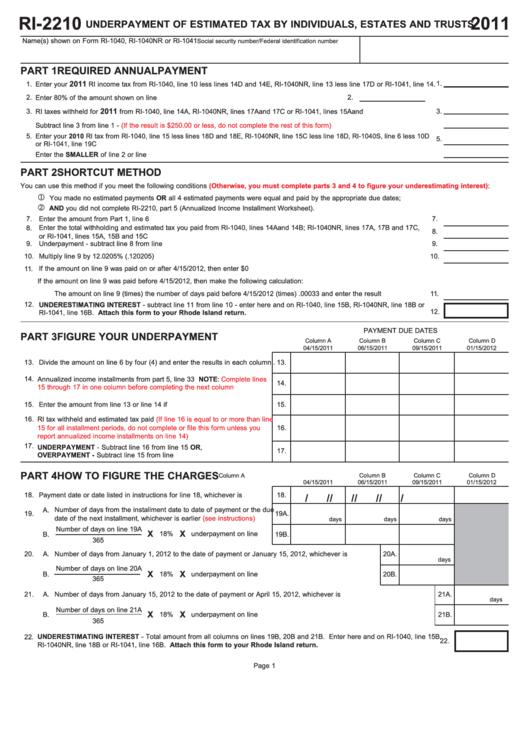

Form Ri-2210 - Underpayment Of Estimated Tax By Individuals, Estates And Trusts - 2011

ADVERTISEMENT

RI-2210

2011

UNDERPAYMENT OF ESTIMATED TAX BY INDIVIDUALS, ESTATES AND TRUSTS

Name(s) shown on Form RI-1040, RI-1040NR or RI-1041

Social security number/Federal identification number

PART 1

REQUIRED ANNUAL PAYMENT

2011

1.

1.

Enter your

RI income tax from RI-1040, line 10 less lines 14D and 14E, RI-1040NR, line 13 less line 17D or RI-1041, line 14.

2.

2.

Enter 80% of the amount shown on line 1.............................................................................................

3.

2011

3.

RI taxes withheld for

from RI-1040, line 14A, RI-1040NR, lines 17A and 17C or RI-1041, lines 15A and 15C............................

4.

Subtract line 3 from line 1 -

(If the result is $250.00 or less, do not complete the rest of this

form).......................................................

4.

5.

Enter your 2010 RI tax from RI-1040, line 15 less lines 18D and 18E, RI-1040NR, line 15C less line 18D, RI-1040S, line 6 less 10D

5.

or RI-1041, line 19C ...................................................................................................................................................................................

6.

Enter the SMALLER of line 2 or line 5.....................................................................................................................................................

6.

PART 2

SHORTCUT METHOD

You can use this method if you meet the following conditions

(Otherwise, you must complete parts 3 and 4 to figure your underestimating

interest):

1

You made no estimated payments OR all 4 estimated payments were equal and paid by the appropriate due dates;

2

AND you did not complete RI-2210, part 5 (Annualized Income Installment Worksheet).

7.

Enter the amount from Part 1, line 6 above........................................................................................................................................

7.

Enter the total withholding and estimated tax you paid from RI-1040, lines 14A and 14B; RI-1040NR, lines 17A, 17B and 17C,

8.

8.

or RI-1041, lines 15A, 15B and 15C ..................................................................................................................................................

9.

Underpayment - subtract line 8 from line 7.........................................................................................................................................

9.

10.

Multiply line 9 by 12.0205% (.120205)................................................................................................................................................

10.

11.

If the amount on line 9 was paid on or after 4/15/2012, then enter $0

If the amount on line 9 was paid before 4/15/2012, then make the following calculation:

The amount on line 9 (times) the number of days paid before 4/15/2012 (times) .00033 and enter the result here.................

11.

12.

UNDERESTIMATING INTEREST - subtract line 11 from line 10 - enter here and on RI-1040, line 15B, RI-1040NR, line 18B or

12.

RI-1041, line 16B. Attach this form to your Rhode Island return. ...............................................................................................

PAYMENT DUE DATES

PART 3

FIGURE YOUR UNDERPAYMENT

Column A

Column B

Column C

Column D

04/15/2011

06/15/2011

09/15/2011

01/15/2012

13.

Divide the amount on line 6 by four (4) and enter the results in each column..

13.

14.

Annualized income installments from part 5, line 33 NOTE:

Complete lines

14.

15 through 17 in one column before completing the next

column.....................

15.

Enter the amount from line 13 or line 14 if applicable.......................................

15.

16.

RI tax withheld and estimated tax paid

(If line 16 is equal to or more than line

15 for all installment periods, do not complete or file this form unless you

16.

report annualized income installments on line

14).............................................

17.

UNDERPAYMENT - Subtract line 16 from line 15 OR,

17.

OVERPAYMENT - Subtract line 15 from line 16................................................

PART 4

HOW TO FIGURE THE CHARGES

Column A

Column B

Column C

Column D

04/15/2011

06/15/2011

09/15/2011

01/15/2012

18.

Payment date or date listed in instructions for line 18, whichever is earlier......

18.

/

/

/

/

/

/

/

/

A.

Number of days from the installment date to date of payment or the due

19.

19A.

date of the next installment, whichever is earlier

(see

instructions)..........

days

days

days

Number of days on line 19A

X

X

B.

18%

underpayment on line 17...

19B.

365

20.

A.

20A.

Number of days from January 1, 2012 to the date of payment or January 15, 2012, whichever is earlier........

days

Number of days on line 20A

X

X

B.

18%

underpayment on line 17............................................................

20B.

365

21.

A.

Number of days from January 15, 2012 to the date of payment or April 15, 2012, whichever is earlier........................................

21A.

days

Number of days on line 21A

X

X

B.

18%

underpayment on line 17.........................................................................................

21B.

365

22.

UNDERESTIMATING INTEREST - Total amount from all columns on lines 19B, 20B and 21B. Enter here and on RI-1040, line 15B,

22.

RI-1040NR, line 18B or RI-1041, line 16B. Attach this form to your Rhode Island return. ...............................................................

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1