Bail Bond Companies Premium Tax - South Dakota Division Of Insurance - 2011

ADVERTISEMENT

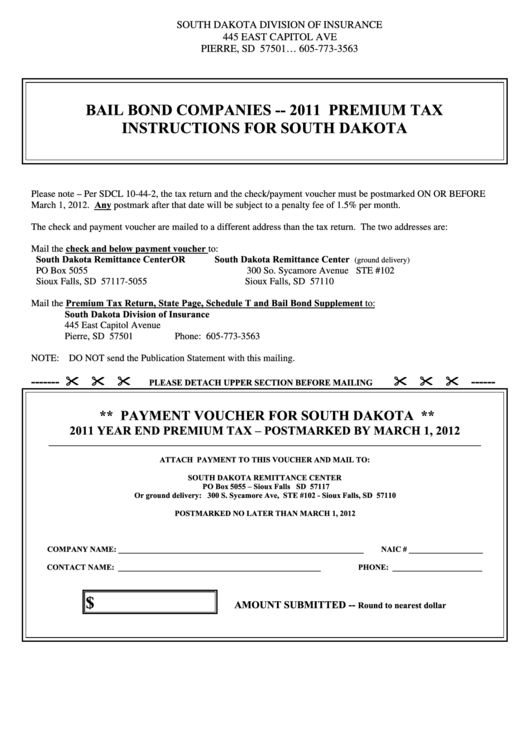

SOUTH DAKOTA DIVISION OF INSURANCE

445 EAST CAPITOL AVE

PIERRE, SD 57501… 605-773-3563

BAIL BOND COMPANIES -- 2011 PREMIUM TAX

INSTRUCTIONS FOR SOUTH DAKOTA

Please note – Per SDCL 10-44-2, the tax return and the check/payment voucher must be postmarked ON OR BEFORE

March 1, 2012. Any postmark after that date will be subject to a penalty fee of 1.5% per month.

The check and payment voucher are mailed to a different address than the tax return. The two addresses are:

Mail the check and below payment voucher to:

South Dakota Remittance Center

OR

South Dakota Remittance Center

(ground delivery)

PO Box 5055

300 So. Sycamore Avenue STE #102

Sioux Falls, SD 57117-5055

Sioux Falls, SD 57110

Mail the Premium Tax Return, State Page, Schedule T and Bail Bond Supplement to:

South Dakota Division of Insurance

445 East Capitol Avenue

Pierre, SD 57501

Phone: 605-773-3563

NOTE: DO NOT send the Publication Statement with this mailing.

-------

------

PLEASE DETACH UPPER SECTION BEFORE MAILING

** PAYMENT VOUCHER FOR SOUTH DAKOTA **

2011 YEAR END PREMIUM TAX – POSTMARKED BY MARCH 1, 2012

_______________________________________________________________________________________________________________

ATTACH PAYMENT TO THIS VOUCHER AND MAIL TO:

SOUTH DAKOTA REMITTANCE CENTER

PO Box 5055 – Sioux Falls SD 57117

Or ground delivery: 300 S. Sycamore Ave, STE #102 - Sioux Falls, SD 57110

POSTMARKED NO LATER THAN MARCH 1, 2012

COMPANY NAME: _______________________________________________________________

NAIC # ___________________

CONTACT NAME: ____________________________________________________

PHONE: _______________________

$

AMOUNT SUBMITTED --

Round to nearest dollar

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5