Form 45-010b - Corporation Estimated Income Worksheet - Iowa Department Of Revenue

ADVERTISEMENT

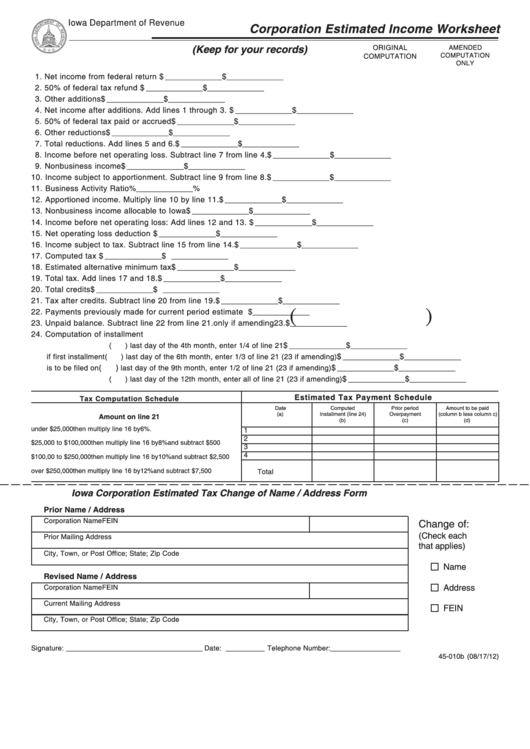

Iowa Department of Revenue

Corporation Estimated Income Worksheet

(Keep for your records)

ORIGINAL

AMENDED

COMPUTATION

COMPUTATION

ONLY

1. Net income from federal return .................................................................................. 1. $ _____________

$ _____________

2. 50% of federal tax refund ........................................................................................... 2. $ _____________

$ _____________

3. Other additions ............................................................................................................ 3. $ _____________

$ _____________

4. Net income after additions. Add lines 1 through 3. .................................................. 4. $ _____________

$ _____________

5. 50% of federal tax paid or accrued ............................................................................ 5. $ _____________

$ _____________

6. Other reductions .......................................................................................................... 6. $ _____________

$ _____________

7. Total reductions. Add lines 5 and 6. .......................................................................... 7. $ _____________

$ _____________

8. Income before net operating loss. Subtract line 7 from line 4. ................................ 8. $ _____________

$ _____________

9. Nonbusiness income ................................................................................................... 9. $ _____________

$ _____________

10. Income subject to apportionment. Subtract line 9 from line 8. ................................ 10. $ _____________

$ _____________

11. Business Activity Ratio ............................................................................................... 11.

____________ %

_____________ %

12. Apportioned income. Multiply line 10 by line 11. ...................................................... 12. $ _____________

$ _____________

13. Nonbusiness income allocable to Iowa ..................................................................... 13. $ _____________

$ _____________

14. Income before net operating loss: Add lines 12 and 13. ......................................... 14. $ _____________

$ _____________

15. Net operating loss deduction ..................................................................................... 15. $ _____________

$ _____________

16. Income subject to tax. Subtract line 15 from line 14. ............................................... 16. $ _____________

$ _____________

17. Computed tax .............................................................................................................. 17. $ _____________

$ _____________

18. Estimated alternative minimum tax ............................................................................ 18. $ _____________

$ _____________

19. Total tax. Add lines 17 and 18. .................................................................................. 19. $ _____________

$ _____________

20. Total credits ................................................................................................................. 20. $ _____________

$ _____________

21. Tax after credits. Subtract line 20 from line 19. ....................................................... 21. $ _____________

$ _____________

(

)

22. Payments previously made for current period estimate tax............... Use these two lines

22. $ _____________

23. Unpaid balance. Subtract line 22 from line 21. ..................................... only if amending

23. $ _____________

24. Computation of installment ......................................................................................... 24.

(

) last day of the 4th month, enter 1/4 of line 21 .........................

$ _____________

$ _____________

if first installment (

) last day of the 6th month, enter 1/3 of line 21 (23 if amending)

$ _____________

$ _____________

is to be filed on

(

)

last day of the 9th month, enter 1/2 of line 21 (23 if amending)

$ _____________

$ _____________

$ _____________

$ _____________

(

) last day of the 12th month, enter all of line 21 (23 if amending)

Estimated Tax Payment Schedule

Tax Computation Schedule

Date

Computed

Prior period

Amount to be paid

(a)

Installment (line 24)

Overpayment

(column b less column c)

Amount on line 21

(b)

(c)

(d)

under $25,000

then multiply line 16 by 6%.

1

2

$25,000 to $100,000 then multiply line 16 by 8% and subtract $500

3

4

$100,00 to $250,000 then multiply line 16 by 10% and subtract $2,500

over $250,000

then multiply line 16 by 12% and subtract $7,500

Total

Iowa Corporation Estimated Tax Change of Name / Address Form

Prior Name / Address

Corporation Name

FEIN

Change of:

(Check each

Prior Mailing Address

that applies)

City, Town, or Post Office; State; Zip Code

Name

Revised Name / Address

Address

Corporation Name

FEIN

Current Mailing Address

FEIN

City, Town, or Post Office; State; Zip Code

Signature: ___________________________________ Date: __________ Telephone Number: __________________

45-010b (08/17/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1