Instructions For Schedule J (Form 541) - 2016

ADVERTISEMENT

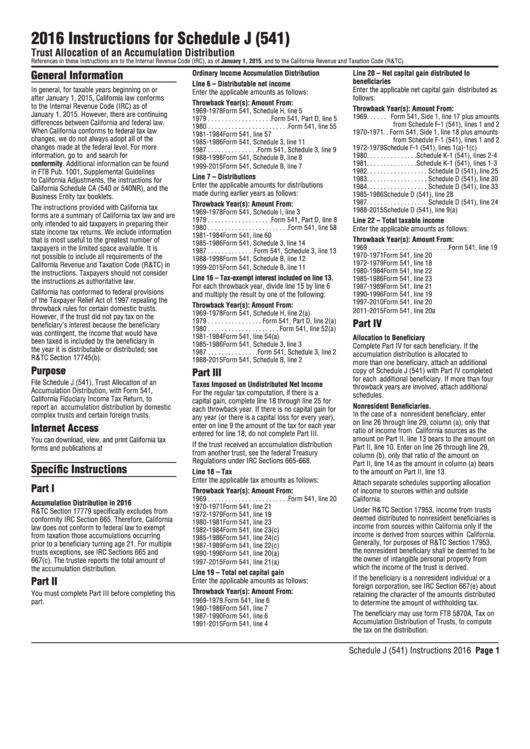

2016 Instructions for Schedule J (541)

Trust Allocation of an Accumulation Distribution

References in these instructions are to the Internal Revenue Code (IRC), as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

General Information

Ordinary Income Accumulation Distribution

Line 20 – Net capital gain distributed to

beneficiaries

Line 6 – Distributable net income

In general, for taxable years beginning on or

Enter the applicable net capital gain distributed as

Enter the applicable amounts as follows:

after January 1, 2015, California law conforms

follows:

Throwback Year(s):

Amount From:

to the Internal Revenue Code (IRC) as of

Throwback Year(s):

Amount From:

1969-1978 . . . . . . . . . .Form 541, Schedule H, line 5

January 1, 2015. However, there are continuing

1969. . . . . . Form 541, Side 1, line 17 plus amounts

1979 . . . . . . . . . . . . . . . . . . .Form 541, Part D, line 5

differences between California and federal law.

from Schedule F-1 (541), lines 1 and 2

1980 . . . . . . . . . . . . . . . . . . . . . . . .Form 541, line 55

When California conforms to federal tax law

1970-1971 . . Form 541, Side 1, line 18 plus amounts

1981-1984 . . . . . . . . . . . . . . . . . . .Form 541, line 57

changes, we do not always adopt all of the

from Schedule F-1 (541), lines 1 and 2

1985-1986 . . . . . . . . . Form 541, Schedule 3, line 11

changes made at the federal level. For more

1972-1979 . . . . . . Schedule F-1 (541), lines 1(a)-1(c)

1987 . . . . . . . . . . . . . . . Form 541, Schedule 3, line 9

information, go to ftb.ca.gov and search for

1980. . . . . . . . . . . . . . . Schedule K-1 (541), lines 2-4

1988-1998 . . . . . . . . . . Form 541, Schedule B, line 8

conformity. Additional information can be found

1981. . . . . . . . . . . . . . . Schedule K-1 (541), lines 1-3

1999-2015 . . . . . . . . . . Form 541, Schedule B, line 7

1982. . . . . . . . . . . . . . . . . . Schedule D (541), line 25

in FTB Pub. 1001, Supplemental Guidelines

Line 7 – Distributions

1983. . . . . . . . . . . . . . . . . . Schedule D (541), line 30

to California Adjustments, the instructions for

Enter the applicable amounts for distributions

1984. . . . . . . . . . . . . . . . . . Schedule D (541), line 33

California Schedule CA (540 or 540NR), and the

made during earlier years as follows:

1985-1986 . . . . . . . . . . . . . Schedule D (541), line 28

Business Entity tax booklets.

1987. . . . . . . . . . . . . . . . . . Schedule D (541), line 24

Throwback Year(s):

Amount From:

The instructions provided with California tax

1988-2015 . . . . . . . . . . . . Schedule D (541), line 9(a)

1969-1978 . . . . . . . . . . Form 541, Schedule I, line 3

forms are a summary of California tax law and are

1979 . . . . . . . . . . . . . . . . . . .Form 541, Part D, line 8

Line 22 – Total taxable income

only intended to aid taxpayers in preparing their

1980 . . . . . . . . . . . . . . . . . . . . . . . .Form 541, line 58

Enter the applicable amounts as follows:

state income tax returns. We include information

1981-1984 . . . . . . . . . . . . . . . . . . .Form 541, line 60

Throwback Year(s):

Amount From:

that is most useful to the greatest number of

1985-1986 . . . . . . . . . Form 541, Schedule 3, line 14

1969 . . . . . . . . . . . . . . . . . . . . . . . .Form 541, line 19

taxpayers in the limited space available. It is

1987 . . . . . . . . . . . . . . Form 541, Schedule 3, line 13

1970-1971 . . . . . . . . . . . . . . . . . . .Form 541, line 20

not possible to include all requirements of the

1988-1998 . . . . . . . . . Form 541, Schedule B, line 12

1972-1979 . . . . . . . . . . . . . . . . . . .Form 541, line 18

California Revenue and Taxation Code (R&TC) in

1999-2015 . . . . . . . . . Form 541, Schedule B, line 11

1980-1984 . . . . . . . . . . . . . . . . . . .Form 541, line 22

the instructions. Taxpayers should not consider

Line 16 – Tax-exempt interest included on line 13.

