Form D-40x - Amended Individual Income Tax Return - 2000

ADVERTISEMENT

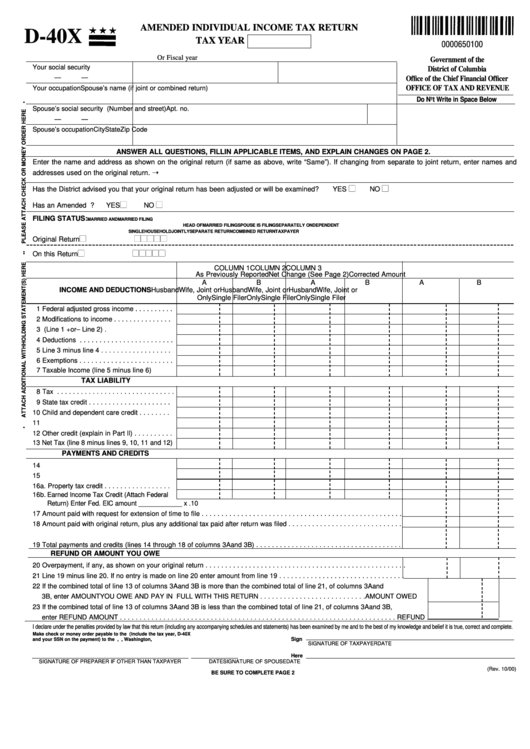

AMENDED INDIVIDUAL INCOME TAX RETURN

D-40X

TAX YEAR

0000650100

Or Fiscal year Beginning..................................... Ending.......................................

Government of the

Your social security no.

Your first name and initial

Last name

District of Columbia

—

—

Office of the Chief Financial Officer

Your occupation

Spouse’s name (if joint or combined return)

OFFICE OF TAX AND REVENUE

Do Not Write in Space Below

Spouse’s social security no.

Present home address (Number and street)

Apt. no.

—

—

Spouse’s occupation

City

State

Zip Code

ANSWER ALL QUESTIONS, FILL IN APPLICABLE ITEMS, AND EXPLAIN CHANGES ON PAGE 2.

Enter the name and address as shown on the original return (if same as above, write “Same”). If changing from separate to joint return, enter names and

addresses used on the original return.

Has the District advised you that your original return has been adjusted or will be examined?

YES

NO

Has an Amended D.C. Return been filed previously for this year?

YES

NO

FILING STATUS:

MARRIED AND

MARRIED FILING

HEAD OF

MARRIED FILING

SPOUSE IS FILING

SEPARATELY ON

DEPENDENT

SINGLE

HOUSEHOLD

JOINTLY

SEPARATE RETURN

COMBINED RETURN

TAXPAYER

Original Return

On this Return

COLUMN 1

COLUMN 2

COLUMN 3

As Previously Reported

Net Change (See Page 2)

Corrected Amount

A

B

A

B

A

B

INCOME AND DEDUCTIONS

Husband

Wife, Joint or

Husband

Wife, Joint or

Husband

Wife, Joint or

Only

Single Filer

Only

Single Filer

Only

Single Filer

1 Federal adjusted gross income . . . . . . . . . .

2 Modifications to income . . . . . . . . . . . . . . .

3 D.C. adj. gross income (Line 1 +or– Line 2) .

4 Deductions . . . . . . . . . . . . . . . . . . . . . . . .

5 Line 3 minus line 4 . . . . . . . . . . . . . . . . . .

6 Exemptions . . . . . . . . . . . . . . . . . . . . . . . .

7 Taxable Income (line 5 minus line 6)

TAX LIABILITY

8 Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 State tax credit . . . . . . . . . . . . . . . . . . . . .

10 Child and dependent care credit . . . . . . . .

11 D.C. Low Income Credit . . . . . . . . . . . . . . .

12 Other credit (explain in Part II) . . . . . . . . . .

13 Net Tax (line 8 minus lines 9, 10, 11 and 12)

PAYMENTS AND CREDITS

14 D.C. Income tax withheld . . . . . . . . . . . . . .

15 D.C. Estimated tax payment . . . . . . . . . . .

16a. Property tax credit . . . . . . . . . . . . . . . . .

16b. Earned Income Tax Credit (Attach Federal

Return) Enter Fed. EIC amount ____________ x .10

17 Amount paid with request for extension of time to file . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18 Amount paid with original return, plus any additional tax paid after return was filed . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 Total payments and credits (lines 14 through 18 of columns 3A and 3B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

REFUND OR AMOUNT YOU OWE

20 Overpayment, if any, as shown on your original return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21 Line 19 minus line 20. If no entry is made on line 20 enter amount from line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 If the combined total of line 13 of columns 3A and 3B is more than the combined total of line 21, of columns 3A and

3B, enter AMOUNT YOU OWE AND PAY IN FULL WITH THIS RETURN . . . . . . . . . . . . . . . . . . . . . . . . . . . AMOUNT OWED

23 If the combined total of line 13 of columns 3A and 3B is less than the combined total of line 21, of columns 3A and 3B,

enter REFUND AMOUNT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . REFUND

I declare under the penalties provided by law that this return (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief it is true, correct and complete.

Make check or money order payable to the D.C. Treasurer. Mail return and payment (include the tax year, D-40X

and your SSN on the payment) to the D.C. Office of Tax and Revenue, P.O. Box 7861, Washington, D.C. 20044-7861

Sign

SIGNATURE OF TAXPAYER

DATE

Here

SIGNATURE OF PREPARER IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF SPOUSE

DATE

(Rev. 10/00)

BE SURE TO COMPLETE PAGE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2