Reconciliation Of Income Tax Withheld Form Bw-3 - Instructions For Cd-Rom Due On Or Before February 28 For The Preceding Year

ADVERTISEMENT

Reconciliation of Income Tax Withheld Form BW-3

Instructions for CD-ROM

Due On or Before February 28 for the Preceding Year

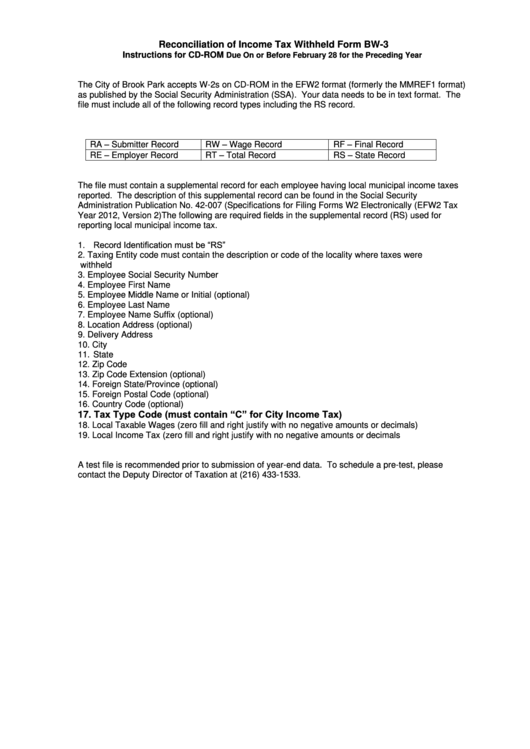

The City of Brook Park accepts W-2s on CD-ROM in the EFW2 format (formerly the MMREF1 format)

as published by the Social Security Administration (SSA). Your data needs to be in text format. The

file must include all of the following record types including the RS record.

RA – Submitter Record

RW – Wage Record

RF – Final Record

RE – Employer Record

RT – Total Record

RS – State Record

The file must contain a supplemental record for each employee having local municipal income taxes

reported. The description of this supplemental record can be found in the Social Security

Administration Publication No. 42-007 (Specifications for Filing Forms W2 Electronically (EFW2 Tax

Year 2012, Version 2) The following are required fields in the supplemental record (RS) used for

reporting local municipal income tax.

1. Record Identification must be “RS”

2. Taxing Entity code must contain the description or code of the locality where taxes were

withheld

3. Employee Social Security Number

4. Employee First Name

5. Employee Middle Name or Initial (optional)

6. Employee Last Name

7. Employee Name Suffix (optional)

8. Location Address (optional)

9. Delivery Address

10. City

11. State

12. Zip Code

13. Zip Code Extension (optional)

14. Foreign State/Province (optional)

15. Foreign Postal Code (optional)

16. Country Code (optional)

17. Tax Type Code (must contain “C” for City Income Tax)

18. Local Taxable Wages (zero fill and right justify with no negative amounts or decimals)

19. Local Income Tax (zero fill and right justify with no negative amounts or decimals

A test file is recommended prior to submission of year-end data. To schedule a pre-test, please

contact the Deputy Director of Taxation at (216) 433-1533.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2