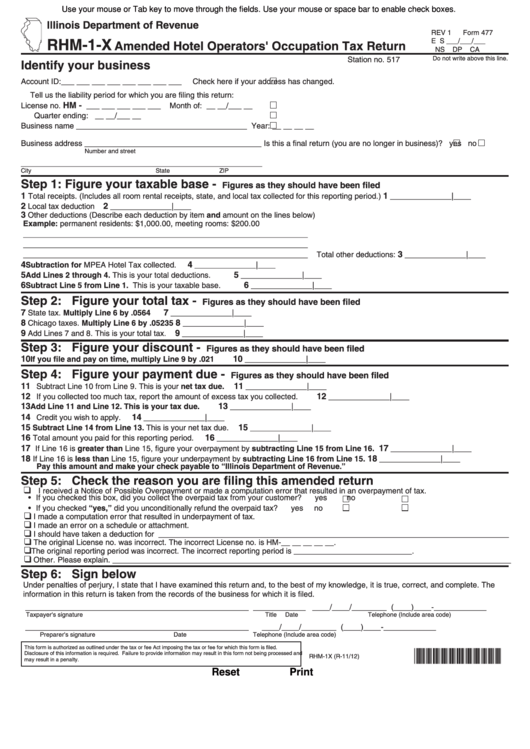

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

REV 1

Form 477

RHM-1-X

E S ___/___/___

Amended Hotel Operators' Occupation Tax Return

NS

DP

CA

Station no. 517

Do not write above this line.

Identify your business

Account ID:___ ___ ___ ___ ___ ___ ___ ___

Check here if your address has changed.

Tell us the liability period for which you are filing this return:

HM -

License no.

___ ___ ___ ___ ___

Month of: __ __/___ __

Quarter ending: __ __/___ __

Business name

_______________________________________

Year: __ __ __ __

Business address ________________________________________

Is this a final return (you are no longer in business)?

yes

no

Number and street

___________________________________________________

City

State

ZIP

Step 1: Figure your taxable base -

Figures as they should have been filed

1

1

Total receipts. (Includes all room rental receipts, state, and local tax collected for this reporting period.)

______________|____

2

2

Local tax deduction

______________|____

3

Other deductions (Describe each deduction by item and amount on the lines below)

Example: permanent residents: $1,000.00, meeting rooms: $200.00

_________________________________________________________________

_________________________________________________________________

3

_________________________________________________________________

Total other deductions:

______________|____

4

4

Subtraction for MPEA Hotel Tax collected.

______________|____

5

5

Add Lines 2 through 4. This is your total deductions.

______________|____

6

6

Subtract Line 5 from Line 1. This is your taxable base.

______________|____

Step 2: Figure your total tax -

Figures as they should have been filed

7

7

State tax. Multiply Line 6 by .0564

______________|____

8

8

Chicago taxes. Multiply Line 6 by .05235

______________|____

9

9

Add Lines 7 and 8. This is your total tax.

______________|____

Step 3: Figure your discount -

Figures as they should have been filed

10

10

If you file and pay on time, multiply Line 9 by .021

______________|____

Step 4: Figure your payment due -

Figures as they should have been filed

11

11

Subtract Line 10 from Line 9. This is your net tax due.

______________|____

12

12

If you collected too much tax, report the amount of excess tax you collected.

______________|____

13

13

Add Line 11 and Line 12. This is your tax due.

______________|____

14

14

Credit you wish to apply.

______________|____

15

15

Subtract Line 14 from Line 13. This is your net tax due.

______________|____

16

16

Total amount you paid for this reporting period.

______________|____

17

17

If Line 16 is greater than Line 15, figure your overpayment by subtracting Line 15 from Line 16.

______________|____

18

18

If Line 16 is less than Line 15, figure your underpayment by subtracting Line 16 from Line 15.

______________|____

Pay this amount and make your check payable to “Illinois Department of Revenue.”

Step 5: Check the reason you are filing this amended return

❑

I received a Notice of Possible Overpayment or made a computation error that resulted in an overpayment of tax.

• If you checked this box, did you collect the overpaid tax from your customer?

yes

no

• If you checked “yes,” did you unconditionally refund the overpaid tax?

yes

no

❑

I made a computation error that resulted in underpayment of tax.

❑

I made an error on a schedule or attachment.

❑

I should have taken a deduction for ________________________________________________________________________________

❑

The original License no. was incorrect. The incorrect License no. is HM-__ __ __ __ __.

❑

The original reporting period was incorrect. The incorrect reporting period is ___________________________.

❑

Other. Please explain. ___________________________________________________________________________________________

Step 6: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete. The

information in this return is taken from the records of the business for which it is filed.

___________________________________________________

____________

____/____/________ (____)____-____________

Taxpayer's signature

Title

Date

Telephone (Include area code)

___________________________________________________

____/____/________ (____)____-____________

Preparer's signature

Date

Telephone (Include area code)

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed.

*247701110*

Disclosure of this information is required. Failure to provide information may result in this form not being processed and

RHM-1X (R-11/12)

may result in a penalty.

Reset

Print

1

1