Form A-212 - Petition For Compromise Of Delinquent Taxes - Wisconsin Department Of Revenue

ADVERTISEMENT

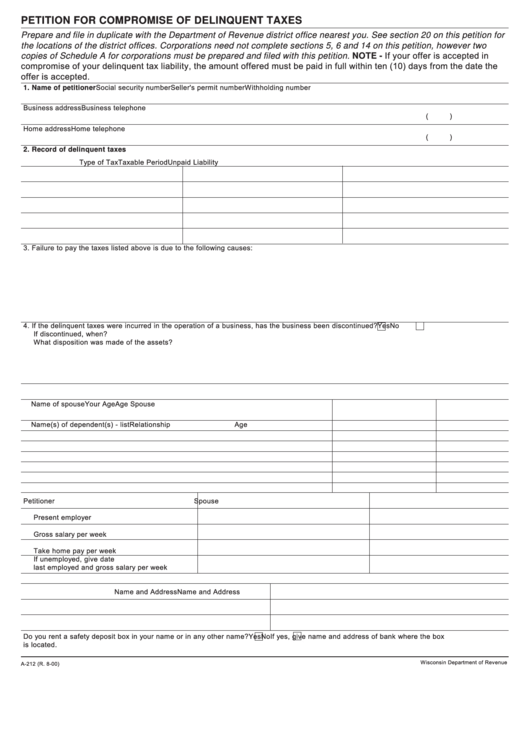

PETITION FOR COMPROMISE OF DELINQUENT TAXES

Prepare and file in duplicate with the Department of Revenue district office nearest you. See section 20 on this petition for

the locations of the district offices. Corporations need not complete sections 5, 6 and 14 on this petition, however two

copies of Schedule A for corporations must be prepared and filed with this petition. NOTE - If your offer is accepted in

compromise of your delinquent tax liability, the amount offered must be paid in full within ten (10) days from the date the

offer is accepted.

Social security number

Seller's permit number

Withholding number

1. Name of petitioner

Business address

Business telephone

(

)

Home address

Home telephone

(

)

2. Record of delinquent taxes

Type of Tax

Taxable Period

Unpaid Liability

3. Failure to pay the taxes listed above is due to the following causes:

4. If the delinquent taxes were incurred in the operation of a business, has the business been discontinued?

Yes

No

If discontinued, when?

What disposition was made of the assets?

5. Family information

Name of spouse

Your Age

Age Spouse

Name(s) of dependent(s) - list

Relationship

Age

Petitioner

Spouse

6. Employment information

Present employer

Gross salary per week

Take home pay per week

If unemployed, give date

last employed and gross salary per week

7. List names of banks and other financial institutions you have done business with any time during the past 3 years.

Name and Address

Name and Address

Do you rent a safety deposit box in your name or in any other name?

Yes

No

If yes, give name and address of bank where the box

is located.

Wisconsin Department of Revenue

A-212 (R. 8-00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4