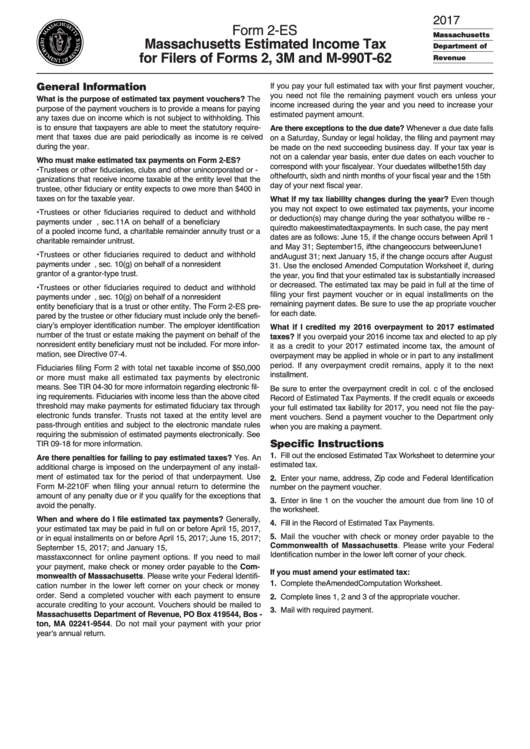

Form 2-Es - Massachusetts Estimated Income Tax For Filers Of Forms 2, 3m And M-990t-62 - 2017

ADVERTISEMENT

2017

Form 2-ES

Massachusetts

Massachusetts Estimated Income Tax

Department of

for Filers of Forms 2, 3M and M-990T-62

Revenue

General Information

If you pay your full estimated tax with your first payment voucher,

you need not file the remaining payment vouch ers unless your

What is the purpose of estimated tax payment vouchers? The

income increased during the year and you need to increase your

purpose of the payment vouchers is to provide a means for paying

estimated payment amount.

any taxes due on income which is not subject to withholding. This

is to ensure that taxpayers are able to meet the statutory require-

Are there exceptions to the due date? Whenever a due date falls

ment that taxes due are paid periodically as income is re ceived

on a Saturday, Sunday or legal holiday, the filing and payment may

during the year.

be made on the next succeeding business day. If your tax year is

not on a calendar year basis, enter due dates on each voucher to

Who must make estimated tax payments on Form 2-ES?

correspond with your fiscal year. Your due dates will be the 15th day

• Trustees or other fiduciaries, clubs and other unincorporated or -

of the fourth, sixth and ninth months of your fiscal year and the 15th

ganizations that receive income taxable at the entity level that the

day of your next fiscal year.

trustee, other fiduciary or entity expects to owe more than $400 in

taxes on for the taxable year.

What if my tax liability changes during the year? Even though

you may not expect to owe estimated tax payments, your income

• Trustees or other fiduciaries required to deduct and withhold

or deduction(s) may change during the year so that you will be re -

payments under M.G.L. c. 62, sec.11A on behalf of a beneficiary

quired to make estimated tax payments. In such case, the pay ment

of a pooled income fund, a charitable remainder annuity trust or a

dates are as follows: June 15, if the change occurs between April 1

charitable remainder unitrust.

and May 31; September 15, if the change occurs between June 1

• Trustees or other fiduciaries required to deduct and withhold

and August 31; next January 15, if the change occurs after August

payments under M.G.L. c. 62, sec. 10(g) on behalf of a nonresident

31. Use the enclosed Amended Computation Worksheet if, during

grantor of a grantor-type trust.

the year, you find that your estimated tax is substantially increased

or decreased. The estimated tax may be paid in full at the time of

• Trustees or other fiduciaries required to deduct and withhold

filing your first payment voucher or in equal installments on the

payments under M.G.L. c. 62, sec. 10(g) on behalf of a nonresident

remaining payment dates. Be sure to use the ap propriate voucher

entity beneficiary that is a trust or other entity. The Form 2-ES pre-

for each date.

pared by the trustee or other fiduciary must include only the benefi-

ciary’s employer identification number. The employer identification

What if I credited my 2016 overpayment to 2017 estimated

number of the trust or estate making the payment on behalf of the

taxes? If you overpaid your 2016 income tax and elected to ap ply

nonresident entity beneficiary must not be included. For more infor-

it as a credit to your 2017 estimated income tax, the amount of

mation, see Directive 07-4.

overpayment may be applied in whole or in part to any installment

period. If any overpayment credit remains, apply it to the next

Fiduciaries filing Form 2 with total net taxable income of $50,000

installment.

or more must make all estimated tax payments by electronic

means. See TIR 04-30 for more informatoin regarding electronic fil-

Be sure to enter the overpayment credit in col. c of the enclosed

ing requirements. Fiduciaries with income less than the above cited

Record of Estimated Tax Payments. If the credit equals or exceeds

threshold may make payments for estimated fiduciary tax through

your full estimated tax liability for 2017, you need not file the pay-

electronic funds transfer. Trusts not taxed at the entity level are

ment vouchers. Send a payment voucher to the Department only

pass-through entities and subject to the electronic mandate rules

when you are making a payment.

requiring the submission of estimated payments electronically. See

Specific Instructions

TIR 09-18 for more information.

1. Fill out the enclosed Estimated Tax Worksheet to determine your

Are there penalties for failing to pay estimated taxes? Yes. An

estimated tax.

additional charge is imposed on the underpayment of any install-

ment of estimated tax for the period of that underpayment. Use

2. Enter your name, address, Zip code and Federal Identification

Form M-2210F when filing your annual return to determine the

number on the payment voucher.

amount of any penalty due or if you qualify for the exceptions that

3. Enter in line 1 on the voucher the amount due from line 10 of

avoid the penalty.

the worksheet.

When and where do I file estimated tax payments? Generally,

4. Fill in the Record of Estimated Tax Payments.

your estimated tax may be paid in full on or before April 15, 2017,

5. Mail the voucher with check or money order payable to the

or in equal installments on or before April 15, 2017; June 15, 2017;

Commonwealth of Massachusetts. Please write your Federal

September 15, 2017; and January 15, 2018. Go to mass.gov/dor/

Identification number in the lower left corner of your check.

masstaxconnect for online payment options. If you need to mail

your payment, make check or money order payable to the Com-

If you must amend your estimated tax:

monwealth of Massachusetts. Please write your Federal Identifi-

1. Complete the Amended Computation Worksheet.

cation number in the lower left corner on your check or money

order. Send a completed voucher with each payment to ensure

2. Complete lines 1, 2 and 3 of the appropriate voucher.

accurate crediting to your account. Vouchers should be mailed to

3. Mail with required payment.

Massachusetts Department of Revenue, PO Box 419544, Bos -

ton, MA 02241-9544. Do not mail your payment with your prior

year’s annual return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6