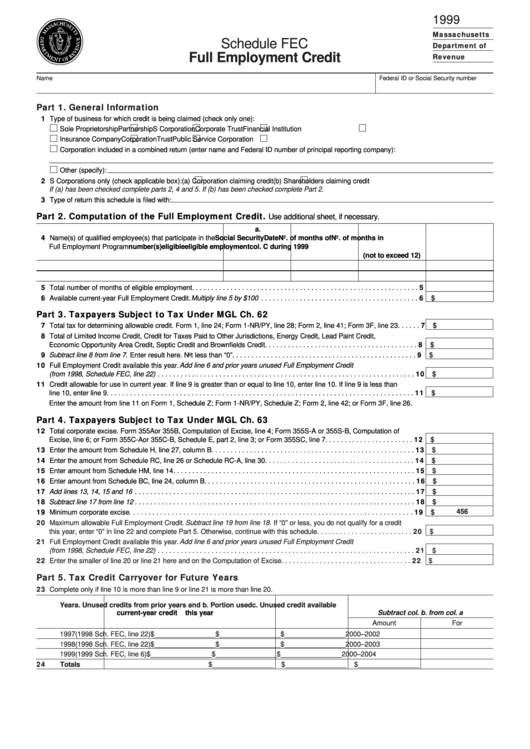

Schedule Fec - Full Employment Credit - 1999

ADVERTISEMENT

1999

Massachusetts

Schedule FEC

Department of

Full Employment Credit

Revenue

Name

Federal ID or Social Security number

Part 1. General Information

11 Type of business for which credit is being claimed (check only one):

Sole Proprietorship

Partnership

S Corporation

Corporate Trust

Financial Institution

Insurance Company

Corporation

Trust

Public Service Corporation

Corporation included in a combined return (enter name and Federal ID number of principal reporting company):

Other (specify):

12 S Corporations only (check applicable box): (a)

Corporation claiming credit (b)

Shareholders claiming credit

If (a) has been checked complete parts 2, 4 and 5. If (b) has been checked complete Part 2.

13 Type of return this schedule is filed with:

Part 2. Computation of the Full Employment Credit.

Use additional sheet, if necessary.

a.

b.

c.

d.

14 Name(s) of qualified employee(s) that participate in the

Social Security

Date

No. of months of

No. of months in

Full Employment Program

number(s)

eligible

eligible employment col. C during 1999

(not to exceed 12)

15 Total number of months of eligible employment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Available current-year Full Employment Credit. Multiply line 5 by $100 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 $

Part 3. Taxpayers Subject to Tax Under MGL Ch. 62

17 Total tax for determining allowable credit. Form 1, line 24; Form 1-NR/PY, line 28; Form 2, line 41; Form 3F, line 23 . . . . . . 7 $

18 Total of Limited Income Credit, Credit for Taxes Paid to Other Jurisdictions, Energy Credit, Lead Paint Credit,

Economic Opportunity Area Credit, Septic Credit and Brownfields Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 $

19 Subtract line 8 from line 7. Enter result here. Not less than “0”. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 $

10 Full Employment Credit available this year. Add line 6 and prior years unused Full Employment Credit

(from 1998, Schedule FEC, line 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 $

11 Credit allowable for use in current year. If line 9 is greater than or equal to line 10, enter line 10. If line 9 is less than

line 10, enter line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 $

Enter the amount from line 11 on Form 1, Schedule Z; Form 1-NR/PY, Schedule Z; Form 2, line 42; or Form 3F, line 26.

Part 4. Taxpayers Subject to Tax Under MGL Ch. 63

12 Total corporate excise. Form 355A or 355B, Computation of Excise, line 4; Form 355S-A or 355S-B, Computation of

Excise, line 6; or Form 355C-A or 355C-B, Schedule E, part 2, line 3; or Form 355SC, line 7. . . . . . . . . . . . . . . . . . . . . . . 12 $

13 Enter the amount from Schedule H, line 27, column B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 $

14 Enter the amount from Schedule RC, line 26 or Schedule RC-A, line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 $

15 Enter amount from Schedule HM, line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 $

16 Enter amount from Schedule BC, line 24, column B. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 $

17 Add lines 13, 14, 15 and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 $

18 Subtract line 17 from line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 $

456

19 Minimum corporate excise . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 $

20 Maximum allowable Full Employment Credit. Subtract line 19 from line 18. If “0” or less, you do not qualify for a credit

this year, enter “0” in line 22 and complete Part 5. Otherwise, continue with this schedule . . . . . . . . . . . . . . . . . . . . . . . . . 20 $

21 Full Employment Credit available this year. Add line 6 and prior years unused Full Employment Credit

(from 1998, Schedule FEC, line 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 $

22 Enter the smaller of line 20 or line 21 here and on the Computation of Excise . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 $

Part 5. Tax Credit Carryover for Future Years

23 Complete only if line 10 is more than line 9 or line 21 is more than line 20.

Year

a. Unused credits from prior years and

b. Portion used

c. Unused credit available

a.

current-year credit

b.

this year

Subtract col. b. from col. a

Amount

For

1997

(1998 Sch. FEC, line 22)

$________________

$________________

$________________

2000–2002

1998

(1998 Sch. FEC, line 22)

$________________

$________________

$________________

2000–2003

1999

(1999 Sch. FEC, line 6)

$________________

$________________

$________________

2000–2004

24

Totals

$________________

$________________

$________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1