Instructions For Form Nyc-202 - Unincorporated Business Tax Return - 2006

ADVERTISEMENT

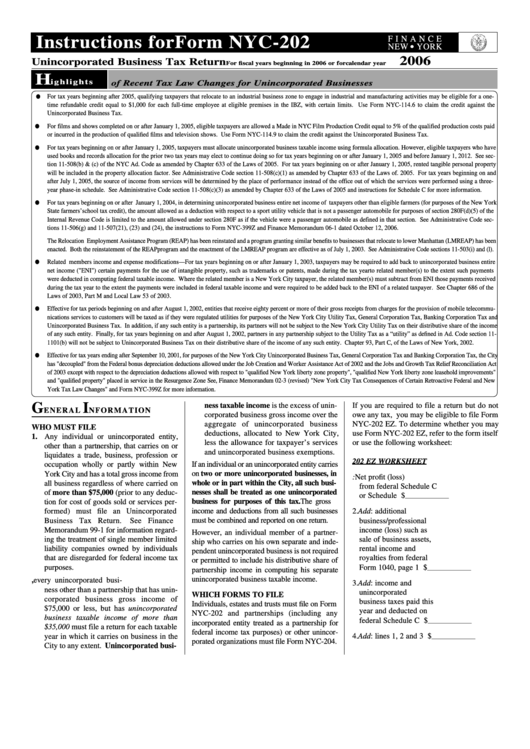

Instructions for Form NYC-202

F I N A N C E

NEW YORK

2006

Unincorporated Business Tax Return

For fiscal years beginning in 2006 or for calendar year

H

i g h l i g h t s

of Recent Tax Law Changes for Unincorporated Businesses

For tax years beginning after 2005, qualifying taxpayers that relocate to an industrial business zone to engage in industrial and manufacturing activities may be eligible for a one-

time refundable credit equal to $1,000 for each full-time employee at eligible premises in the IBZ, with certain limits. Use Form NYC-114.6 to claim the credit against the

Unincorporated Business Tax.

For films and shows completed on or after January 1, 2005, eligible taxpayers are allowed a Made in NYC Film Production Credit equal to 5% of the qualified production costs paid

or incurred in the production of qualified films and television shows. Use Form NYC-114.9 to claim the credit against the Unincorporated Business Tax.

For tax years beginning on or after January 1, 2005, taxpayers must allocate unincorporated business taxable income using formula allocation. However, eligible taxpayers who have

used books and records allocation for the prior two tax years may elect to continue doing so for tax years beginning on or after January 1, 2005 and before January 1, 2012. See sec-

tion 11-508(b) & (c) of the NYC Ad. Code as amended by Chapter 633 of the Laws of 2005. For tax years beginning on or after January 1, 2005, rented tangible personal property

will be included in the property allocation factor. See Administrative Code section 11-508(c)(1) as amended by Chapter 633 of the Laws of. 2005. For tax years beginning on and

after July 1, 2005, the source of income from services will be determined by the place of performance instead of the office out of which the services were performed using a three-

year phase-in schedule. See Administrative Code section 11-508(c)(3) as amended by Chapter 633 of the Laws of 2005 and instructions for Schedule C for more information.

For tax years beginning on or after January 1, 2004, in determining unincorporated business entire net income of taxpayers other than eligible farmers (for purposes of the New York

State farmers’ school tax credit), the amount allowed as a deduction with respect to a sport utility vehicle that is not a passenger automobile for purposes of section 280F(d)(5) of the

Internal Revenue Code is limited to the amount allowed under section 280F as if the vehicle were a passenger automobile as defined in that section. See Administrative Code sec-

tions 11-506(g) and 11-507(21), (23) and (24), the instructions to Form NYC-399Z and Finance Memorandum 06-1 dated October 12, 2006.

The Relocation Employment Assistance Program (REAP) has been reinstated and a program granting similar benefits to businesses that relocate to lower Manhattan (LMREAP) has been

enacted. Both the reinstatement of the REAP program and the enactment of the LMREAP program are effective as of July 1, 2003. See Administrative Code sections 11-503(i) and (l).

