Form Mo-1040v - Individual Income Tax Payment Voucher - 2016

ADVERTISEMENT

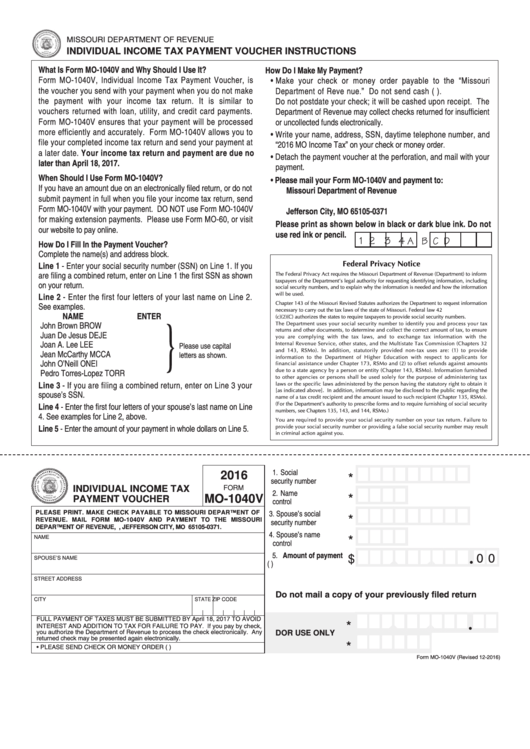

MISSOURI DEPARTMENT OF REVENUE

INDIVIDUAL INCOME TAX PAYMENT VOUCHER INSTRUCTIONS

What Is Form MO-1040V and Why Should I Use It?

How Do I Make My Payment?

Form MO-1040V, Individual Income Tax Payment Voucher, is

• Make your check or money order payable to the “Missouri

the voucher you send with your payment when you do not make

Department of Reve nue.” Do not send cash (U.S. funds only).

the payment with your income tax return. It is similar to

Do not postdate your check; it will be cashed upon receipt. The

vouchers returned with loan, utility, and credit card payments.

Department of Revenue may collect checks returned for insufficient

Form MO-1040V ensures that your payment will be processed

or uncollected funds electronically.

more efficiently and accurately. Form MO-1040V allows you to

• Write your name, address, SSN, daytime telephone number, and

file your completed income tax return and send your payment at

“2016 MO Income Tax” on your check or money order.

a later date. Your income tax return and payment are due no

• Detach the payment voucher at the perforation, and mail with your

later than April 18, 2017.

payment.

When Should I Use Form MO-1040V?

• Please mail your Form MO-1040V and payment to:

If you have an amount due on an electronically filed return, or do not

Missouri Department of Revenue

submit payment in full when you file your income tax return, send

P.O. Box 371

Form MO-1040V with your payment. DO NOT use Form MO-1040V

Jefferson City, MO 65105-0371

for making extension payments. Please use Form MO-60, or visit

Please print as shown below in black or dark blue ink. Do not

our website to pay online.

use red ink or pencil.

1 2 3 4

A B C D

How Do I Fill In the Payment Voucher?

Complete the name(s) and address block.

Federal Privacy Notice

Line 1 - Enter your social security number (SSN) on Line 1. If you

are filing a combined return, enter on Line 1 the first SSN as shown

The Federal Privacy Act requires the Missouri Department of Revenue (Department) to inform

taxpayers of the Department’s legal authority for requesting identifying information, including

on your return.

social security numbers, and to explain why the information is needed and how the information

will be used.

Line 2 - Enter the first four letters of your last name on Line 2.

Chapter 143 of the Missouri Revised Statutes authorizes the Department to request information

See examples.

necessary to carry out the tax laws of the state of Missouri. Federal law 42 U.S.C. Section 405

NAME

ENTER

(c)(2)(C) authorizes the states to require taxpayers to provide social security numbers.

John Brown

BROW

The Department uses your social security number to identify you and process your tax

}

returns and other documents, to determine and collect the correct amount of tax, to ensure

Juan De Jesus

DEJE

you are complying with the tax laws, and to exchange tax information with the

Joan A. Lee

LEE

Internal Revenue Service, other states, and the Multistate Tax Commission (Chapters 32

Please use capital

and 143, RSMo). In addition, statutorily provided non-tax uses are: (1) to provide

Jean McCarthy

MCCA

letters as shown.

information to the Department of Higher Education with respect to applicants for

John O’Neill

ONEI

financial assistance under Chapter 173, RSMo and (2) to offset refunds against amounts

due to a state agency by a person or entity (Chapter 143, RSMo). Information furnished

Pedro Torres-Lopez

TORR

to other agencies or persons shall be used solely for the purpose of administering tax

Line 3 - If you are filing a combined return, enter on Line 3 your

laws or the specific laws administered by the person having the statutory right to obtain it

[as indicated above]. In addition, information may be disclosed to the public regarding the

spouse’s SSN.

name of a tax credit recipient and the amount issued to such recipient (Chapter 135, RSMo).

(For the Department’s authority to prescribe forms and to require furnishing of social security

Line 4 - Enter the first four letters of your spouse’s last name on Line

numbers, see Chapters 135, 143, and 144, RSMo.)

4. See examples for Line 2, above.

You are required to provide your social security number on your tax return. Failure to

Line 5 - Enter the amount of your payment in whole dollars on Line 5.

provide your social security number or providing a false social security number may result

in criminal action against you.

Reset Form

Print Form

1. Social

2016

*

security number ..........

INDIVIDUAL INCOME TAX

FORM

2. Name

MO-1040V

*

PAYMENT VOUCHER

control ........................

3. Spouse’s social

PLEASE PRINT. MAKE CHECK PAYABLE TO MISSOURI DEPARTMENT OF

*

REVENUE. MAIL FORM MO-1040V AND PAYMENT TO THE MISSOURI

security number ..........

DEPARTMENT OF REVENUE, P.O. BOX 371, JEFFERSON CITY, MO 65105-0371.

4. Spouse’s name

NAME

*

control .......................

5. Amount of payment

0 0

$

SPOUSE’S NAME

•

(U.S. funds only) ........

STREET ADDRESS

Do not mail a copy of your previously filed return

CITY

STATE

ZIP CODE

FULL PAYMENT OF TAXES MUST BE SUBMITTED BY April 18, 2017 TO AVOID

*

INTEREST AND ADDITION TO TAX FOR FAILURE TO PAY. If you pay by check,

•

you authorize the Department of Revenue to process the check electronically. Any

DOR USE ONLY

returned check may be presented again electronically.

*

• PLEASE SEND CHECK OR MONEY ORDER (U.S. FUNDS ONLY)

Form MO-1040V (Revised 12-2016)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1