Form Il-1363 - Instructions For Schedule P, Projected Income Schedule For Drug Coverage

ADVERTISEMENT

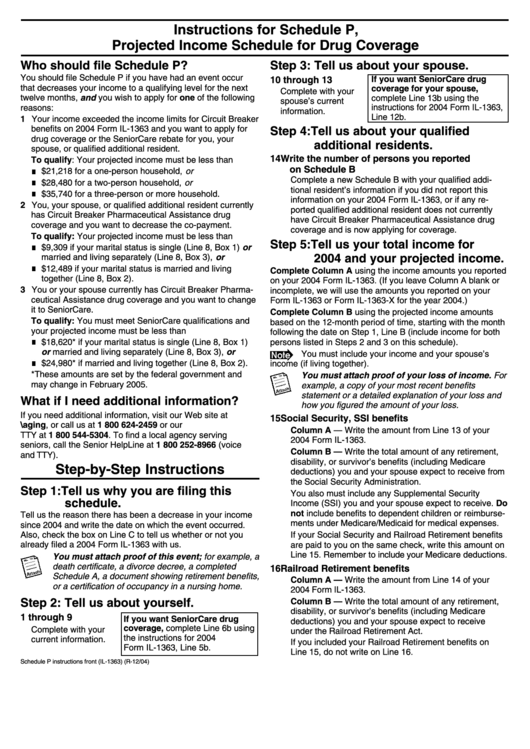

Instructions for Schedule P,

Projected Income Schedule for Drug Coverage

Who should file Schedule P?

Step 3: Tell us about your spouse.

You should file Schedule P if you have had an event occur

If you want SeniorCare drug

10 through 13

that decreases your income to a qualifying level for the next

coverage for your spouse,

Complete with your

twelve months, and you wish to apply for one of the following

complete Line 13b using the

spouse’s current

reasons:

instructions for 2004 Form IL-1363,

information.

Line 12b.

1 Your income exceeded the income limits for Circuit Breaker

benefits on 2004 Form IL-1363 and you want to apply for

Step 4: Tell us about your qualified

drug coverage or the SeniorCare rebate for you, your

additional residents.

spouse, or qualified additional resident.

14 Write the number of persons you reported

To qualify: Your projected income must be less than

on Schedule B

$21,218 for a one-person household, or

Complete a new Schedule B with your qualified addi-

$28,480 for a two-person household, or

tional resident’s information if you did not report this

$35,740 for a three-person or more household.

information on your 2004 Form IL-1363, or if any re-

2 You, your spouse, or qualified additional resident currently

ported qualified additional resident does not currently

has Circuit Breaker Pharmaceutical Assistance drug

have Circuit Breaker Pharmaceutical Assistance drug

coverage and you want to decrease the co-payment.

coverage and is now applying for coverage.

To qualify: Your projected income must be less than

Step 5: Tell us your total income for

$9,309 if your marital status is single (Line 8, Box 1) or

2004 and your projected income.

married and living separately (Line 8, Box 3), or

$12,489 if your marital status is married and living

Complete Column A using the income amounts you reported

together (Line 8, Box 2).

on your 2004 Form IL-1363. (If you leave Column A blank or

3 You or your spouse currently has Circuit Breaker Pharma-

incomplete, we will use the amounts you reported on your

ceutical Assistance drug coverage and you want to change

Form IL-1363 or Form IL-1363-X for the year 2004.)

it to SeniorCare.

Complete Column B using the projected income amounts

To qualify: You must meet SeniorCare qualifications and

based on the 12-month period of time, starting with the month

your projected income must be less than

following the date on Step 1, Line B (include income for both

$18,620* if your marital status is single (Line 8, Box 1)

persons listed in Steps 2 and 3 on this schedule).

or married and living separately (Line 8, Box 3), or

You must include your income and your spouse’s

$24,980* if married and living together (Line 8, Box 2).

income (if living together).

* These amounts are set by the federal government and

You must attach proof of your loss of income. For

may change in February 2005.

example, a copy of your most recent benefits

statement or a detailed explanation of your loss and

What if I need additional information?

how you figured the amount of your loss.

If you need additional information, visit our Web site at

15 Social Security, SSI benefits

, or call us at 1 800 624-2459 or our

Column A — Write the amount from Line 13 of your

TTY at 1 800 544-5304. To find a local agency serving

2004 Form IL-1363.

seniors, call the Senior HelpLine at 1 800 252-8966 (voice

Column B — Write the total amount of any retirement,

and TTY).

disability, or survivor’s benefits (including Medicare

Step-by-Step Instructions

deductions) you and your spouse expect to receive from

the Social Security Administration.

Step 1: Tell us why you are filing this

You also must include any Supplemental Security

schedule.

Income (SSI) you and your spouse expect to receive. Do

not include benefits to dependent children or reimburse-

Tell us the reason there has been a decrease in your income

ments under Medicare/Medicaid for medical expenses.

since 2004 and write the date on which the event occurred.

Also, check the box on Line C to tell us whether or not you

If your Social Security and Railroad Retirement benefits

already filed a 2004 Form IL-1363 with us.

are paid to you on the same check, write this amount on

Line 15. Remember to include your Medicare deductions.

You must attach proof of this event; for example, a

death certificate, a divorce decree, a completed

16 Railroad Retirement benefits

Schedule A, a document showing retirement benefits,

Column A — Write the amount from Line 14 of your

or a certification of occupancy in a nursing home.

2004 Form IL-1363.

Step 2: Tell us about yourself.

Column B — Write the total amount of any retirement,

disability, or survivor’s benefits (including Medicare

1 through 9

If you want SeniorCare drug

deductions) you and your spouse expect to receive

coverage, complete Line 6b using

Complete with your

under the Railroad Retirement Act.

the instructions for 2004

current information.

If you included your Railroad Retirement benefits on

Form IL-1363, Line 5b.

Line 15, do not write on Line 16.

Schedule P instructions front (IL-1363) (R-12/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2