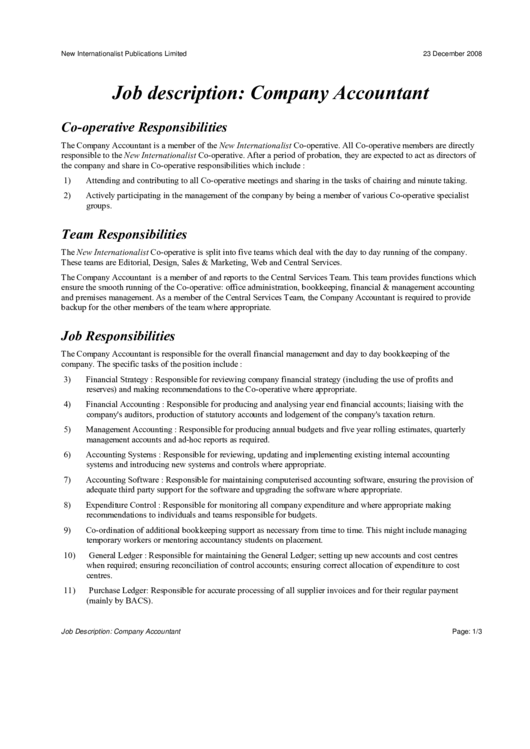

Job Description: Company Accountant

ADVERTISEMENT

New Internationalist Publications Limited

23 December 2008

Job description: Company Accountant

Co-operative Responsibilities

The Company Accountant is a member of the New Internationalist Co-operative. All Co-operative members are directly

responsible to the New Internationalist Co-operative. After a period of probation, they are expected to act as directors of

the company and share in Co-operative responsibilities which include :

1)

Attending and contributing to all Co-operative meetings and sharing in the tasks of chairing and minute taking.

2)

Actively participating in the management of the company by being a member of various Co-operative specialist

groups.

Team Responsibilities

The New Internationalist Co-operative is split into five teams which deal with the day to day running of the company.

These teams are Editorial, Design, Sales & Marketing, Web and Central Services.

The Company Accountant is a member of and reports to the Central Services Team. This team provides functions which

ensure the smooth running of the Co-operative: office administration, bookkeeping, financial & management accounting

and premises management. As a member of the Central Services Team, the Company Accountant is required to provide

backup for the other members of the team where appropriate.

Job Responsibilities

The Company Accountant is responsible for the overall financial management and day to day bookkeeping of the

company. The specific tasks of the position include :

3)

Financial Strategy : Responsible for reviewing company financial strategy (including the use of profits and

reserves) and making recommendations to the Co-operative where appropriate.

4)

Financial Accounting : Responsible for producing and analysing year end financial accounts; liaising with the

company's auditors, production of statutory accounts and lodgement of the company's taxation return.

5)

Management Accounting : Responsible for producing annual budgets and five year rolling estimates, quarterly

management accounts and ad-hoc reports as required.

6)

Accounting Systems : Responsible for reviewing, updating and implementing existing internal accounting

systems and introducing new systems and controls where appropriate.

7)

Accounting Software : Responsible for maintaining computerised accounting software, ensuring the provision of

adequate third party support for the software and upgrading the software where appropriate.

8)

Expenditure Control : Responsible for monitoring all company expenditure and where appropriate making

recommendations to individuals and teams responsible for budgets.

9)

Co-ordination of additional bookkeeping support as necessary from time to time. This might include managing

temporary workers or mentoring accountancy students on placement.

10)

General Ledger : Responsible for maintaining the General Ledger; setting up new accounts and cost centres

when required; ensuring reconciliation of control accounts; ensuring correct allocation of expenditure to cost

centres.

11)

Purchase Ledger: Responsible for accurate processing of all supplier invoices and for their regular payment

(mainly by BACS).

Job Description: Company Accountant

Page: 1/3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3