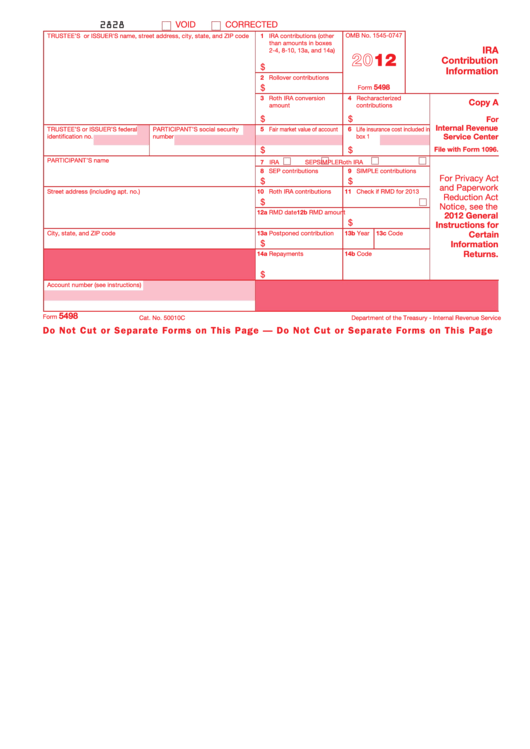

Form 5498 - Ira Contribution Information - 2012

ADVERTISEMENT

2828

VOID

CORRECTED

TRUSTEE’S or ISSUER'S name, street address, city, state, and ZIP code

1 IRA contributions (other

OMB No. 1545-0747

than amounts in boxes

IRA

2-4, 8-10, 13a, and 14a)

2012

Contribution

$

Information

2 Rollover contributions

5498

$

Form

3 Roth IRA conversion

4 Recharacterized

Copy A

amount

contributions

$

$

For

Internal Revenue

TRUSTEE’S or ISSUER’S federal

PARTICIPANT’S social security

5 Fair market value of account

6 Life insurance cost included in

Service Center

identification no.

number

box 1

$

$

File with Form 1096.

PARTICIPANT’S name

7 IRA

SEP

SIMPLE

Roth IRA

8 SEP contributions

9 SIMPLE contributions

For Privacy Act

$

$

and Paperwork

Street address (including apt. no.)

10 Roth IRA contributions

11 Check if RMD for 2013

Reduction Act

$

Notice, see the

12a RMD date

12b RMD amount

2012 General

$

Instructions for

City, state, and ZIP code

13a Postponed contribution

13b Year

13c Code

Certain

$

Information

14a Repayments

14b Code

Returns.

$

Account number (see instructions)

5498

Form

Cat. No. 50010C

Department of the Treasury - Internal Revenue Service

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5