Form Ia 706 - Iowa Inheritance/estate Tax Return - 2013

ADVERTISEMENT

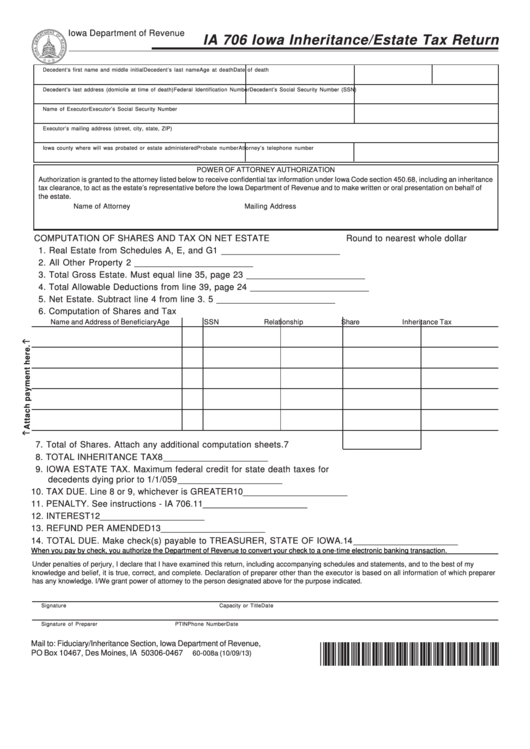

Iowa Department of Revenue

IA 706 Iowa Inheritance/Estate Tax Return

Decedent’s first name and middle initial

Decedent’s last name

Age at death

Date of death

Decedent’s last address (domicile at time of death)

Federal Identification Number

Decedent’s Social Security Number (SSN)

Name of Executor

Executor’s Social Security Number

Executor’s mailing address (street, city, state, ZIP)

Iowa county where will was probated or estate administered

Probate number

Attorney’s telephone number

POWER OF ATTORNEY AUTHORIZATION

Authorization is granted to the attorney listed below to receive confidential tax information under Iowa Code section 450.68, including an inheritance

tax clearance, to act as the estate’s representative before the Iowa Department of Revenue and to make written or oral presentation on behalf of

the estate.

Name of Attorney

Mailing Address

COMPUTATION OF SHARES AND TAX ON NET ESTATE

Round to nearest whole dollar

1. Real Estate from Schedules A, E, and G ................................................ 1 _________________________

2. All Other Property ....................................................................................... 2 _________________________

3. Total Gross Estate. Must equal line 35, page 2 ........................................ 3 _________________________

4. Total Allowable Deductions from line 39, page 2 ...................................... 4 _________________________

5. Net Estate. Subtract line 4 from line 3. ..................................................... 5 _________________________

6. Computation of Shares and Tax

Name and Address of Beneficiary

Age

SSN

Relationship

Share

Inheritance Tax

7. Total of Shares. Attach any additional computation sheets. ................... 7

8. TOTAL INHERITANCE TAX .......................................................................................... 8 ______________________

9. IOWA ESTATE TAX. Maximum federal credit for state death taxes for

decedents dying prior to 1/1/05 ................................................................................... 9 ______________________

10. TAX DUE. Line 8 or 9, whichever is GREATER ........................................................ 10 ______________________

11. PENALTY. See instructions - IA 706. ......................................................................... 11 ______________________

12. INTEREST .................................................................................................................... 12 ______________________

13. REFUND PER AMENDED .......................................................................................... 13 ______________________

14. TOTAL DUE. Make check(s) payable to TREASURER, STATE OF IOWA. ............ 14 ______________________

When you pay by check, you authorize the Department of Revenue to convert your check to a one-time electronic banking transaction.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer other than the executor is based on all information of which preparer

has any knowledge. I/We grant power of attorney to the person designated above for the purpose indicated.

Signature

Capacity or Title

Date

Signature of Preparer

PTIN

Phone Number

Date

Mail to: Fiduciary/Inheritance Section, Iowa Department of Revenue,

*1360008019999*

PO Box 10467, Des Moines, IA 50306-0467

60-008a (10/09/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2