Publication 873 - Sales Tax Collection Charts For Qualified Motor Fuel Or Highway Diesel Motor Fuel Sold At Retail - Nys Dept.of Taxation

ADVERTISEMENT

Publication 873

(8/11)

Sales Tax Collection Charts

For Qualified Motor Fuel or Highway Diesel Motor Fuel

Sold at Retail

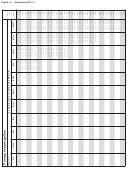

The charts in this publication show the amount of the local

B. Subtract the local Sales tax per gallon amount

sales tax component in any given pump price of a gallon

shown in the far right column of this publication

of qualified motor fuel or highway diesel motor fuel. They

for that pump price from the amount determined

are to be used to verify the sales tax due, not to establish

in step 1A above. Note: For sales made in the

pump prices.

cities of Auburn and Rome, you must also

subtract the cents-per-gallon rate in effect in these

Note: Use this publication only to compute the local

localities. See Publication 718-F, Local Sales and

sales tax due in jurisdictions that continue to impose and

Use Tax Rates on Qualified Motor Fuel, Highway

compute their sales tax on qualified motor fuel or highway

Diesel Motor Fuel, and B20 Biodiesel, for the

diesel motor fuel using a percentage sales tax rate. This

applicable cents-per-gallon rates.

method does not apply in those localities that have

C. Multiply the amount from step 1B by the number

changed to a cents-per-gallon method of computing the

of gallons sold at that pump price.

local sales tax due.

D. Add the resulting amounts for all pump

The pump price per gallon of fuel at each sales tax rate

prices.

must include:

2. To compute taxable sales and self-use:

• federal tax (current rates are available from the Internal

A. Subtract the New York State motor fuel or

Revenue Service), and

diesel motor fuel excise tax (see Article 12-A

rates in Publication 908, Fuel Tax Rates, for the

• New York State motor fuel or diesel motor fuel

applicable cents-per-gallon rate) from the amount

excise tax, and the petroleum business tax (see

determined in step 1B above. This is the taxable

Publication 908, Fuel Tax Rates, for the applicable

base price for each gallon sold at that pump price.

cents-per-gallon rates), and

B. Multiply the taxable base price from step 2A

• New York State sales tax (8 cents per gallon), and

above by the number of gallons sold at that pump

• local sales tax, and

price.

C. Add the resulting amounts for all pump prices.

• Metropolitan Commuter Transportation District

This is your taxable sales amount.

(MCTD) sales tax (¾ cents per gallon), if applicable.

D. To compute your taxable self-use, subtract the

The MCTD consists of the city of New York and

New York State motor fuel or diesel motor fuel

the counties of Dutchess, Nassau, Orange, Putnam,

excise tax from your purchase price. Multiply the

Rockland, Suffolk, and Westchester.

result by the number of gallons you removed from

Computing gross sales, taxable sales

inventory for your use.

and self-use, and sales tax due:

E. Add the amounts from step 2C and 2D (your

taxable sales and self-use).

Note: This publication contains two separate charts. Part 1

provides the local sales tax component for jurisdictions

For B20 biodiesel only: To determine the local sales tax

outside the MCTD, where the state sales tax is 8 cents

on sales and uses of qualified highway B20 biodiesel,

per gallon. Part 2 provides the local sales tax component

multiply 80% of the taxable receipt by the percentage

for jurisdictions inside the MCTD, where the state sales

rate for the jurisdiction. Therefore, you must multiply

tax is 8 ¾ cents per gallon. Please be sure to reference

the result from step 2E above by 80% to determine your

the appropriate chart for the jurisdiction where you made

taxable sales and self-use of B20 biodiesel.

taxable sales when performing the computations below.

3. To compute sales tax due, multiply the taxable sales

Using the incorrect chart will result in errors in your

and self-use amounts from step 2E above by the local

computations.

sales tax rate listed on Schedule FR, Sales and Use

1. To compute gross sales:

Tax on Qualified Motor Fuel and Highway Diesel

A. Subtract the New York State 8 cents-per-gallon

Motor Fuel. This calculation must be done for each

and MCTD ¾ cents-per-gallon sales tax (if

jurisdiction in which you made taxable sales or uses

applicable) from the pump price.

of qualified motor fuel or highway diesel motor fuel.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9