Instructions For 2016 Schedules R - Wisconsin Research Credits

ADVERTISEMENT

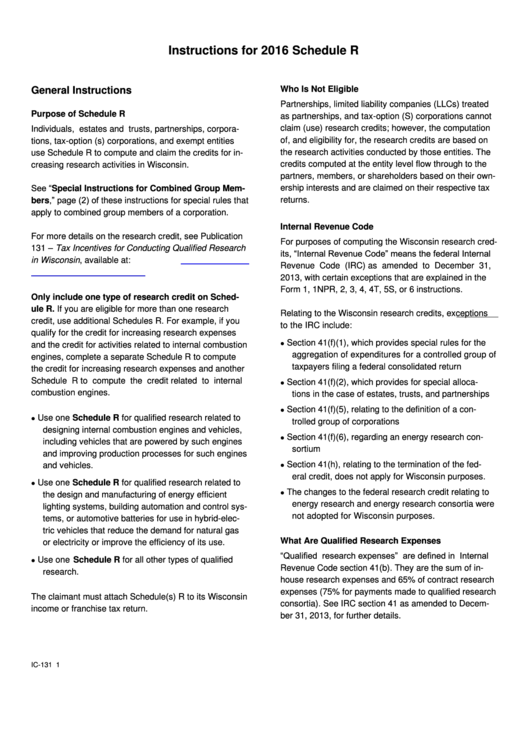

Instructions for 2016 Schedule R

Who Is Not Eligible

General Instructions

Partnerships, limited liability companies (LLCs) treated

Purpose of Schedule R

as partnerships, and tax-option (S) corporations cannot

claim (use) research credits; however, the computation

Individuals, estates and trusts, partnerships, corpora-

of, and eligibility for, the research credits are based on

tions, tax-option (s) corporations, and exempt entities

the research activities conducted by those entities. The

use Schedule R to compute and claim the credits for in-

credits computed at the entity level flow through to the

creasing research activities in Wisconsin.

partners, members, or shareholders based on their own-

See “Special Instructions for Combined Group Mem-

ership interests and are claimed on their respective tax

bers,” page (2) of these instructions for special rules that

returns.

apply to combined group members of a corporation.

Internal Revenue Code

For more details on the research credit, see Publication

For purposes of computing the Wisconsin research cred-

131 – Tax Incentives for Conducting Qualified Research

its, “Internal Revenue Code” means the federal Internal

in

Wisconsin,

available

at:

https://

Revenue Code (IRC) as amended to December 31,

nue.wi.gov/html/taxpubs.html

2013, with certain exceptions that are explained in the

Form 1, 1NPR, 2, 3, 4, 4T, 5S, or 6 instructions.

Only include one type of research credit on Sched-

ule R. If you are eligible for more than one research

Relating to the Wisconsin research credits, exceptions

credit, use additional Schedules R. For example, if you

to the IRC include:

qualify for the credit for increasing research expenses

Section 41(f)(1), which provides special rules for the

and the credit for activities related to internal combustion

aggregation of expenditures for a controlled group of

engines, complete a separate Schedule R to compute

taxpayers filing a federal consolidated return

the credit for increasing research expenses and another

Section 41(f)(2), which provides for special alloca-

Schedule R to compute the credit related to internal

combustion engines.

tions in the case of estates, trusts, and partnerships

Section 41(f)(5), relating to the definition of a con-

Use one Schedule R for qualified research related to

trolled group of corporations

designing internal combustion engines and vehicles,

Section 41(f)(6), regarding an energy research con-

including vehicles that are powered by such engines

sortium

and improving production processes for such engines

Section 41(h), relating to the termination of the fed-

and vehicles.

eral credit, does not apply for Wisconsin purposes.

Use one Schedule R for qualified research related to

The changes to the federal research credit relating to

the design and manufacturing of energy efficient

energy research and energy research consortia were

lighting systems, building automation and control sys-

not adopted for Wisconsin purposes.

tems, or automotive batteries for use in hybrid-elec-

tric vehicles that reduce the demand for natural gas

What Are Qualified Research Expenses

or electricity or improve the efficiency of its use.

“Qualified research expenses” are defined in Internal

Use one Schedule R for all other types of qualified

Revenue Code section 41(b). They are the sum of in-

research.

house research expenses and 65% of contract research

expenses (75% for payments made to qualified research

The claimant must attach Schedule(s) R to its Wisconsin

consortia). See IRC section 41 as amended to Decem-

income or franchise tax return.

ber 31, 2013, for further details.

IC-131

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4