Form Tw-1 - Return Of Income Tax Withheld - City Of Troy - 2012

ADVERTISEMENT

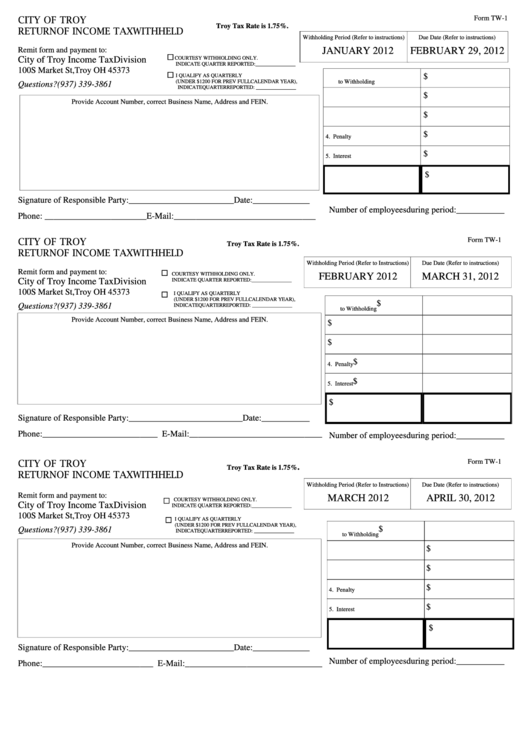

CITY OF TROY

Form TW-1

Troy Tax Rate is 1.75%.

RETURN OF INCOME TAX WITHHELD

Withholding Period (Refer to instructions)

Due Date (Refer to instructions)

Remit form and payment to:

JANUARY 2012

FEBRUARY 29, 2012

COURTESY WITHHOLDING ONLY.

City of Troy Income Tax Division

INDICATE QUARTER REPORTED: _______________

100 S Market St, Troy OH 45373

1. Gross Compensation Subject

$

I QUALIFY AS QUARTERLY

(UNDER $1200 FOR PREV FULL CALENDAR YEAR),

to Withholding

Questions? (937) 339-3861

INDICATE QUARTER REPORTED: _______________

$

2. Tax Withheld during Period

Provide Account Number, correct Business Name, Address and FEIN.

$

3. Adjustment to Prior Period

$

4. Penalty

$

5. Interest

$

6. TOTAL DUE

Signature of Responsible Party:________________________ Date:_____________

Number of employees during period:___________

Phone: _______________________ E-Mail:________________________________

CITY OF TROY

Form TW-1

Troy Tax Rate is 1.75%.

RETURN OF INCOME TAX WITHHELD

Withholding Period (Refer to Instructions)

Due Date (Refer to instructions)

Remit form and payment to:

COURTESY WITHHOLDING ONLY.

FEBRUARY 2012

MARCH 31, 2012

INDICATE QUARTER REPORTED: _______________

City of Troy Income Tax Division

100 S Market St, Troy OH 45373

I QUALIFY AS QUARTERLY

(UNDER $1200 FOR PREV FULL CALENDAR YEAR),

1. Gross Compensation Subject

$

Questions? (937) 339-3861

INDICATE QUARTER REPORTED: _______________

to Withholding

Provide Account Number, correct Business Name, Address and FEIN.

$

2. Tax Withheld during Period

$

3. Adjustment to Prior Period

$

4. Penalty

$

5. Interest

$

6. TOTAL DUE

Signature of Responsible Party:__________________________ Date:___________

Phone:__________________________ E-Mail:______________________________

Number of employees during period:___________

CITY OF TROY

Form TW-1

.

Troy Tax Rate is 1.75%

RETURN OF INCOME TAX WITHHELD

Withholding Period (Refer to Instructions)

Due Date (Refer to instructions)

Remit form and payment to:

MARCH 2012

APRIL 30, 2012

COURTESY WITHHOLDING ONLY.

City of Troy Income Tax Division

INDICATE QUARTER REPORTED: _______________

100 S Market St, Troy OH 45373

I QUALIFY AS QUARTERLY

(UNDER $1200 FOR PREV FULL CALENDAR YEAR),

1. Gross Compensation Subject

$

Questions? (937) 339-3861

INDICATE QUARTER REPORTED: _______________

to Withholding

Provide Account Number, correct Business Name, Address and FEIN.

$

2. Tax Withheld during Period

$

3. Adjustment to Prior Period

$

4. Penalty

$

5. Interest

$

6. TOTAL DUE

Signature of Responsible Party:________________________ Date:_____________

Number of employees during period:___________

Phone:_________________________ E-Mail:_______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4