Reset Form

Rev. 3/07

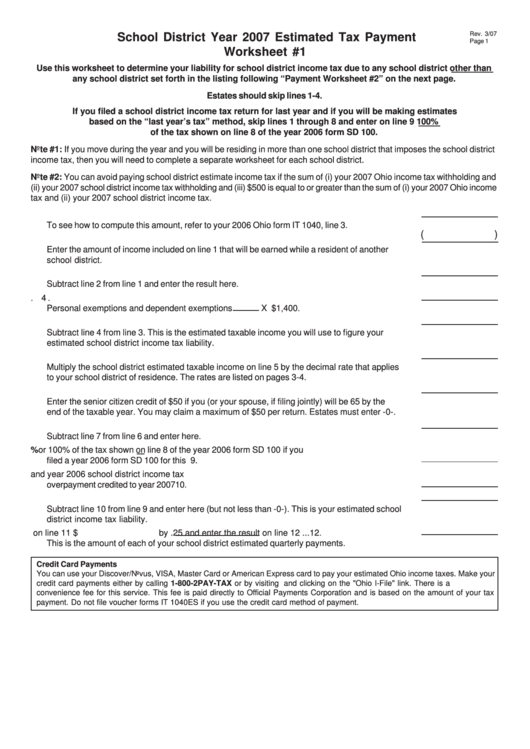

School District Year 2007 Estimated Tax Payment

Page 1

Worksheet #1

Use this worksheet to determine your liability for school district income tax due to any school district other than

any school district set forth in the listing following “Payment Worksheet #2” on the next page.

Estates should skip lines 1-4.

If you filed a school district income tax return for last year and if you will be making estimates

based on the “last year’s tax” method, skip lines 1 through 8 and enter on line 9 100%

of the tax shown on line 8 of the year 2006 form SD 100.

Note #1: If you move during the year and you will be residing in more than one school district that imposes the school district

income tax, then you will need to complete a separate worksheet for each school district.

Note #2: You can avoid paying school district estimate income tax if the sum of (i) your 2007 Ohio income tax withholding and

(ii) your 2007 school district income tax withholding and (iii) $500 is equal to or greater than the sum of (i) your 2007 Ohio income

tax and (ii) your 2007 school district income tax.

1. Enter your year 2007 estimated Ohio adjusted gross income ............................................... 1.

To see how to compute this amount, refer to your 2006 Ohio form IT 1040, line 3.

(

)

2. Part-year/nonresident deduction ............................................................................................. 2.

Enter the amount of income included on line 1 that will be earned while a resident of another

school district.

3. Estimated school district adjusted gross income .................................................................... 3.

Subtract line 2 from line 1 and enter the result here.

4. Exemptions ................................................................................................................................ 4.

Personal exemptions and dependent exemptions

X $1,400.

5. Estimated school district taxable income ............................................................................... 5.

Subtract line 4 from line 3. This is the estimated taxable income you will use to figure your

estimated school district income tax liability.

6. School district tax ..................................................................................................................... 6.

Multiply the school district estimated taxable income on line 5 by the decimal rate that applies

to your school district of residence. The rates are listed on pages 3-4.

7. Senior citizen credit ................................................................................................................... 7.

Enter the senior citizen credit of $50 if you (or your spouse, if filing jointly) will be 65 by the

end of the taxable year. You may claim a maximum of $50 per return. Estates must enter -0-.

8. School district tax after credits ................................................................................................ 8.

Subtract line 7 from line 6 and enter here.

9. Multiply line 8 by 90% or 100% of the tax shown on line 8 of the year 2006 form SD 100 if you

filed a year 2006 form SD 100 for this district ............................................................................... 9.

10. School district income tax to be withheld and year 2006 school district income tax

overpayment credited to year 2007 .............................................................................................. 10.

11. School district estimated income tax due .............................................................................. 11.

Subtract line 10 from line 9 and enter here (but not less than -0-). This is your estimated school

district income tax liability.

12. Multiply the amount on line 11 $

by .25 and enter the result on line 12 ... 12.

This is the amount of each of your school district estimated quarterly payments.

Credit Card Payments

You can use your Discover/Novus, VISA, Master Card or American Express card to pay your estimated Ohio income taxes. Make your

credit card payments either by calling 1-800-2PAY-TAX or by visiting tax.ohio.gov and clicking on the "Ohio I-File" link. There is a

convenience fee for this service. This fee is paid directly to Official Payments Corporation and is based on the amount of your tax

payment. Do not file voucher forms IT 1040ES if you use the credit card method of payment.

1

1 2

2 3

3 4

4