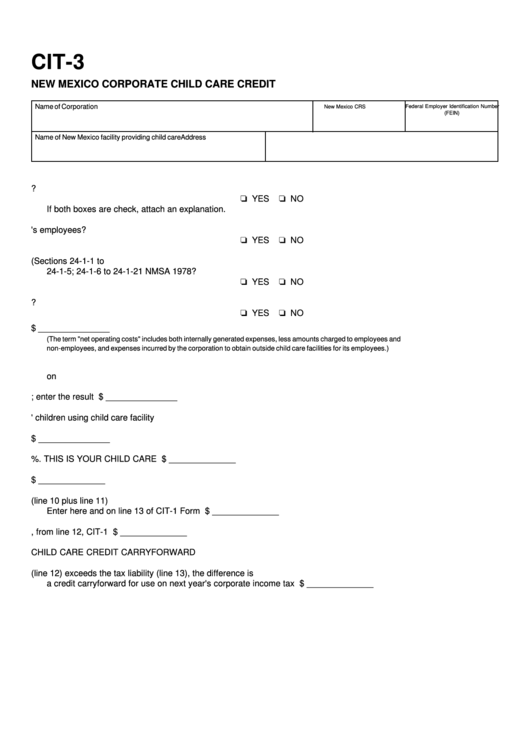

CIT-3

NEW MEXICO CORPORATE CHILD CARE CREDIT

Name of Corporation

Federal Employer Identification Number

New Mexico CRS I.D. Number

(FEIN)

Name of New Mexico facility providing child care

Address

1. Are the children who are being cared for dependents of employees of the corporation?

YES

NO

If both boxes are check, attach an explanation.

2. Is the child care facility in New Mexico used primarily by the dependent children of the corporation's employees?

YES

NO

3. Is the child care facility operated under authority of a license pursuant to the Public Health Act (Sections 24-1-1 to

24-1-5; 24-1-6 to 24-1-21 NMSA 1978?

YES

NO

4. Is the child care facility operated on a non-profit basis by the corporation?

YES

NO

5. Net operating Costs ...............................................................................................................

5. $ _______________

(The term "net operating costs" includes both internally generated expenses, less amounts charged to employees and

non-employees, and expenses incurred by the corporation to obtain outside child care facilities for its employees.)

6. Total number of children served by child care facility including children

on non-employees .......................................................................................... ____________

7. Divide line 5 by line 6; enter the result here ...........................................................................

7. $ _______________

8. Number of employees' children using child care facility .................................. ____________

9. Multiply line 7 by line 8. THIS IS THE AMOUNT SUBJECT TO THE CREDIT .....................

9. $ _______________

10. Multiply line 9 by 30%. THIS IS YOUR CHILD CARE CREDIT. ............................................

10. $ ______________

11. Child Care Credit carry forward from prior year .....................................................................

11. $ ______________

12. Total available Child Care Credit (line 10 plus line 11)

Enter here and on line 13 of CIT-1 Form ...............................................................................

12. $ ______________

13. New Mexico Corporate Income Tax liability, from line 12, CIT-1 Form. .................................

13. $ ______________

CHILD CARE CREDIT CARRYFORWARD

14. If the available child care credit (line 12) exceeds the tax liability (line 13), the difference is

a credit carryforward for use on next year's corporate income tax return. .............................

14. $ ______________

1

1