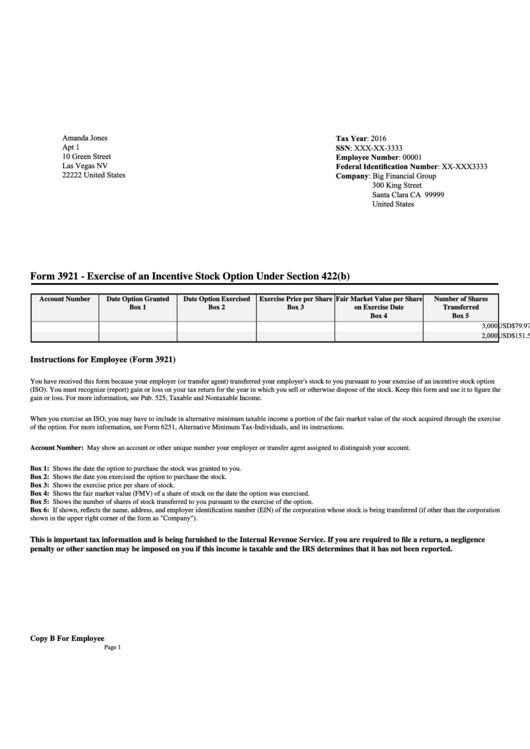

Form 3921 - Exercise Of An Incentive Stock Option Under Section 422(B)

ADVERTISEMENT

Amanda Jones

Tax Year: 2016

Apt 1

SSN: XXX-XX-3333

10 Green Street

Employee Number: 00001

Las Vegas NV

Federal Identification Number: XX-XXX3333

22222 United States

Company: Big Financial Group

300 King Street

Santa Clara CA 99999

United States

Form 3921 - Exercise of an Incentive Stock Option Under Section 422(b)

Account Number

Date Option Granted

Date Option Exercised

Exercise Price per Share

Fair Market Value per Share

Number of Shares

Box 1

Box 2

Box 3

on Exercise Date

Transferred

Box 4

Box 5

044444-01

28-Apr-2009

11-Feb-2016

$19.48

USD

$79.97

USD

3,000

044444-02

30-Apr-2010

21-Nov-2016

$49.18

USD

$151.57

USD

2,000

Instructions for Employee (Form 3921)

You have received this form because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option

(ISO). You must recognize (report) gain or loss on your tax return for the year in which you sell or otherwise dispose of the stock. Keep this form and use it to figure the

gain or loss. For more information, see Pub. 525, Taxable and Nontaxable Income.

When you exercise an ISO, you may have to include in alternative minimum taxable income a portion of the fair market value of the stock acquired through the exercise

of the option. For more information, see Form 6251, Alternative Minimum Tax-Individuals, and its instructions.

Account Number: May show an account or other unique number your employer or transfer agent assigned to distinguish your account.

Box 1: Shows the date the option to purchase the stock was granted to you.

Box 2: Shows the date you exercised the option to purchase the stock.

Box 3: Shows the exercise price per share of stock.

Box 4: Shows the fair market value (FMV) of a share of stock on the date the option was exercised.

Box 5: Shows the number of shares of stock transferred to you pursuant to the exercise of the option.

Box 6: If shown, reflects the name, address, and employer identification number (EIN) of the corporation whose stock is being transferred (if other than the corporation

shown in the upper right corner of the form as "Company").

This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence

penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported.

Copy B For Employee

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1