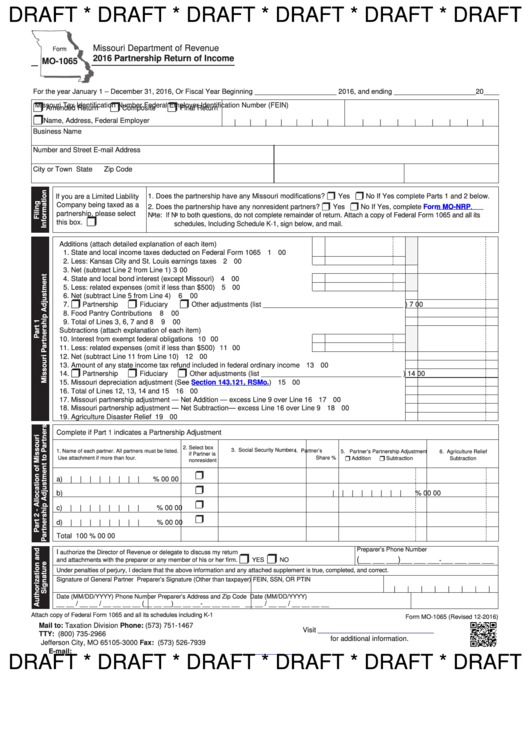

Form Mo-1065 Draft - Partnership Return Of Income - 2016

ADVERTISEMENT

DRAFT * DRAFT * DRAFT * DRAFT * DRAFT * DRAFT

Missouri Department of Revenue

Form

2016 Partnership Return of Income

MO-1065

For the year January 1 – December 31, 2016, Or Fiscal Year Beginning _____________________ 2016, and ending _____________________20____

r

r

r

Missouri Tax Identification Number

Federal Employer Identification Number (FEIN)

Amended Return

Composite

Final Return

r

Name, Address, Federal Employer I.D. Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Name

Number and Street

E-mail Address

City or Town

State

Zip Code

r

r

If you are a Limited Liability

1. Does the partnership have any Missouri modifications?

Yes

No If Yes complete Parts 1 and 2 below.

r

r

Company being taxed as a

2. Does the partnership have any nonresident partners?

Yes

No If Yes, complete

Form

MO-NRP.

partnership, please select

Note: If No to both questions, do not complete remainder of return. Attach a copy of Federal Form 1065 and all its

r

this box.

schedules, Including Schedule K-1, sign below, and mail.

Additions (attach detailed explanation of each item)

1. State and local income taxes deducted on Federal Form 1065 ........................

1

00

2. Less: Kansas City and St. Louis earnings taxes ................................................

2

00

3. Net (subtract Line 2 from Line 1) ......................................................................................................................... 3

00

4. State and local bond interest (except Missouri) .................................................

4

00

5. Less: related expenses (omit if less than $500) ................................................

5

00

6. Net (subtract Line 5 from Line 4) .......................................................................................................................

6

00

r

r

r

7.

Partnership

Fiduciary

Other adjustments (list ____________________________________ ) 7

00

8. Food Pantry Contributions .................................................................................................................................

8

00

9. Total of Lines 3, 6, 7 and 8 ................................................................................................................................

9

00

Subtractions (attach explanation of each item)

10. Interest from exempt federal obligations ............................................................ 10

00

11. Less: related expenses (omit if less than $500) ................................................ 11

00

12. Net (subtract Line 11 from Line 10) ................................................................................................................... 12

00

13. Amount of any state income tax refund included in federal ordinary income .................................................... 13

00

r

r

r

14.

Partnership

Fiduciary

Other adjustments (list ____________________________________ ) 14

00

15. Missouri depreciation adjustment (See

Section 143.121,

RSMo.) ................................................................... 15

00

16. Total of Lines 12, 13, 14 and 15 ........................................................................................................................ 16

00

17. Missouri partnership adjustment — Net Addition — excess Line 9 over Line 16 .............................................. 17

00

18. Missouri partnership adjustment — Net Subtraction — excess Line 16 over Line 9 ......................................... 18

00

19. Agriculture Disaster Relief ................................................................................................................................ 19

00

Complete if Part 1 indicates a Partnership Adjustment

2. Select box

3. Social Security Number

1. Name of each partner. All partners must be listed.

4. Partner’s

5. Partner’s Partnership Adjustment

6. Agriculture Relief

if Partner is

Share %

Use attachment if more than four.

r Addition

r Subtraction

Subtraction

nonresident

r

a)

|

|

|

|

|

|

|

|

%

00

00

r

b)

|

|

|

|

|

|

|

|

%

00

00

r

c)

|

|

|

|

|

|

|

|

%

00

00

r

d)

|

|

|

|

|

|

|

|

%

00

00

Total

100 %

00

00

Preparer’s Phone Number

I

authorize the Director of Revenue or delegate to discuss my return

r

r

(

)

and attachments with the preparer or any member of his or her firm.

YES

NO

___ ___ ___

___ ___ ___-___ ___ ___ ___

Under penalties of perjury, I declare that the above information and any attached supplement is true, completed, and correct.

Signature of General Partner

Preparer’s Signature (Other than taxpayer)

FEIN, SSN, OR PTIN

|

|

|

|

|

|

|

|

Date (MM/DD/YYYY)

Phone Number

Preparer’s Address and Zip Code

Date (MM/DD/YYYY)

(__ __ __)__ __ __-__ __ __ __

__ __ / __ __ / __ __ __ __

__ __ / __ __ / __ __ __ __

Attach copy of Federal Form 1065 and all its schedules including K-1

Form MO-1065 (Revised 12-2016)

Mail to:

Taxation Division

Phone: (573) 751-1467

Visit

P.O. Box 3000

TTY: (800) 735-2966

for additional information.

Jefferson City, MO 65105-3000

Fax: (573) 526-7939

E-mail:

income@dor.mo.gov

DRAFT * DRAFT * DRAFT * DRAFT * DRAFT * DRAFT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5