Form Rv-2 Instructions - Periodic Rental Motor Vehicle, Tour Vehicle, And Car-Sharing Vehicle Surcharge Tax Return - 2016

ADVERTISEMENT

HOW TO COMPLETE YOUR PERIODIC

FORM RV-2

INSTRUCTIONS

RENTAL MOTOR VEHICLE, TOUR VEHICLE, AND CAR-SHARING VEHICLE

(REV. 2016)

SURCHARGE TAX RETURN (FORM RV-2)

WHO MUST FILE

20% of the tax unpaid within 60 days of the prescribed due

date.

The rental motor vehicle, tour vehicle, and car-sharing

Failure to Pay by EFT — The penalty for failure to pay by

vehicle surcharge tax (RV tax) contains three separate

EFT for taxpayers who are required to pay by EFT is 2% of

taxes with different tax rates:

the tax due.

1) The rental motor vehicle surcharge tax is levied at the

Interest — Interest at the rate of 2/3 of 1% per month, or

rate of $3 per day, or a portion of a day, on the lessor of any

part of a month, shall be assessed on unpaid taxes and

rental motor vehicle.

penalties beginning with the first calendar day after the date

2) The tour vehicle surcharge tax is imposed on tour

prescribed for payment, whether or not that first calendar

vehicle operators for use of a vehicle on a monthly basis, or

day falls on Saturday, Sunday, or legal holiday.

a portion of a month, at the following rates:

Please check your return carefully. Additional penalties may

•

$65 - Over 25 passenger tour vehicle; and

be assessed if you make an underpayment of tax due to

negligence, intentional disregard of the Department’s rules,

•

$15 - 8 to 25 passenger tour vehicle.

or fraud.

3) The car-sharing vehicle surcharge tax is levied at the

Follow the example presented in italics for a sample of

rate of $0.25 (25 cents) per half-hour, or any portion of a

how to fill out the form. The circled numbers on the sample

half-hour, that a rental motor vehicle is rented or leased by

form correspond to the steps in the instructions.

a car-sharing organization; provided that for each rental of

six hours or more, the rental motor vehicle surcharge tax

Example: A taxpayer, BTK Car-Sharing, Rentals, and

shall be assessed. The car-sharing vehicle surcharge tax is

Tour Vehicles (BTK), with Hawaii Tax I.D. No. RV-

levied on the car-sharing organization.

123-456-7890-01, files its January return. On Oahu,

BTK operates a car-sharing membership program,

FILING FREQUENCY

and has twenty rental cars, two tour vehicles (8-25

passengers), and one tour vehicle (40 passengers).

RV tax periodic returns (Form RV-2) are filed on a

For the month of January, rental motor vehicles in

monthly, quarterly, or semiannual basis depending on the

the car-sharing membership program were rented

amount of a person’s tax liability. Form RV-2 is due with

for 1,202 car-sharing vehicle half-hours. The twenty

rental cars were rented for 550 rental days of which 30

payment on or before the 20th day of the calendar month

rental days were to lessees whose vehicles were being

following the close of the filing period. For example, if

repaired. The rental cars were, therefore, rented for a

your filing period ends on January 31st, then your return and

total of 520 net rental days. Both of the vans and the

payment will be due on February 20th. An RV tax annual

tour bus were in service for the month of January.

return and reconciliation (Form RV-3) summarizing RV tax

activity for the past year also must be filed.

Note: The taxpayer must have an average paid use period

of six hours or less across all vehicles rented.

Taxpayers whose liability for the RV tax exceeds

$100,000 per year are required to pay the tax by Electronic

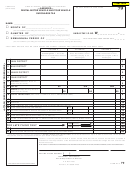

THE TOP OF THE TAX RETURN (fig. 2.0)

Funds Transfer (EFT).

STEP 1 - Write your name (taxpayer’s name) in the area

These instructions will assist you in filling out your

periodic RV tax returns (Form RV-2) correctly.

provided.

STEP 2 - Enter your Hawaii Tax I.D. No. in the area provided.

If a payment is being made with Form RV-2, make

your check or money order payable to “Hawaii State Tax

STEP 3 - Enter the last 4 digits of your FEIN or SSN in the

Collector.” Write “RV”, the filing period, your Hawaii Tax I.D.

area provided.

No., and your daytime phone number on the check. Attach

STEP 4 - Enter the filing period information with the

your check or money order where indicated on Form RV-2.

appropriate numeric (two digit) month and year end for the

last month of the filing period (e.g., Month of January 2017

IMPORTANT!!!

= 01/17; Quarterly period of January through March 2017 =

03/17; Semiannual period of January through June 2017 =

If you do not have any RV tax activity, and the result

06/17).

is no tax liability, enter “0.00” on line 8. This periodic

return must be filed.

BTK files monthly returns, so BTK entered 01/17 for

the numeric month and year end for the month of the

To correct a previously filed Form RV-2, file an amended

filing period.

return on Form RV-2.

PENALTIES AND INTEREST

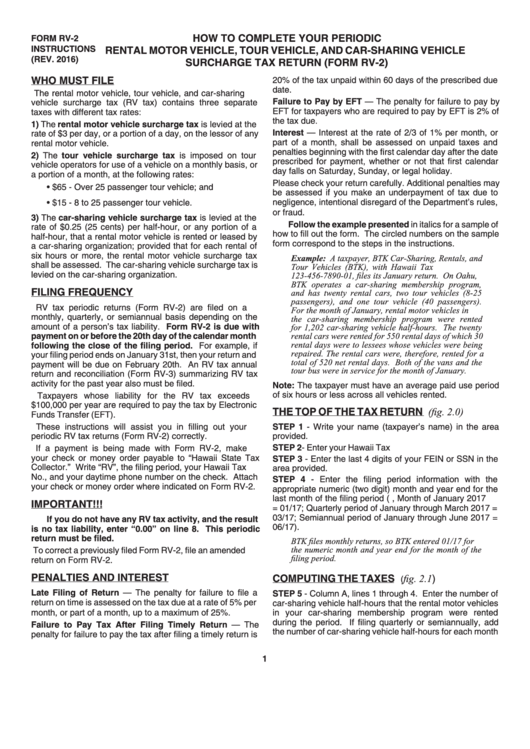

fig. 2.1)

COMPUTING THE TAXES

(

Late Filing of Return — The penalty for failure to file a

STEP 5 - Column A, lines 1 through 4. Enter the number of

return on time is assessed on the tax due at a rate of 5% per

car-sharing vehicle half-hours that the rental motor vehicles

month, or part of a month, up to a maximum of 25%.

in your car-sharing membership program were rented

during the period. If filing quarterly or semiannually, add

Failure to Pay Tax After Filing Timely Return — The

the number of car-sharing vehicle half-hours for each month

penalty for failure to pay the tax after filing a timely return is

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4