Related members income and expense modifications—For tax years beginning on or after January 1, 2003, taxpayers may be required to add back to unincorporated business entire

net income ("ENI") certain payments for the use of intangible property, such as trademarks or patents, made during the tax year to related member(s) to the extent such payments

were deducted in computing federal taxable income. Where the related member is a New York City taxpayer, the related member(s) must subtract from ENI those payments received

during the tax year to the extent the payments were included in federal taxable income and were required to be added back to the ENI of a related taxpayer. See Chapter 686 of the

Laws of 2003, Part M and Local Law 53 of 2003.

Effective for tax periods beginning on and after August 1, 2002, entities that receive eighty percent or more of their gross receipts from charges for the provision of mobile telecommu-

nications services to customers will be taxed as if they were regulated utilities for purposes of the New York City Utility Tax, General Corporation Tax, Banking Corporation Tax and

Unincorporated Business Tax. In addition, if any such entity is a partnership, its partners will not be subject to the New York City Utility Tax on their distributive share of the income

of any such entity. Finally, for tax years beginning on and after August 1, 2002, partners in any partnership subject to the Utility Tax as a “utility” as defined in Ad. Code section 11-

1101(b) will not be subject to Unincorporated Business Tax on their distributive share of the income of any such entity. Chapter 93, Part C, of the Laws of New York, 2002.

Effective for tax years ending after September 10, 2001, for purposes of the New York City Unincorporated Business Tax, General Corporation Tax and Banking Corporation Tax, the City

has "decoupled" from the Federal bonus depreciation deductions allowed under the Job Creation and Worker Assistance Act of 2002 and the Jobs and Growth Tax Relief Reconciliation Act

of 2003 except with respect to the depreciation deductions allowed with respect to "qualified New York liberty zone property", "qualified New York liberty zone leasehold improvements"

and "qualified property" placed in service in the Resurgence Zone See, Finance Memorandum 02-3 (revised) "New York City Tax Consequences of Certain Retroactive Federal and New

York Tax Law Changes" and Form NYC-399Z for more information.

G

I

ness taxable income is the excess of unin-

If you are required to file a return but do not

ENERAL

NFORMATION

corporated business gross income over the

owe any tax, you may be eligible to file Form

aggregate of unincorporated business

NYC-202 EZ. To determine whether you may

WHO MUST FILE

deductions, allocated to New York City,

use Form NYC-202 EZ, refer to the form itself

1. Any individual or unincorporated entity,

less the allowance for taxpayer’s services

or use the following worksheet:

other than a partnership, that carries on or

and unincorporated business exemptions.

liquidates a trade, business, profession or

202 EZ WORKSHEET

If an individual or an unincorporated entity carries

occupation wholly or partly within New

on two or more unincorporated businesses, in

York City and has a total gross income from

1. Enter: Net profit (loss)

whole or in part within the City, all such busi-

all business regardless of where carried on

from federal Schedule C

of more than $75,000 (prior to any deduc-

nesses shall be treated as one unincorporated

or Schedule C-EZ........... $

____________________

business for purposes of this tax. The gross

tion for cost of goods sold or services per-

income and deductions from all such businesses

formed) must file an Unincorporated

2. Add: additional

Business Tax Return.

See Finance

must be combined and reported on one return.

business/professional

Memorandum 99-1 for information regard-

income (loss) such as

However, an individual member of a partner-

ing the treatment of single member limited

sale of business assets,

ship who carries on his own separate and inde-

liability companies owned by individuals

rental income and

pendent unincorporated business is not required

that are disregarded for federal income tax

royalties from federal

or permitted to include his distributive share of

purposes.

Form 1040, page 1 ........ $

partnership income in computing his separate

____________________

unincorporated business taxable income.

2. In addition, every unincorporated busi-

3. Add: income and

ness other than a partnership that has unin-

unincorporated

WHICH FORMS TO FILE

corporated business gross income of

business taxes paid this

Individuals, estates and trusts must file on Form

$75,000 or less, but has unincorporated

year and deducted on

NYC-202 and partnerships (including any

business taxable income of more than

federal Schedule C ........ $

incorporated entity treated as a partnership for

____________________

$35,000 must file a return for each taxable

federal income tax purposes) or other unincor-

year in which it carries on business in the

4. Add: lines 1, 2 and 3 ..... $

____________________

porated organizations must file Form NYC-204.

City to any extent. Unincorporated busi-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12