1985-1986 . . . . . . . . . . . . . . . . . . .Form 541, line 23

the instructions as authoritative law.

For each throwback year, divide line 15 by line 6

1987-1989 . . . . . . . . . . . . . . . . . . .Form 541, line 21

California has conformed to federal provisions

and multiply the result by one of the following:

1990-1996 . . . . . . . . . . . . . . . . . . .Form 541, line 19

of the Taxpayer Relief Act of 1997 repealing the

1997-2010 . . . . . . . . . . . . . . . . . . .Form 541, line 20

Throwback Year(s):

Amount From:

throwback rules for certain domestic trusts.

2011-2015 . . . . . . . . . . . . . . . . . . Form 541, line 20a

1969-1978 . . . . . . . Form 541, Schedule H, line 2(a)

However, if the trust did not pay tax on the

1979 . . . . . . . . . . . . . . . . Form 541, Part D, line 2(a)

Part IV

beneficiary’s interest because the beneficiary

1980 . . . . . . . . . . . . . . . . . . . . . Form 541, line 52(a)

was contingent, the income that would have

1981-1984 . . . . . . . . . . . . . . . . Form 541, line 54(a)

Allocation to Beneficiary

been taxed is included by the beneficiary in

1985-1986 . . . . . . . . . .Form 541, Schedule 3, line 3

Complete Part IV for each beneficiary. If the

the year it is distributable or distributed; see

1987 . . . . . . . . . . . . . . .Form 541, Schedule 3, line 2

accumulation distribution is allocated to

R&TC Section 17745(b).

1988-2015 . . . . . . . . . .Form 541, Schedule B, line 2

more than one beneficiary, attach an additional

Purpose

Part III

copy of Schedule J (541) with Part IV completed

for each additional beneficiary. If more than four

File Schedule J (541), Trust Allocation of an

Taxes Imposed on Undistributed Net Income

throwback years are involved, attach additional

Accumulation Distribution, with Form 541,

For the regular tax computation, if there is a

schedules.

California Fiduciary Income Tax Return, to

capital gain, complete line 18 through line 25 for

Nonresident Beneficiaries.

report an accumulation distribution by domestic

each throwback year. If there is no capital gain for

In the case of a nonresident beneficiary, enter

complex trusts and certain foreign trusts.

any year (or there is a capital loss for every year),

on line 26 through line 29, column (a), only that

enter on line 9 the amount of the tax for each year

Internet Access

ratio of income from California sources as the

entered for line 18; do not complete Part III.

amount on Part II, line 13 bears to the amount on

You can download, view, and print California tax

If the trust received an accumulation distribution

Part II, line 10. Enter on line 26 through line 29,

forms and publications at ftb.ca.gov.

from another trust, see the federal Treasury

column (b), only that ratio of the amount on

Regulations under IRC Sections 665-668.

Part II, line 14 as the amount in column (a) bears

Specific Instructions

Line 18 – Tax

to the amount on Part II, line 13.

Enter the applicable tax amounts as follows:

Attach separate schedules supporting allocation

Part I

Throwback Year(s):

Amount From:

of income to sources within and outside

1969 . . . . . . . . . . . . . . . . . . . . . . . .Form 541, line 20

California.

Accumulation Distribution in 2016

1970-1971 . . . . . . . . . . . . . . . . . . .Form 541, line 21

Under R&TC Section 17953, income from trusts

R&TC Section 17779 specifically excludes from

1972-1979 . . . . . . . . . . . . . . . . . . .Form 541, line 19

deemed distributed to nonresident beneficiaries is

conformity IRC Section 665. Therefore, California

1980-1981 . . . . . . . . . . . . . . . . . . .Form 541, line 23

income from sources within California only if the

law does not conform to federal law to exempt

1982-1984 . . . . . . . . . . . . . . . . Form 541, line 23(c)

income is derived from sources within California.

from taxation those accumulations occurring

1985-1986 . . . . . . . . . . . . . . . . Form 541, line 24(c)

Generally, for purposes of R&TC Section 17953,

prior to a beneficiary turning age 21. For multiple

1987-1989 . . . . . . . . . . . . . . . . Form 541, line 22(c)

the nonresident beneficiary shall be deemed to be

trusts exceptions, see IRC Sections 665 and

1990-1996 . . . . . . . . . . . . . . . . Form 541, line 20(a)

the owner of intangible personal property from

667(c). The trustee reports the total amount of

1997-2015 . . . . . . . . . . . . . . . . Form 541, line 21(a)

which the income of the trust is derived.

the accumulation distribution.

Line 19 – Total net capital gain

If the beneficiary is a nonresident individual or a

Part II

Enter the applicable amounts as follows:

foreign corporation, see IRC Section 667(e) about

Throwback Year(s): Amount From:

You must complete Part III before completing this

retaining the character of the amounts distributed

1969-1979 . . . . . . . . . . . . . . . . . . . .Form 541, line 6

part.

to determine the amount of withholding tax.

1980-1986 . . . . . . . . . . . . . . . . . . . .Form 541, line 7

The beneficiary may use form FTB 5870A, Tax on

1987-1990 . . . . . . . . . . . . . . . . . . . .Form 541, line 6

Accumulation Distribution of Trusts, to compute

1991-2015 . . . . . . . . . . . . . . . . . . . .Form 541, line 4

the tax on the distribution.

Schedule J (541) Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1