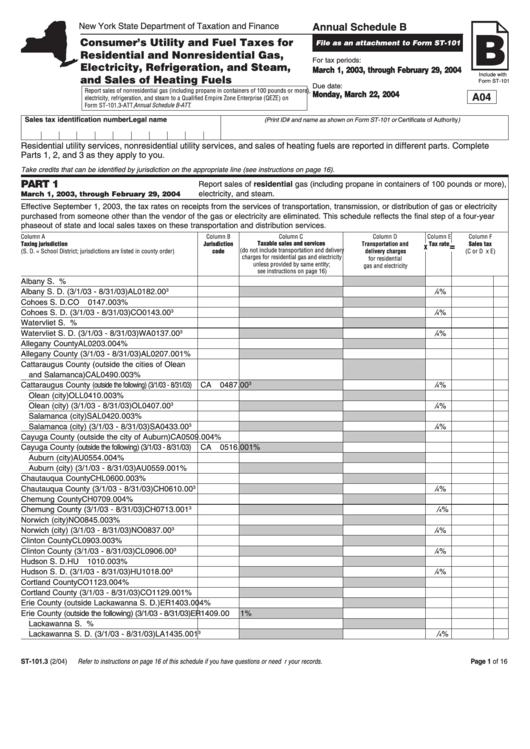

Form St-101 - Consumer'S Utility And Fuel Taxes For Residential And Nonresidential Gas, Electricity, Refrigeration, And Steam, And Sales Of Heating Fuels

ADVERTISEMENT

New York State Department of Taxation and Finance

Annual Schedule B

Consumer’s Utility and Fuel Taxes for

File as an attachment to Form ST-101

Residential and Nonresidential Gas,

For tax periods:

Electricity, Refrigeration, and Steam,

March 1, 2003, through February 29, 2004

Include with

and Sales of Heating Fuels

Form ST-101

Due date:

Report sales of nonresidential gas (including propane in containers of 100 pounds or more),

Monday, March 22, 2004

A04

electricity, refrigeration, and steam to a Qualified Empire Zone Enterprise (QEZE) on

Form ST-101.3-ATT, Annual Schedule B-ATT .

Sales tax identification number

Legal name

(Print ID# and name as shown on Form ST-101 or Certificate of Authority )

Residential utility services, nonresidential utility services, and sales of heating fuels are reported in different parts. Complete

Parts 1, 2, and 3 as they apply to you.

Take credits that can be identified by jurisdiction on the appropriate line (see instructions on page 16).

PART 1

Report sales of residential gas (including propane in containers of 100 pounds or more),

electricity, and steam.

March 1, 2003, through February 29, 2004

Effective September 1, 2003, the tax rates on receipts from the services of transportation, transmission, or distribution of gas or electricity

purchased from someone other than the vendor of the gas or electricity are eliminated. This schedule reflects the final step of a four-year

phaseout of state and local sales taxes on these transportation and distribution services.

Column A

Column B

Column C

Column D

Column E

Column F

Taxable sales and services

Taxing jurisdiction

Jurisdiction

Transportation and

Tax rate

Sales tax

=

X

(do not include transportation and delivery

(S. D. = School District; jurisdictions are listed in county order)

code

delivery charges

(C or D x E)

charges for residential gas and electricity

for residential

unless provided by same entity;

gas and electricity

see instructions on page 16)

Albany S. D.

AL

0167

.00

3%

Albany S. D. (3/1/03 - 8/31/03)

AL

0182

.00

3

/

%

4

Cohoes S. D.

CO

0147

.00

3%

3

Cohoes S. D. (3/1/03 - 8/31/03)

CO

0143

.00

/

%

4

Watervliet S. D.

WA

0157

.00

3%

Watervliet S. D. (3/1/03 - 8/31/03)

WA

0137

.00

3

/

%

4

Allegany County

AL

0203

.00

4%

Allegany County (3/1/03 - 8/31/03)

AL

0207

.00

1%

Cattaraugus County (outside the cities of Olean

and Salamanca)

CA L0490

.00

3%

Cattaraugus County (outside the following) (3/1/03 - 8/31/03)

CA

0487

.00

3

/

%

4

Olean (city)

OL L0410

.00

3%

Olean (city) (3/1/03 - 8/31/03)

OL

0407

.00

3

/

%

4

Salamanca (city)

SA L0420

.00

3%

3

/

Salamanca (city) (3/1/03 - 8/31/03)

SA

0433

.00

%

4

Cayuga County (outside the city of Auburn)

CA

0509

.00

4%

Cayuga County (outside the following) (3/1/03 - 8/31/03)

CA

0516

.00

1%

Auburn (city)

AU

0554

.00

4%

Auburn (city) (3/1/03 - 8/31/03)

AU

0559

.00

1%

Chautauqua County

CH L0600

.00

3%

3

/

Chautauqua County (3/1/03 - 8/31/03)

CH

0610

.00

%

4

Chemung County

CH

0709

.00

4%

Chemung County (3/1/03 - 8/31/03)

CH

0713

.00 1

3

/

%

4

Norwich (city)

NO

0845

.00

3%

3

Norwich (city) (3/1/03 - 8/31/03)

NO

0837

.00

/

%

4

Clinton County

CL

0903

.00

3%

Clinton County (3/1/03 - 8/31/03)

CL

0906

.00

3

/

%

4

Hudson S. D.

HU

1010

.00

3%

Hudson S. D. (3/1/03 - 8/31/03)

HU

1018

.00

3

/

%

4

Cortland County

CO

1123

.00

4%

Cortland County (3/1/03 - 8/31/03)

CO

1129

.00

1%

Erie County (outside Lackawanna S. D.)

ER

1403

.00

4%

Erie County (outside the following) (3/1/03 - 8/31/03)

ER

1409

.00

1%

Lackawanna S. D.

LA

1427

.00

7%

Lackawanna S. D. (3/1/03 - 8/31/03)

LA

1435

.00 1

3

/

%

4

ST-101.3 (2/04)

Refer to instructions on page 16 of this schedule if you have questions or need help.

Please be sure to keep a completed copy for your records.

Page 1 of 16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15