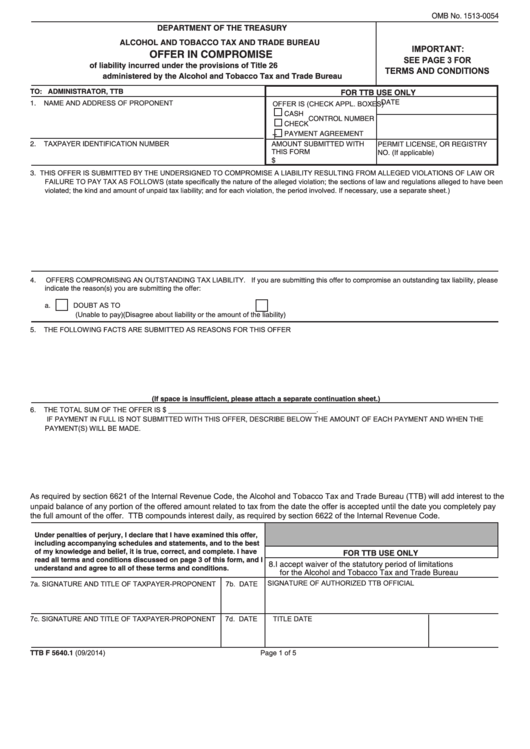

OMB No. 1513-0054

DEPARTMENT OF THE TREASURY

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU

IMPORTANT:

OFFER IN COMPROMISE

SEE PAGE 3 FOR

of liability incurred under the provisions of Title 26 U.S.C. enforced and

TERMS AND CONDITIONS

administered by the Alcohol and Tobacco Tax and Trade Bureau

TO: ADMINISTRATOR, TTB

FOR TTB USE ONLY

DATE

NAME AND ADDRESS OF PROPONENT

1.

OFFER IS (CHECK APPL. BOXES)

CASH

CONTROL NUMBER

CHECK

PAYMENT AGREEMENT

T

TAXPAYER IDENTIFICATION NUMBER

2.

AMOUNT SUBMITTED WITH

PERMIT LICENSE, OR REGISTRY

THIS FORM

NO. (If applicable)

$

THIS OFFER IS SUBMITTED BY THE UNDERSIGNED TO COMPROMISE A LIABILITY RESULTING FROM ALLEGED VIOLATIONS OF LAW OR

3.

FAILURE TO PAY TAX AS FOLLOWS (state specifically the nature of the alleged violation; the sections of law and regulations alleged to have been

violated; the kind and amount of unpaid tax liability; and for each violation, the period involved. If necessary, use a separate sheet.)

OFFERS COMPROMISING AN OUTSTANDING TAX LIABILITY. If you are submitting this offer to compromise an outstanding tax liability, please

4.

indicate the reason(s) you are submitting the offer:

a.

DOUBT AS TO COLLECTIBILITY

b.

DOUBT AS TO LIABILITY

(Unable to pay)

(Disagree about liability or the amount of the liability)

THE FOLLOWING FACTS ARE SUBMITTED AS REASONS FOR THIS OFFER

5.

(If space is insufficient, please attach a separate continuation sheet.)

THE TOTAL SUM OF THE OFFER IS $ ______________________________________.

6.

IF PAYMENT IN FULL IS NOT SUBMITTED WITH THIS OFFER, DESCRIBE BELOW THE AMOUNT OF EACH PAYMENT AND WHEN THE

PAYMENT(S) WILL BE MADE.

As required by section 6621 of the Internal Revenue Code, the Alcohol and Tobacco Tax and Trade Bureau (TTB) will add interest to the

unpaid balance of any portion of the offered amount related to tax from the date the offer is accepted until the date you completely pay

the full amount of the offer. TTB compounds interest daily, as required by section 6622 of the Internal Revenue Code.

Under penalties of perjury, I declare that I have examined this offer,

including accompanying schedules and statements, and to the best

of my knowledge and belief, it is true, correct, and complete. I have

FOR TTB USE ONLY

read all terms and conditions discussed on page 3 of this form, and I

8. I accept waiver of the statutory period of limitations

understand and agree to all of these terms and conditions.

for the Alcohol and Tobacco Tax and Trade Bureau

SIGNATURE OF AUTHORIZED TTB OFFICIAL

7a. SIGNATURE AND TITLE OF TAXPAYER-PROPONENT

7b. DATE

7c. SIGNATURE AND TITLE OF TAXPAYER-PROPONENT

7d. DATE

TITLE

DATE

TTB F 5640.1 (09/2014)

Page 1 of 5

1

1