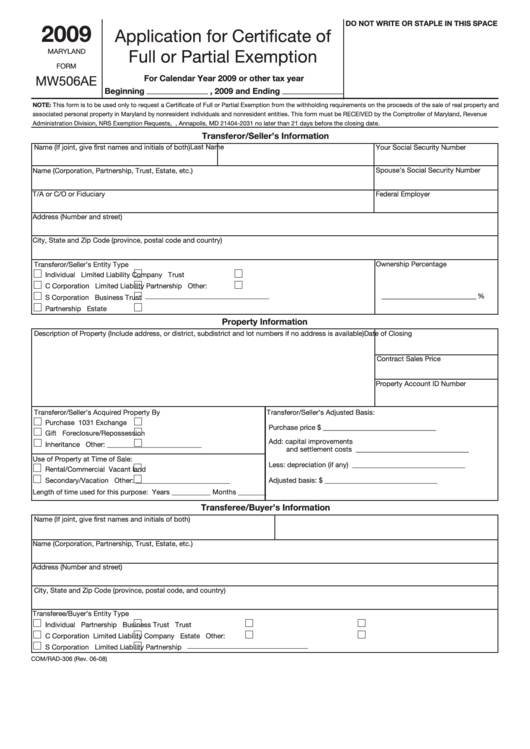

DO NOT WRITE OR STAPLE IN THIS SPACE

2009

Application for Certificate of

Full or Partial Exemption

MARYLAND

FORM

For Calendar Year 2009 or other tax year

MW506AE

Beginning ________________ , 2009 and Ending ________________

NOTE: This form is to be used only to request a Certificate of Full or Partial Exemption from the withholding requirements on the proceeds of the sale of real property and

associated personal property in Maryland by nonresident individuals and nonresident entities. This form must be RECEIVED by the Comptroller of Maryland, Revenue

Administration Division, NRS Exemption Requests, P.O. Box 2031, Annapolis, MD 21404-2031 no later than 21 days before the closing date.

Transferor/Seller’s Information

Last Name

Name (If joint, give first names and initials of both)

Your Social Security Number

Spouse’s Social Security Number

Name (Corporation, Partnership, Trust, Estate, etc.)

T/A or C/O or Fiduciary

Federal Employer I.D. Number

Address (Number and street)

City, State and Zip Code (province, postal code and country)

Ownership Percentage

Transferor/Seller’s Entity Type

Individual

Limited Liability Company

Trust

C Corporation

Limited Liability Partnership

Other:

______________________________________

_____________________________ %

S Corporation

Business Trust

Partnership

Estate

Property Information

Description of Property (Include address, or district, subdistrict and lot numbers if no address is available)

Date of Closing

Contract Sales Price

Property Account ID Number

Transferor/Seller’s Acquired Property By

Transferor/Seller’s Adjusted Basis:

Purchase

1031 Exchange

Purchase price

$ ________________________________

Gift

Foreclosure/Repossession

Add: capital improvements

Inheritance

Other: _____________________________

and settlement costs

________________________________

Use of Property at Time of Sale:

Less: depreciation (if any)

________________________________

Rental/Commercial

Vacant land

Adjusted basis:

$ ________________________________

Secondary/Vacation

Other: _____________________________

Length of time used for this purpose: Years ___________ Months ________

Transferee/Buyer’s Information

Name (If joint, give first names and initials of both)

Name (Corporation, Partnership, Trust, Estate, etc.)

Address (Number and street)

City, State and Zip Code (province, postal code, and country)

Transferee/Buyer’s Entity Type

Individual

Partnership

Business Trust

Trust

C Corporation

Limited Liability Company

Estate

Other:

_____________________________________

S Corporation

Limited Liability Partnership

COM/RAD-306 (Rev. 06-08)

1

1 2

2