Form Ucs-71 - Quarterly Concurrent Employment Report - Florida Department Of Revenue

ADVERTISEMENT

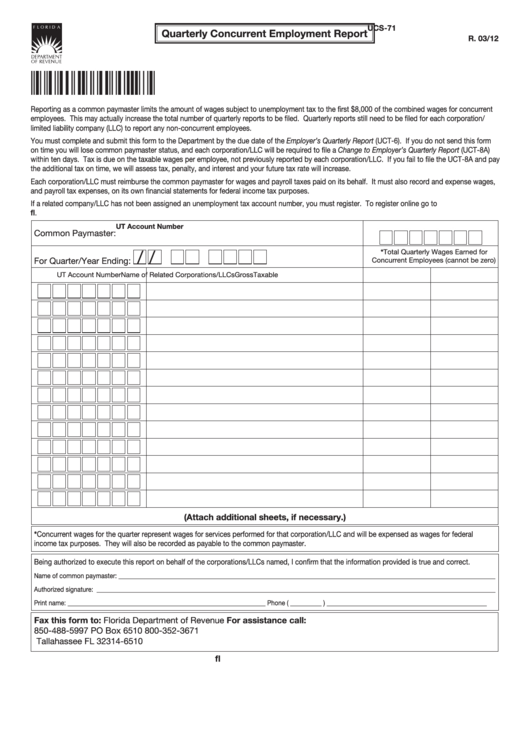

UCS-71

Quarterly Concurrent Employment Report

R. 03/12

Reporting as a common paymaster limits the amount of wages subject to unemployment tax to the first $8,000 of the combined wages for concurrent

employees. This may actually increase the total number of quarterly reports to be filed. Quarterly reports still need to be filed for each corporation/

limited liability company (LLC) to report any non-concurrent employees.

You must complete and submit this form to the Department by the due date of the Employer’s Quarterly Report (UCT-6). If you do not send this form

on time you will lose common paymaster status, and each corporation/LLC will be required to file a Change to Employer’s Quarterly Report (UCT-8A)

within ten days. Tax is due on the taxable wages per employee, not previously reported by each corporation/LLC. If you fail to file the UCT-8A and pay

the additional tax on time, we will assess tax, penalty, and interest and your future tax rate will increase.

Each corporation/LLC must reimburse the common paymaster for wages and payroll taxes paid on its behalf. It must also record and expense wages,

and payroll tax expenses, on its own financial statements for federal income tax purposes.

If a related company/LLC has not been assigned an unemployment tax account number, you must register. To register online go to

UT Account Number

Common Paymaster:

/

/

*Total Quarterly Wages Earned for

For Quarter/Year Ending:

Concurrent Employees (cannot be zero)

UT Account Number

Name of Related Corporations/LLCs

Gross

Taxable

(Attach additional sheets, if necessary.)

*Concurrent wages for the quarter represent wages for services performed for that corporation/LLC and will be expensed as wages for federal

income tax purposes. They will also be recorded as payable to the common paymaster.

Being authorized to execute this report on behalf of the corporations/LLCs named, I confirm that the information provided is true and correct.

Name of common paymaster: ________________________________________________________________________________________________________________________

Authorized signature: _______________________________________________________________________________________________________________________________

Print name: _______________________________________________________________

Phone ( __________ ) ___________________________________________________

Fax this form to:

For assistance call:

Florida Department of Revenue

850-488-5997

PO Box 6510

800-352-3671

Tallahassee FL 32314-6510

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1