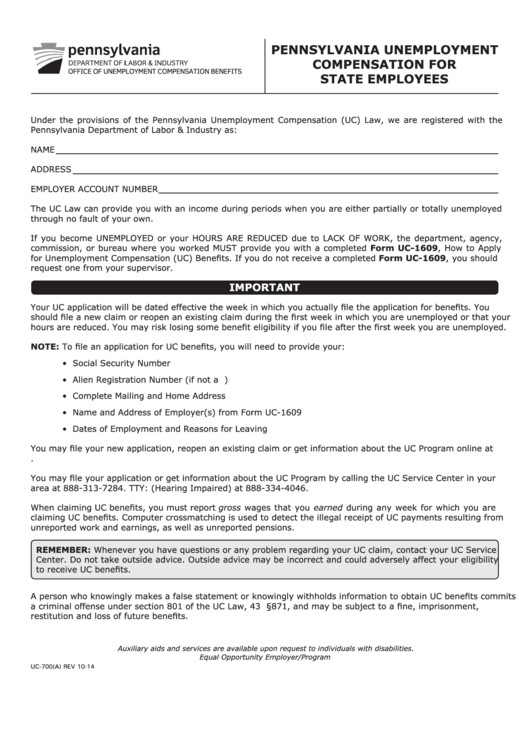

PENNSYLVANIA UNEMPLOYMENT

COMPENSATION FOR

OFFICE OF UNEMPLOYMENT COMPENSATION BENEFITS

STATE EMPLOYEES

Under the provisions of the Pennsylvania Unemployment Compensation (UC) Law, we are registered with the

Pennsylvania Department of Labor & Industry as:

NAME

ADDRESS

EMPLOYER ACCOUNT NUMBER

The UC Law can provide you with an income during periods when you are either partially or totally unemployed

through no fault of your own.

If you become UNEMPLOYED or your HOURS ARE REDUCED due to LACK OF WORK, the department, agency,

commission, or bureau where you worked MUST provide you with a completed Form UC-1609, How to Apply

for Unemployment Compensation (UC) Benefits. If you do not receive a completed Form UC-1609, you should

request one from your supervisor.

IMPORTANT

Your UC application will be dated effective the week in which you actually file the application for benefits. You

should file a new claim or reopen an existing claim during the first week in which you are unemployed or that your

hours are reduced. You may risk losing some benefit eligibility if you file after the first week you are unemployed.

NOTE: To file an application for UC benefits, you will need to provide your:

• Social Security Number

• Alien Registration Number (if not a U.S. citizen)

• Complete Mailing and Home Address

• Name and Address of Employer(s) from Form UC-1609

• Dates of Employment and Reasons for Leaving

You may file your new application, reopen an existing claim or get information about the UC Program online at

You may file your application or get information about the UC Program by calling the UC Service Center in your

area at 888-313-7284. TTY: (Hearing Impaired) at 888-334-4046.

When claiming UC benefits, you must report gross wages that you earned during any week for which you are

claiming UC benefits. Computer crossmatching is used to detect the illegal receipt of UC payments resulting from

unreported work and earnings, as well as unreported pensions.

REMEMBER: Whenever you have questions or any problem regarding your UC claim, contact your UC Service

Center. Do not take outside advice. Outside advice may be incorrect and could adversely affect your eligibility

to receive UC benefits.

A person who knowingly makes a false statement or knowingly withholds information to obtain UC benefits commits

a criminal offense under section 801 of the UC Law, 43 P.S. §871, and may be subject to a fine, imprisonment,

restitution and loss of future benefits.

Auxiliary aids and services are available upon request to individuals with disabilities.

Equal Opportunity Employer/Program

UC-700(A) REV 10-14

1

1