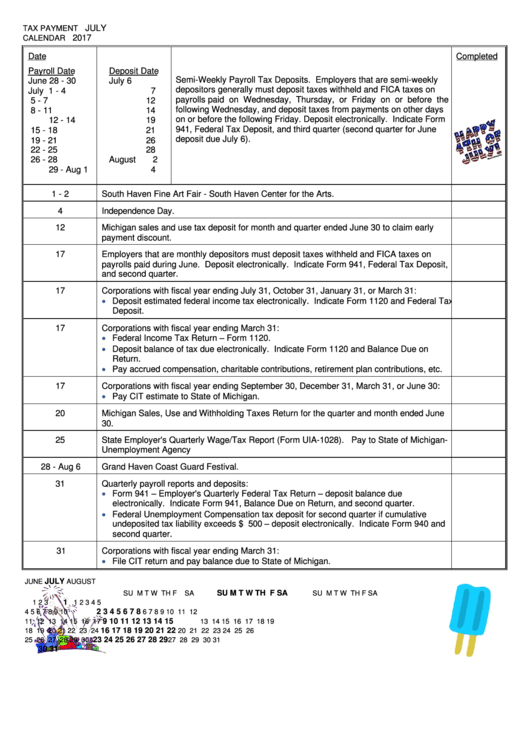

Tax Payment Calendar - 2017

ADVERTISEMENT

JULY

TAX PAYMENT

2017

CALENDAR

Date

Completed

Payroll Date

Deposit Date

Semi-Weekly Payroll Tax Deposits. Employers that are semi-weekly

June 28 - 30

July

6

depositors generally must deposit taxes withheld and FICA taxes on

July

1 - 4

7

payrolls paid on Wednesday, Thursday, or Friday on or before the

5 - 7

12

following Wednesday, and deposit taxes from payments on other days

8 - 11

14

on or before the following Friday. Deposit electronically. Indicate Form

12 - 14

19

941, Federal Tax Deposit, and third quarter (second quarter for June

15 - 18

21

deposit due July 6).

19 - 21

26

22 - 25

28

26 - 28

August

2

29 - Aug 1

4

1 - 2

South Haven Fine Art Fair - South Haven Center for the Arts.

4

Independence Day.

12

Michigan sales and use tax deposit for month and quarter ended June 30 to claim early

payment discount.

17

Employers that are monthly depositors must deposit taxes withheld and FICA taxes on

payrolls paid during June. Deposit electronically. Indicate Form 941, Federal Tax Deposit,

and second quarter.

17

Corporations with fiscal year ending July 31, October 31, January 31, or March 31:

Deposit estimated federal income tax electronically. Indicate Form 1120 and Federal Tax

Deposit.

17

Corporations with fiscal year ending March 31:

Federal Income Tax Return – Form 1120.

Deposit balance of tax due electronically. Indicate Form 1120 and Balance Due on

Return.

Pay accrued compensation, charitable contributions, retirement plan contributions, etc.

17

Corporations with fiscal year ending September 30, December 31, March 31, or June 30:

Pay CIT estimate to State of Michigan.

20

Michigan Sales, Use and Withholding Taxes Return for the quarter and month ended June

30.

25

State Employer's Quarterly Wage/Tax Report (Form UIA-1028). Pay to State of Michigan-

Unemployment Agency

28 - Aug 6

Grand Haven Coast Guard Festival.

31

Quarterly payroll reports and deposits:

Form 941 – Employer's Quarterly Federal Tax Return – deposit balance due

electronically. Indicate Form 941, Balance Due on Return, and second quarter.

Federal Unemployment Compensation tax deposit for second quarter if cumulative

undeposited tax liability exceeds $ 500 – deposit electronically. Indicate Form 940 and

second quarter.

31

Corporations with fiscal year ending March 31:

File CIT return and pay balance due to State of Michigan.

JULY

JUNE

AUGUST

SU M T W TH F SA

SU M T W TH F SA

SU M T W TH F SA

1

1

2

3

1

2

3

4

5

2 3 4 5 6 7 8

4

5

6

7

8

9 10

6

7

8

9 10 11 12

9 10 11 12 13 14 15

11 12 13 14 15 16 17

13 14 15 16 17 18 19

16 17 18 19 20 21 22

18 19 20 21 22 23 24

20 21 22 23 24 25 26

23 24 25 26 27 28 29

25 26 27 28 29 30

27 28 29 30 31

30 31

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2