Print

Clear

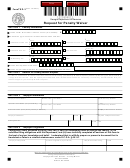

TSD-3

(Rev. 12/2011)

Form

Georgia Department of Revenue

Request for Penalty Waiver

SECTION 1

Penalty Information

L

Enter Letter ID number listed on notice (if available):

Check tax type and enter related identification number:

FEIN:

SSN:

Individual Income Tax

-

-

-

Corporate Income Tax

STN:

IFTA: GA

S

l a

s e

a

n

d

U

s

e

T

a

x

IFTA Fuel Tax

TAX ID:

WTN:

-

Other

Withholding Tax

.

Enter Penalty Waiver amount:

Enter tax periods related to the requested Penalty Waiver amount:

SECTION 2

Reason for Penalty Waiver Request

In order to understand the facts and circumstances surrounding your Penalty Waiver Request , please explain why you were unable to

comply with the tax law. Use the space provided below and use additional sheets as necessary. Include any documentation that you

believe supports your Penalty Waiver Request.

SECTION 3

Taxpayer Information

Taxpayer’s First Name

Middle Initial

Last Name

Social Security Number

Spouse’s First Name (if a joint liability)

Middle Initial Last Name

Social Security Number

Business Name

Employer Identification Number

(use if penalty owed by a business)

City

State

ZIP

Taxpayer’s Address

Daytime Telephone Number

Mailing Address

City

State

ZIP

SECTION 4

Taxpayer’s Signature

Signature

/ I

W

e

d

e

c

a l

e r

u

n

d

r e

p

e

n

a

t l

e i

s

f o

p

r e

u j

y r

h t

t a

/ I

w

e

) i (

h

a

v

e

n

o

o

u

s t

a t

n

d

n i

g

S

a t

e t

f o

G

e

o

g r

a i

a t

x

l

a i

b

i l i

y t

( ,

) i i

n

o

unfulfilled filing obligations with the Department, and (iii) have truthfully completed all sections of this form to

the

best of my/our knowledge and belief. I understand that to willfully prepare or present a document that is

fraudulent or false is a criminal misdemeanor under O.C.G.A. § 48-1-6.

Taxpayer’s Signature

Spouse’s Signature (if joint return)

Title (for business entity)

Date

Representative’s Name

Representative’s Signature

Telephone Number

Date

Mail this application and all attachments to the following address:

Georgia Department of Revenue

Taxpayer Services Division – Penalty Waiver

P.O. Box 105596

Atlanta, GA 30348

1

1 2

2