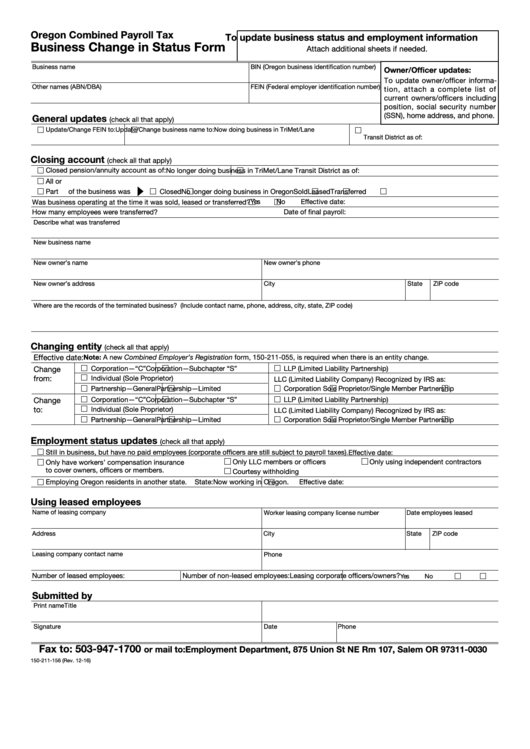

Clear This Page

Oregon Combined Payroll Tax

To update business status and employment information

Business Change in Status Form

Attach additional sheets if needed.

Business name

BIN (Oregon business identification number)

Owner/Officer updates:

To update owner/officer informa-

Other names (ABN/DBA)

FEIN (Federal employer identification number)

tion, attach a complete list of

current owners/officers including

position, social security number

(SSN), home address, and phone.

General updates

(check all that apply)

Update/Change FEIN to:

Update/Change business name to:

Now doing business in TriMet/Lane

Transit District as of:

Closing account

(check all that apply)

Closed pension/annuity account as of:

No longer doing business in TriMet/Lane Transit District as of:

All or

Part

of the business was

Closed

No longer doing business in Oregon

Sold

Leased

Transferred

Yes

No

Effective date:

Was business operating at the time it was sold, leased or transferred?

Date of final payroll:

How many employees were transferred?

Describe what was transferred

New business name

New owner’s name

New owner’s phone

New owner’s address

City

State

ZIP code

Where are the records of the terminated business? (Include contact name, phone, address, city, state, ZIP code)

Changing entity

(check all that apply)

Effective date:

Note: A new Combined Employer’s Registration form, 150-211-055, is required when there is an entity change.

Change

Corporation —“C”

Corporation—Subchapter “S”

LLP (Limited Liability Partnership)

from:

Individual (Sole Proprietor)

LLC (Limited Liability Company) Recognized by IRS as:

Partnership —General

Partnership—Limited

Corporation

Sole Proprietor/Single Member

Partnership

Change

Corporation —“C”

Corporation—Subchapter “S”

LLP (Limited Liability Partnership)

to:

Individual (Sole Proprietor)

LLC (Limited Liability Company) Recognized by IRS as:

Partnership —General

Partnership—Limited

Corporation

Sole Proprietor/Single Member

Partnership

Employment status updates

(check all that apply)

Still in business, but have no paid employees (corporate officers are still subject to payroll taxes). Effective date:

Only have workers’ compensation insurance

Only LLC members or officers

Only using independent contractors

to cover owners, officers or members.

Courtesy withholding

Employing Oregon residents in another state.

State:

Now working in Oregon.

Effective date:

Using leased employees

Name of leasing company

Worker leasing company license number

Date employees leased

Address

City

State

ZIP code

Leasing company contact name

Phone

Number of leased employees:

Number of non-leased employees:

Leasing corporate officers/owners?

Yes

No

Submitted by

Print name

Title

Signature

Date

Phone

Fax to: 503-947-1700

or mail to: Employment Department, 875 Union St NE Rm 107, Salem OR 97311-0030

150-211-156 (Rev. 12-16)

1

1 2

2