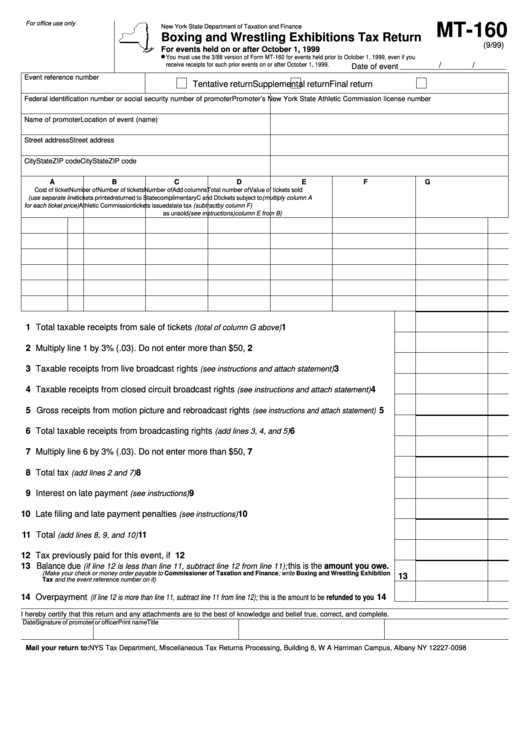

Form Mt-160 - Boxing And Wrestling Exhibitions Tax Return - 1999

ADVERTISEMENT

For office use only

MT-160

New York State Department of Taxation and Finance

Boxing and Wrestling Exhibitions Tax Return

(9/99)

For events held on or after October 1, 1999

You must use the 3/88 version of Form MT-160 for events held prior to October 1, 1999, even if you

receive receipts for such prior events on or after October 1, 1999.

/

/

Date of event

Event reference number

Tentative return

Supplemental return

Final return

Federal identification number or social security number of promoter

Promoter’s New York State Athletic Commission license number

Name of promoter

Location of event (name)

Street address

Street address

City

State

ZIP code

City

State

ZIP code

A

B

C

D

E

F

G

Cost of ticket

Number of

Number of tickets

Number of

Add columns

Total number of

Value of tickets sold

(use separate line

tickets printed

returned to State

complimentary

C and D

tickets subject to

(multiply column A

for each ticket price)

Athletic Commission

tickets issued

state tax (subtract

by column F)

as unsold

(see instructions)

column E from B)

1 Total taxable receipts from sale of tickets

...........................................

1

(total of column G above)

2 Multiply line 1 by 3% (.03). Do not enter more than $50,000 ...................................................

2

3 Taxable receipts from live broadcast rights

.....................

3

(see instructions and attach statement)

4 Taxable receipts from closed circuit broadcast rights

......

4

(see instructions and attach statement)

5 Gross receipts from motion picture and rebroadcast rights

....

5

(see instructions and attach statement)

6 Total taxable receipts from broadcasting rights

.......................................

6

(add lines 3, 4, and 5)

7 Multiply line 6 by 3% (.03). Do not enter more than $50,000 ...................................................

7

8 Total tax

.......................................................................................................

8

(add lines 2 and 7)

9 Interest on late payment

................................................................................

9

(see instructions)

10 Late filing and late payment penalties

............................................................ 10

(see instructions)

11 Total

......................................................................................................

11

(add lines 8, 9, and 10)

12 Tax previously paid for this event, if any ..................................................................................

12

13 Balance due

this is the amount you owe.

(if line 12 is less than line 11, subtract line 12 from line 11);

(Make your check or money order payable to Commissioner of Taxation and Finance; write Boxing and Wrestling Exhibition

13

...............................................................................................

Tax and the event reference number on it)

14 Overpayment

..... 14

(if line 12 is more than line 11, subtract line 11 from line 12); this is the amount to be refunded to you

I hereby certify that this return and any attachments are to the best of knowledge and belief true, correct, and complete.

Date

Signature of promoter or officer

Print name

Title

Mail your return to: NYS Tax Department, Miscellaneous Tax Returns Processing, Building 8, W A Harriman Campus, Albany NY 12227-0098

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1