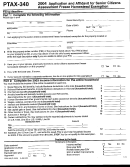

Part 4: Affidavit

Sworn under oath, I state the following:

1

(Mark the statement that applies.)

On January 1, 2017, the property identified in Part 2, Line 1, was improved with a permanent structure

a

that I used as my principal residence.

____

b

for which I received this exemption previously and is either unoccupied or used as my spouse’s principal residence. I

____

am now a resident of a facility licensed under the Assisted Living and Shared Housing Act, Nursing Home Care Act,

ID/DD (intellectually disabled/developmentally disabled) Community Care Act, or Specialized Mental Health Rehabili-

tation Act of 2013.

_______________________________________

_________________________________________________

Name of facility

Mailing address

2

(Mark the statement that applies.)

On January 1, 2017,

I

a

was the owner of record of the property identified in Part 2, Line 1.

____

b

had a legal or equitable interest by a written instrument in the property listed in Part 2, Line 1.

____

c

____

had a leasehold interest in the property identified in Part 2, Line 1, that was used as a single-family residence.

3

I am liable for paying real property taxes on the property identified in Part 2, Line 1.

Note:

If I have not received this exemption for this property previously, I also met the eligibility requirements listed in Part 4,

Lines 1, 2, and 3 for this property on January 1, 2016.

4

(Mark the statement that applies.)

a

____ In 2017,

I am, or will be, 65 years of age or older.

b

my s pouse, who died in 2017, would have been 65 years of age or older. (Complete the following information.)

____ In 2017,

_____________________________________________

__________________________________________________

Deceased spouse’s name

Tax ID number

____ ____ /____ ____ /____ ____ ____ ____

____ ____ /____ ____ /____ ____ ____ ____

Date of birth (month, day, year)

Date of death (month, day, year)

5

The property identified in Part 2, Line 1, is the only property for which I am applying for a senior citizens assessment freeze

homestead exemption for 201 7 .

6

The amount reported in Part 3, Line 13, of this form includes the income of my spouse and all persons living in my household

and the total household income for 201 6 is $55,000 or less.

7

On January 1, 201 7 , the following individuals also used the property identified in Part 2, Line 1, for their principal residence.

My spouse is included if he or she used the property as his or her principal dwelling place on January 1, 201 7 . The total

income of all individuals and my spouse (regardless of his or her principal residence) are included in Part 3. (Attach an ad-

ditional sheet if necessary.)

First and last name

Tax ID number

a

__________________________________________________

__________________________________________________

b

__________________________________________________

__________________________________________________

8

(Mark the statement that applies.)

On January 1, 201 7 , I was

a

b

c

single, widow(er), or divorced.

____ married and living together.

married, but not living together.

____

____

My spouse’s name and address is

_____________________________________________________________________________

First name

MI

Last name

_____________________________________________________________________________________________________________

Street Address

City

State

ZIP

Under penalties of perjury, I state that, to the best of my knowledge, the information contained in this affidavit is true, correct, and complete.

_______________________________________ ____ ____/____ ____/____ ____ ____ ____

Signature of applicant

Date (month, day, year)

Subscribed and sworn to before me this

day of

20

_______

________________________________,

_____.

____________________________________________________

Notary public

Note: The CCAO may conduct an audit to verify that the taxpayer is eligible to receive this exemption.

Mail your completed Form PTAX-340 to:

If you have any questions, please call:

_________________Co. Chief County Assessment Officer

(_________)_________ _________________________________

—

_______________________________________________________

Last date to apply ___ ___/___ ___/___ ___ ___ ___

Mailing address

Month

Day

Year

____________________________________IL _________________

ZIP

City

This form is authorized in accordance with the Illinois Property Tax Code. Disclosure of this information is required.

Failure to provide information may result in this form not being processed and may result in a penalty.

2 of 4

PTAX-340 (R-12/16)

Reset

Print

1

1 2

2