Form Pe-100 - Register Of Deeds - Criteria For A Completed Real Estate Transfer Return (Form Pe-500) With Instructions For County Officials (Section V)

ADVERTISEMENT

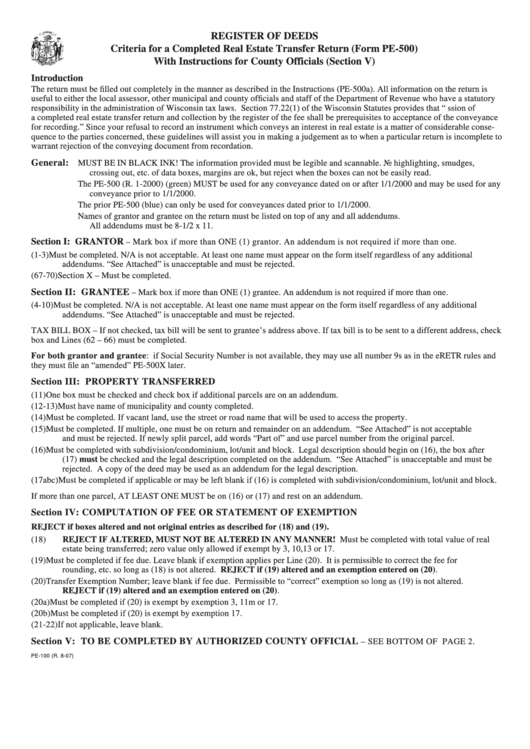

REGISTER OF DEEDS

Criteria for a Completed Real Estate Transfer Return (Form PE-500)

With Instructions for County Officials (Section V)

Introduction

The return must be filled out completely in the manner as described in the Instructions (PE-500a). All information on the return is

useful to either the local assessor, other municipal and county officials and staff of the Department of Revenue who have a statutory

responsibility in the administration of Wisconsin tax laws. Section 77.22(1) of the Wisconsin Statutes provides that “...submission of

a completed real estate transfer return and collection by the register of the fee shall be prerequisites to acceptance of the conveyance

for recording.” Since your refusal to record an instrument which conveys an interest in real estate is a matter of considerable conse-

quence to the parties concerned, these guidelines will assist you in making a judgement as to when a particular return is incomplete to

warrant rejection of the conveying document from recordation.

General:

MUST BE IN BLACK INK! The information provided must be legible and scannable. No highlighting, smudges,

crossing out, etc. of data boxes, margins are ok, but reject when the boxes can not be easily read.

The PE-500 (R. 1-2000) (green) MUST be used for any conveyance dated on or after 1/1/2000 and may be used for any

conveyance prior to 1/1/2000.

The prior PE-500 (blue) can only be used for conveyances dated prior to 1/1/2000.

Names of grantor and grantee on the return must be listed on top of any and all addendums.

All addendums must be 8-1/2 x 11.

Section I: GRANTOR

– Mark box if more than ONE (1) grantor. An addendum is not required if more than one.

(1-3)

Must be completed. N/A is not acceptable. At least one name must appear on the form itself regardless of any additional

addendums. “See Attached” is unacceptable and must be rejected.

(67-70) Section X – Must be completed.

Section II: GRANTEE

– Mark box if more than ONE (1) grantee. An addendum is not required if more than one.

(4-10)

Must be completed. N/A is not acceptable. At least one name must appear on the form itself regardless of any additional

addendums. “See Attached” is unacceptable and must be rejected.

TAX BILL BOX – If not checked, tax bill will be sent to grantee’s address above. If tax bill is to be sent to a different address, check

box and Lines (62 – 66) must be completed.

For both grantor and grantee: if Social Security Number is not available, they may use all number 9s as in the eRETR rules and

they must file an “amended” PE-500X later.

Section III: PROPERTY TRANSFERRED

(11)

One box must be checked and check box if additional parcels are on an addendum.

(12-13) Must have name of municipality and county completed.

(14)

Must be completed. If vacant land, use the street or road name that will be used to access the property.

(15)

Must be completed. If multiple, one must be on return and remainder on an addendum. “See Attached” is not acceptable

and must be rejected. If newly split parcel, add words “Part of” and use parcel number from the original parcel.

(16)

Must be completed with subdivision/condominium, lot/unit and block. Legal description should begin on (16), the box after

(17) must be checked and the legal description completed on the addendum. “See Attached” is unacceptable and must be

rejected. A copy of the deed may be used as an addendum for the legal description.

(17 abc) Must be completed if applicable or may be left blank if (16) is completed with subdivision/condominium, lot/unit and block.

If more than one parcel, AT LEAST ONE MUST be on (16) or (17) and rest on an addendum.

Section IV: COMPUTATION OF FEE OR STATEMENT OF EXEMPTION

REJECT if boxes altered and not original entries as described for (18) and (19).

(18)

REJECT IF ALTERED, MUST NOT BE ALTERED IN ANY MANNER! Must be completed with total value of real

estate being transferred; zero value only allowed if exempt by 3, 10,13 or 17.

(19)

Must be completed if fee due. Leave blank if exemption applies per Line (20). It is permissible to correct the fee for

rounding, etc. so long as (18) is not altered. REJECT if (19) altered and an exemption entered on (20).

(20)

Transfer Exemption Number; leave blank if fee due. Permissible to “correct” exemption so long as (19) is not altered.

REJECT if (19) altered and an exemption entered on (20).

(20a)

Must be completed if (20) is exempt by exemption 3, 11m or 17.

(20b)

Must be completed if (20) is exempt by exemption 17.

(21-22) If not applicable, leave blank.

Section V: TO BE COMPLETED BY AUTHORIZED COUNTY OFFICIAL

– SEE BOTTOM OF PAGE 2.

PE-100 (R. 8-07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2