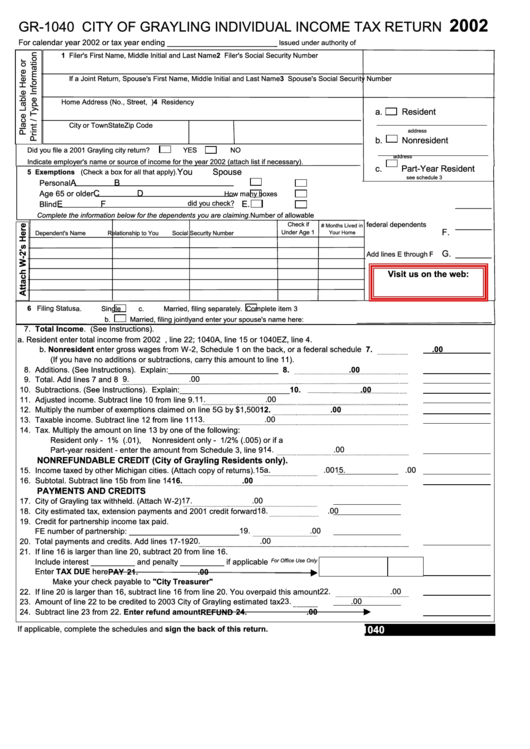

Form Gr-1040 - City Of Grayling Individual Income Tax Return - 2002

ADVERTISEMENT

2002

GR-1040 CITY OF GRAYLING INDIVIDUAL INCOME TAX RETURN

For calendar year 2002 or tax year ending __________________________

Issued under authority of P.A. 284 of 1964. Filing is mandatory.

1 Filer's First Name, Middle Initial and Last Name

2 Filer's Social Security Number

If a Joint Return, Spouse's First Name, Middle Initial and Last Name

3 Spouse's Social Security Number

Home Address (No., Street, P.O. Box or Rural Route)

4 Residency

a.

Resident

City or Town

State

Zip Code

address

b.

Nonresident

Did you file a 2001 Grayling city return?

YES

NO

address

Indicate employer's name or source of income for the year 2002 (attach list if necessary).

c.

Part-Year Resident

You

Spouse

5 Exemptions (Check a box for all that apply).

see schedule 3

A

B

Personal

C

D

Age 65 or older

How many boxes

E

F

E.

did you check?

Blind

Complete the information below for the dependents you are claiming.

Number of allowable

federal dependents

Check if

# Months Lived in

F.

Under Age 1

Dependent's Name

Relationship to You

Social Security Number

Your Home

G.

Add lines E through F

Visit us on the web:

6 Filing Status

a.

Single

c.

Married, filing separately. Complete item 3

b.

Married, filing jointly

and enter your spouse's name here:

7. Total Income. (See Instructions).

a. Resident enter total income from 2002 U.S. 1040, line 22; 1040A, line 15 or 1040EZ, line 4.

b. Nonresident enter gross wages from W-2, Schedule 1 on the back, or a federal schedule

7.

.00

(If you have no additions or subtractions, carry this amount to line 11).

8.

.00

8. Additions. (See Instructions). Explain:_________________________

9.

.00

9. Total. Add lines 7 and 8

10. Subtractions. (See Instructions). Explain:_________________________

10.

.00

11.

.00

11. Adjusted income. Subtract line 10 from line 9.

12. Multiply the number of exemptions claimed on line 5G by $1,500

12.

.00

13.

.00

13. Taxable income. Subtract line 12 from line 11

14. Tax. Multiply the amount on line 13 by one of the following:

Resident only - 1% (.01),

Nonresident only - 1/2% (.005) or if a

Part-year resident - enter the amount from Schedule 3, line 9

14.

.00

NONREFUNDABLE CREDIT (City of Grayling Residents only).

15a.

.00

15.

.00

15. Income taxed by other Michigan cities. (Attach copy of returns).

16.

.00

16. Subtotal. Subtract line 15b from line 14

PAYMENTS AND CREDITS

17.

.00

17. City of Grayling tax withheld. (Attach W-2)

18.

.00

18. City estimated tax, extension payments and 2001 credit forward

19. Credit for partnership income tax paid.

FE number of partnership: _________________________

19.

.00

20.

.00

20. Total payments and credits. Add lines 17-19

21. If line 16 is larger than line 20, subtract 20 from line 16.

Include interest __________ and penalty __________ if applicable

For Office Use Only

Enter TAX DUE here

PAY 21.

.00

Make your check payable to "City Treasurer"

22. If line 20 is larger than 16, subtract line 16 from line 20. You overpaid this amount

22.

.00

23.

.00

23. Amount of line 22 to be credited to 2003 City of Grayling estimated tax

24. Subtract line 23 from 22. Enter refund amount

REFUND 24.

.00

GRAYLING

GR-1040

If applicable, complete the schedules and sign the back of this return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2