Form Ia 4506 - Request For Copy Of Tax Return - 2009

ADVERTISEMENT

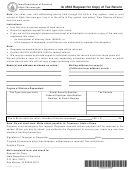

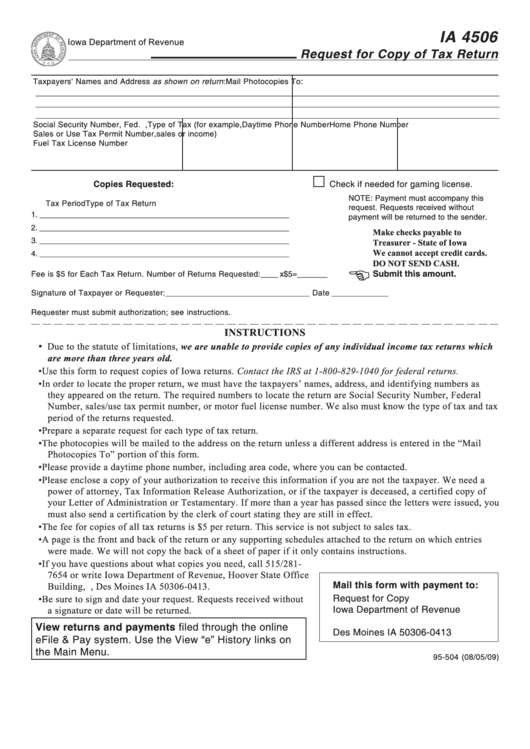

IA 4506

Iowa Department of Revenue

Request for Copy of Tax Return

Taxpayers’ Names and Address as shown on return:

Mail Photocopies To:

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

Social Security Number, Fed. I.D.,

Type of Tax (for example,

Daytime Phone Number

Home Phone Number

Sales or Use Tax Permit Number,

sales or income)

Fuel Tax License Number

Copies Requested:

Check if needed for gaming license.

NOTE: Payment must accompany this

Tax Period

Type of Tax Return

request. Requests received without

1. ___________

______________________________________________

payment will be returned to the sender.

2. ___________

______________________________________________

Make checks payable to

3. ___________

______________________________________________

Treasurer - State of Iowa

We cannot accept credit cards.

4. ___________

______________________________________________

DO NOT SEND CASH.

Submit this amount.

Fee is $5 for Each Tax Return. Number of Returns Requested: ____ x $5 = _______

Signature of Taxpayer or Requester: _________________________________ Date _____________

Requester must submit authorization; see instructions.

INSTRUCTIONS

•

Due to the statute of limitations, we are unable to provide copies of any individual income tax returns which

are more than three years old.

• Use this form to request copies of Iowa returns. Contact the IRS at 1-800-829-1040 for federal returns.

• In order to locate the proper return, we must have the taxpayers’ names, address, and identifying numbers as

they appeared on the return. The required numbers to locate the return are Social Security Number, Federal I.D.

Number, sales/use tax permit number, or motor fuel license number. We also must know the type of tax and tax

period of the returns requested.

• Prepare a separate request for each type of tax return.

• The photocopies will be mailed to the address on the return unless a different address is entered in the “Mail

Photocopies To” portion of this form.

• Please provide a daytime phone number, including area code, where you can be contacted.

• Please enclose a copy of your authorization to receive this information if you are not the taxpayer. We need a

power of attorney, Tax Information Release Authorization, or if the taxpayer is deceased, a certified copy of

your Letter of Administration or Testamentary. If more than a year has passed since the letters were issued, you

must also send a certification by the clerk of court stating they are still in effect.

• The fee for copies of all tax returns is $5 per return. This service is not subject to sales tax.

• A page is the front and back of the return or any supporting schedules attached to the return on which entries

were made. We will not copy the back of a sheet of paper if it only contains instructions.

• If you have questions about what copies you need, call 515/281-

7654 or write Iowa Department of Revenue, Hoover State Office

Mail this form with payment to:

Building, P.O. Box 10413, Des Moines IA 50306-0413.

Request for Copy

• Be sure to sign and date your request. Requests received without

Iowa Department of Revenue

a signature or date will be returned.

P.O. Box 10413

View returns and payments filed through the online

Des Moines IA 50306-0413

eFile & Pay system. Use the View “e” History links on

the Main Menu.

95-504 (08/05/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1