Form Dr-133n - Instructions For Filing Gross Receipts Tax Return - 2003

ADVERTISEMENT

DR-

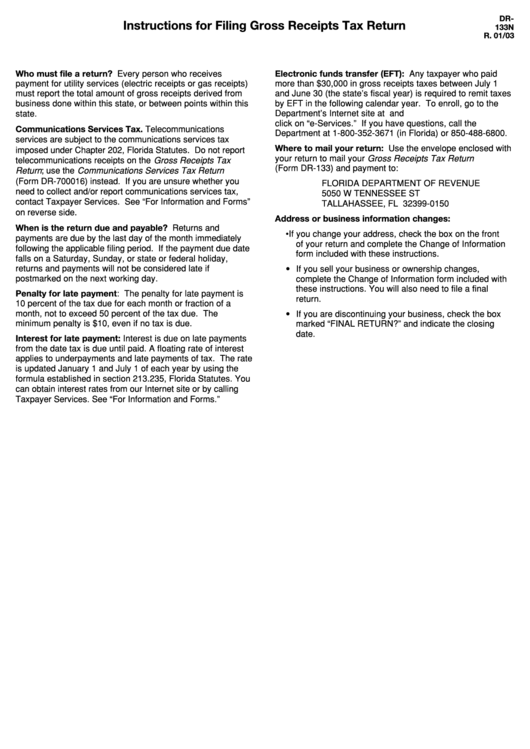

Instructions for Filing Gross Receipts Tax Return

133N

R. 01/03

Who must file a return? Every person who receives

Electronic funds transfer (EFT): Any taxpayer who paid

payment for utility services (electric receipts or gas receipts)

more than $30,000 in gross receipts taxes between July 1

must report the total amount of gross receipts derived from

and June 30 (the state’s fiscal year) is required to remit taxes

business done within this state, or between points within this

by EFT in the following calendar year. To enroll, go to the

state.

Department’s Internet site at and

click on “e-Services.” If you have questions, call the

Communications Services Tax. Telecommunications

Department at 1-800-352-3671 (in Florida) or 850-488-6800.

services are subject to the communications services tax

Where to mail your return: Use the envelope enclosed with

imposed under Chapter 202, Florida Statutes. Do not report

your return to mail your Gross Receipts Tax Return

telecommunications receipts on the Gross Receipts Tax

(Form DR-133) and payment to:

Return ; use the Communications Services Tax Return

(Form DR-700016) instead. If you are unsure whether you

FLORIDA DEPARTMENT OF REVENUE

need to collect and/or report communications services tax,

5050 W TENNESSEE ST

contact Taxpayer Services. See “For Information and Forms”

TALLAHASSEE, FL 32399-0150

on reverse side.

Address or business information changes:

When is the return due and payable? Returns and

• If you change your address, check the box on the front

payments are due by the last day of the month immediately

of your return and complete the Change of Information

following the applicable filing period. If the payment due date

form included with these instructions.

falls on a Saturday, Sunday, or state or federal holiday,

returns and payments will not be considered late if

• If you sell your business or ownership changes,

postmarked on the next working day.

complete the Change of Information form included with

these instructions. You will also need to file a final

Penalty for late payment: The penalty for late payment is

return.

10 percent of the tax due for each month or fraction of a

month, not to exceed 50 percent of the tax due. The

• If you are discontinuing your business, check the box

minimum penalty is $10, even if no tax is due.

marked “FINAL RETURN?” and indicate the closing

date.

Interest for late payment: Interest is due on late payments

from the date tax is due until paid. A floating rate of interest

applies to underpayments and late payments of tax. The rate

is updated January 1 and July 1 of each year by using the

formula established in section 213.235, Florida Statutes. You

can obtain interest rates from our Internet site or by calling

Taxpayer Services. See “For Information and Forms.”

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2