Instructions For Form 306 - North Dakota Income Tax Withholding Return

ADVERTISEMENT

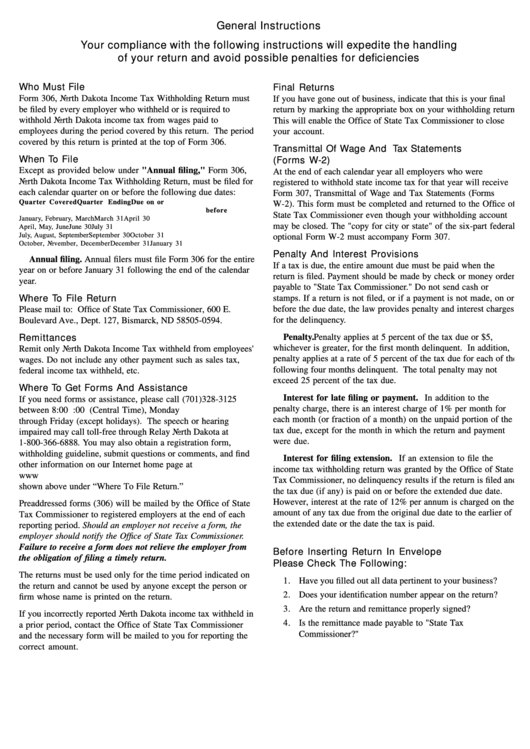

General Instructions

Your compliance with the following instructions will expedite the handling

of your return and avoid possible penalties for deficiencies

Who Must File

Final Returns

Form 306, North Dakota Income Tax Withholding Return must

If you have gone out of business, indicate that this is your final

be filed by every employer who withheld or is required to

return by marking the appropriate box on your withholding return.

withhold North Dakota income tax from wages paid to

This will enable the Office of State Tax Commissioner to close

employees during the period covered by this return. The period

your account.

covered by this return is printed at the top of Form 306.

Transmittal Of Wage And Tax Statements

When To File

(Forms W-2)

Except as provided below under "Annual filing," Form 306,

At the end of each calendar year all employers who were

North Dakota Income Tax Withholding Return, must be filed for

registered to withhold state income tax for that year will receive

each calendar quarter on or before the following due dates:

Form 307, Transmittal of Wage and Tax Statements (Forms

Quarter Covered

Quarter Ending

Due on or

W-2). This form must be completed and returned to the Office of

before

State Tax Commissioner even though your withholding account

January, February, March

March 31

April 30

may be closed. The "copy for city or state" of the six-part federal

April, May, June

June 30

July 31

July, August, September

September 30

October 31

optional Form W-2 must accompany Form 307.

October, November, December

December 31

January 31

Penalty And Interest Provisions

Annual filing. Annual filers must file Form 306 for the entire

If a tax is due, the entire amount due must be paid when the

year on or before January 31 following the end of the calendar

return is filed. Payment should be made by check or money order

year.

payable to "State Tax Commissioner." Do not send cash or

Where To File Return

stamps. If a return is not filed, or if a payment is not made, on or

before the due date, the law provides penalty and interest charges

Please mail to: Office of State Tax Commissioner, 600 E.

for the delinquency.

Boulevard Ave., Dept. 127, Bismarck, ND 58505-0594.

Remittances

Penalty. Penalty applies at 5 percent of the tax due or $5,

whichever is greater, for the first month delinquent. In addition,

Remit only North Dakota Income Tax withheld from employees'

penalty applies at a rate of 5 percent of the tax due for each of the

wages. Do not include any other payment such as sales tax,

following four months delinquent. The total penalty may not

federal income tax withheld, etc.

exceed 25 percent of the tax due.

Where To Get Forms And Assistance

Interest for late filing or payment. In addition to the

If you need forms or assistance, please call (701)328-3125

penalty charge, there is an interest charge of 1% per month for

between 8:00 a.m. and 5:00 p.m. (Central Time), Monday

each month (or fraction of a month) on the unpaid portion of the

through Friday (except holidays). The speech or hearing

tax due, except for the month in which the return and payment

impaired may call toll-free through Relay North Dakota at

were due.

1-800-366-6888. You may also obtain a registration form,

withholding guideline, submit questions or comments, and find

Interest for filing extension. If an extension to file the

other information on our Internet home page at

income tax withholding return was granted by the Office of State

Or you may write to the address

Tax Commissioner, no delinquency results if the return is filed and

shown above under “Where To File Return.”

the tax due (if any) is paid on or before the extended due date.

However, interest at the rate of 12% per annum is charged on the

Preaddressed forms (306) will be mailed by the Office of State

amount of any tax due from the original due date to the earlier of

Tax Commissioner to registered employers at the end of each

the extended date or the date the tax is paid.

reporting period. Should an employer not receive a form, the

employer should notify the Office of State Tax Commissioner.

Failure to receive a form does not relieve the employer from

Before Inserting Return In Envelope

the obligation of filing a timely return.

Please Check The Following:

The returns must be used only for the time period indicated on

1. Have you filled out all data pertinent to your business?

the return and cannot be used by anyone except the person or

2. Does your identification number appear on the return?

firm whose name is printed on the return.

3. Are the return and remittance properly signed?

If you incorrectly reported North Dakota income tax withheld in

4. Is the remittance made payable to "State Tax

a prior period, contact the Office of State Tax Commissioner

Commissioner?"

and the necessary form will be mailed to you for reporting the

correct amount.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1