is a tax lot/are tax lots in a condominium, does this addendum cover all lots listed on Form TC109?

. If yes,

________

skip section b.

b.

Does this schedule cover more than one tax lot? ______. If yes, state total number of lots ______, and list block and lot numbers:

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Check if applicable:

Additional lots are listed on page _____

All lots are contiguous

2. APPLICANT'S RELATION TO PROPERTY; ATTACHMENTS TO ESTABLISH LEGAL STANDING

Mark one box below with an X to indicate the applicant’s standing as a person aggrieved by the assessment.

1.

The applicant is an owner/title holder of the entire property (tax lot(s) in issue).

2.

The applicant is a lessee of the entire property who pays all property charges, such as taxes, insurance and

maintenance, in addition to rent ("net lease") and is not barred by the lease or otherwise from contesting the assessment.

3.

The applicant is a partial tenant or lessee, or lessee of the entire property who does not pay all property charges.

Attach a copy or abstract of lease, highlighting the tax clause and description of leased premises.

4.

The applicant is a contract vendee (buyer).

Attach (or submit at your hearing) a copy of contract of sale signed by the buyer and seller. See TC200 Instructions.

5.

The applicant is a mortgagee (lender) in possession.

Attach a copy of the court order that appoints a receiver or trustee, grants possession to the lender's nominee, or directs a

sale or transfer of the property.

6.

The applicant or signer is a receiver (court appointee), or trustee in bankruptcy.

Attach a copy of the court order or other relevant documents that establish standing as a person aggrieved.

7.

The applicant is a condominium board of managers.

8.

The applicant owns a divided interest. Attach copy of deed and a sketch of the tax lot showing applicant’s part.

9.

If none of the above, specify the applicant's relation to the property: _____________________________________

Attach relevant documents or portions thereof that establish legal standing and authority to contest the assessment.

Does applicant lease property from a related person? _____. If yes, specify applicant's relation to lessor ____________

__________________________________ and lessor's relation to property _____________________________________

Does applicant or a related person pay rent pursuant to an arms-length lease of the entire property? _____. If yes,

complete Part 5 below.

Is the entire property subject to a net lease in which the lessee is obligated to pay all property charges, such as taxes,

insurance and maintenance, in addition to rent? ____. If yes, provide lease information in Part 5 below or on Form TC201.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2