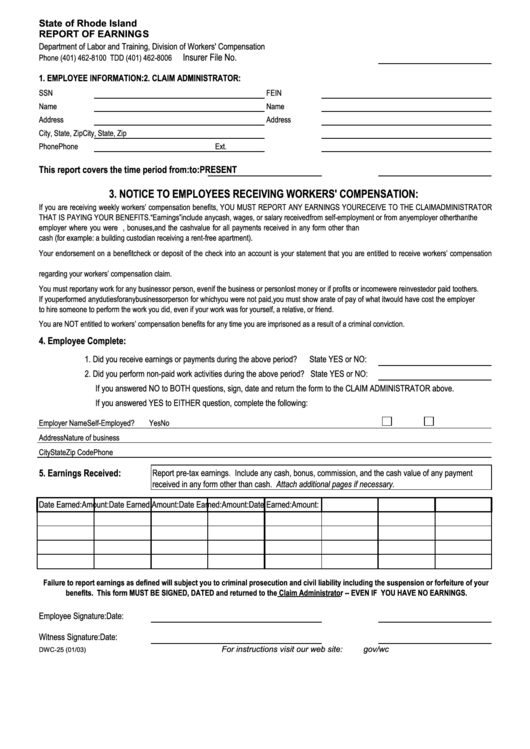

State of Rhode Island

REPORT OF EARNINGS

Department of Labor and Training, Division of Workers' Compensation

Insurer File No.

Phone (401) 462-8100 TDD (401) 462-8006

1. EMPLOYEE INFORMATION:

2. CLAIM ADMINISTRATOR:

SSN

FEIN

Name

Name

Address

Address

City, State, Zip

City, State, Zip

Phone

Phone

Ext.

This report covers the time period from:

to:

PRESENT

3. NOTICE TO EMPLOYEES RECEIVING WORKERS' COMPENSATION:

If you are receiving weekly workers’ compensation benefits, YOU MUST REPORT ANY EARNINGS YOU RECEIVE TO THE CLAIM ADMINISTRATOR

THAT IS PAYING YOUR BENEFITS. “Earnings” include any cash, wages, or salary received from self-employment or from any employer other than the

employer where you were injured. Earnings also include commissions, bonuses, and the cash value for all payments received in any form other than

cash (for example: a building custodian receiving a rent-free apartment).

Your endorsement on a benefit check or deposit of the check into an account is your statement that you are entitled to receive workers’ compensation

benefits. Your signature on a benefit check is a further affirmation that you have made no false claims or statements or concealed any material fact

regarding your workers’ compensation claim.

You must report any work for any business or person, even if the business or person lost money or if profits or income were reinvested or paid to others.

If you performed any duties for any business or person for which you were not paid, you must show a rate of pay of what it would have cost the employer

to hire someone to perform the work you did, even if your work was for yourself, a relative, or friend.

You are NOT entitled to workers’ compensation benefits for any time you are imprisoned as a result of a criminal conviction.

4. Employee Complete:

1. Did you receive earnings or payments during the above period?

State YES or NO:

2. Did you perform non-paid work activities during the above period? State YES or NO:

If you answered NO to BOTH questions, sign, date and return the form to the CLAIM ADMINISTRATOR above.

If you answered YES to EITHER question, complete the following:

Employer Name

Self-Employed?

Yes

No

Address

Nature of business

City

State

Zip Code

Phone

5. Earnings Received:

Report pre-tax earnings. Include any cash, bonus, commission, and the cash value of any payment

received in any form other than cash. Attach additional pages if necessary.

Date Earned:

Amount:

Date Earned:

Amount:

Date Earned:

Amount:

Date Earned:

Amount:

Failure to report earnings as defined will subject you to criminal prosecution and civil liability including the suspension or forfeiture of your

benefits. This form MUST BE SIGNED, DATED and returned to the Claim Administrator -- EVEN IF YOU HAVE NO EARNINGS.

Employee Signature:

Date:

Witness Signature:

Date:

For instructions visit our web site:

DWC-25 (01/03)

1

1 2

2