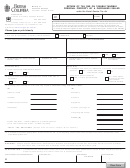

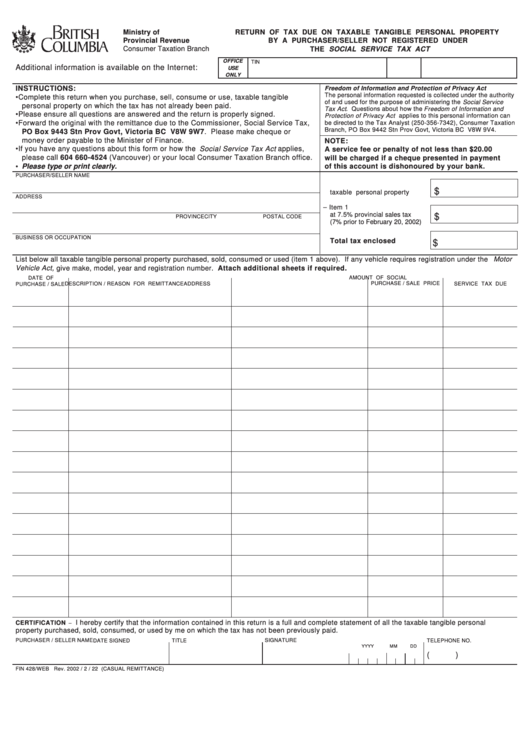

Form Fin 428/web - Return Of Tax Due On Taxable Tangible Personal Property By A Purchaser/seller Not Registered Under The Social Service Tax Act

ADVERTISEMENT

RETURN OF TAX DUE ON TAXABLE TANGIBLE PERSONAL PROPERTY

Ministry of

Provincial Revenue

BY A PURCHASER/SELLER NOT REGISTERED UNDER

Consumer Taxation Branch

THE SOCIAL SERVICE TAX ACT

OFFICE

TIN NO.

REGISTRATION/PROFILE/CASE

Additional information is available on the Internet:

USE

ONLY

INSTRUCTIONS:

Freedom of Information and Protection of Privacy Act

The personal information requested is collected under the authority

• Complete this return when you purchase, sell, consume or use, taxable tangible

of and used for the purpose of administering the Social Service

personal property on which the tax has not already been paid.

Tax Act . Questions about how the Freedom of Information and

• Please ensure all questions are answered and the return is properly signed.

Protection of Privacy Act applies to this personal information can

• Forward the original with the remittance due to the Commissioner, Social Service Tax,

be directed to the Tax Analyst (250-356-7342), Consumer Taxation

Branch, PO Box 9442 Stn Prov Govt, Victoria BC V8W 9V4.

PO Box 9443 Stn Prov Govt, Victoria BC V8W 9W7. Please make cheque or

money order payable to the Minister of Finance.

NOTE:

• If you have any questions about this form or how the Social Service Tax Act applies,

A service fee or penalty of not less than $20.00

please call 604 660-4524 (Vancouver) or your local Consumer Taxation Branch office.

will be charged if a cheque presented in payment

• Please type or print clearly.

of this account is dishonoured by your bank.

PURCHASER/SELLER NAME

1. Total purchase/sale price of

$

taxable personal property

ADDRESS

2. Tax collected/due – Item 1

at 7.5% provincial sales tax

$

POSTAL CODE

CITY

PROVINCE

(7% prior to February 20, 2002)

BUSINESS OR OCCUPATION

Total tax enclosed

$

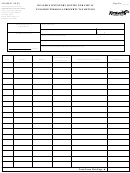

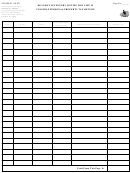

List below all taxable tangible personal property purchased, sold, consumed or used (item 1 above). If any vehicle requires registration under the Motor

Vehicle Act, give make, model, year and registration number. Attach additional sheets if required.

DATE OF

AMOUNT OF SOCIAL

PURCHASE / SALE PRICE

DESCRIPTION / REASON FOR REMITTANCE

ADDRESS

SERVICE TAX DUE

PURCHASE / SALE

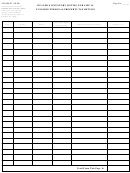

I hereby certify that the information contained in this return is a full and complete statement of all the taxable tangible personal

CERTIFICATION

–

property purchased, sold, consumed, or used by me on which the tax has not been previously paid.

PURCHASER / SELLER NAME

TITLE

SIGNATURE

DATE SIGNED

TELEPHONE NO.

YYYY

MM

DD

(

)

FIN 428/WEB Rev. 2002 / 2 / 22 (CASUAL REMITTANCE)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1