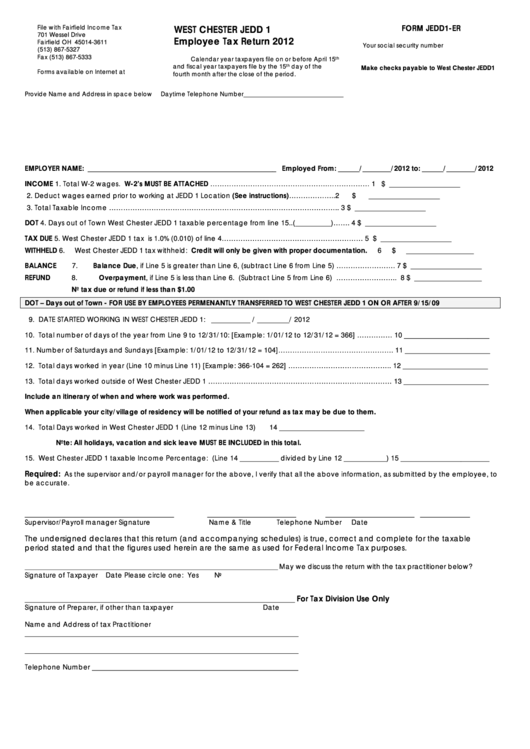

Form Jedd1-Er - Employee Tax Return - 2012

ADVERTISEMENT

File with Fairfield Income Tax

WEST CHESTER JEDD 1

FORM JEDD1-ER

701 Wessel Drive

Employee Tax Return 2012

Fairfield OH 45014-3611

Your social security number

(513) 867-5327

Fax (513) 867-5333

Calendar year taxpayers file on or before April 15

th

and fiscal year taxpayers file by the 15

day of the

th

Make checks payable to West Chester JEDD1

Forms available on Internet at

fourth month after the close of the period.

Provide Name and Address in space below

Daytime Telephone Number_________________________________

EMPLOYER NAME: _____________________________________________________ Employed From: ______/________/2012 to: ______/________/2012

INCOME

1.

Total W-2 wages. W-2’s MUST BE ATTACHED ………………………………….……….……………… 1

$ ____________________

2.

Deduct wages earned prior to working at JEDD 1 Location (See instructions)……………….. 2

$ ____________________

3.

Total Taxable Income …………………………………………………………………………………….. 3

$ ____________________

DOT

4.

Days out of Town West Chester JEDD 1 taxable percentage from line 15..(__________)……. 4

$ ____________________

TAX DUE

5.

West Chester JEDD 1 tax is 1.0% (0.010) of line 4…………………………………………………… 5

$ ____________________

WITHHELD

6.

West Chester JEDD 1 tax withheld: Credit will only be given with proper documentation.

6

$ ___________________

BALANCE

7.

Balance Due, if Line 5 is greater than Line 6, (subtract Line 6 from Line 5) ……………………. 7

$ ____________________

REFUND

8.

Overpayment, if Line 5 is less than Line 6. (Subtract Line 5 from Line 6) ....…………………….. 8

$ ___________________

No tax due or refund if less than $1.00

DOT – Days out of Town - FOR USE BY EMPLOYEES PERMENANTLY TRANSFERRED TO WEST CHESTER JEDD 1 ON OR AFTER 9/15/09

9. DATE STARTED WORKING IN WEST CHESTER JEDD 1: ___________ / _________/ 2012

10. Total number of days of the year from Line 9 to 12/31/10: [Example: 1/01/12 to 12/31/12 = 366] …………… 10

________________________

11. Number of Saturdays and Sundays [Example: 1/01/12 to 12/31/12 = 104]…………………………………………. 11

________________________

12. Total days worked in year (Line 10 minus Line 11) [Example: 366-104 = 262] …………………………………….. 12

________________________

13. Total days worked outside of West Chester JEDD 1 …………………………………………………………………… 13

________________________

Include an itinerary of when and where work was performed.

When applicable your city/village of residency will be notified of your refund as tax may be due to them.

14. Total Days worked in West Chester JEDD 1 (Line 12 minus Line 13)

14

________________________

Note: All holidays, vacation and sick leave MUST BE INCLUDED in this total.

15. West Chester JEDD 1 taxable Income Percentage: (Line 14 ___________ divided by Line 12 ____________) 15

_________________________

Required:

As the supervisor and/or payroll manager for the above, I verify that all the above information, as submitted by the employee, to

be accurate.

__________________________________________

_________________________

_________________________

______________

Supervisor/Payroll manager Signature

Name & Title

Telephone Number

Date

The undersigned declares that this return (and accompanying schedules) is true, correct and complete for the taxable

period stated and that the figures used herein are the same as used for Federal Income Tax purposes.

May we discuss the return with the tax practitioner below?

___________________________________________________________________________________________________

Signature of Taxpayer

Date

Please circle one:

Yes

No

For Tax Division Use Only

____________________________________________________________________________

Signature of Preparer, if other than taxpayer

Date

Name and Address of tax Practitioner

_____________________________________________________________________________

_____________________________________________________________________________

Telephone Number __________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1