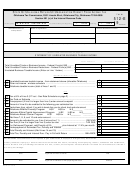

Form 990-Ez - Return Of Organization Exempt From Income Tax - 2012 Page 12

ADVERTISEMENT

Schedule G (Form 990 or 990-EZ) 2012

Does the organization operate gaming activities with nonmembers?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. Yes r- No

12

Is the organization a grantor , beneficiary or trustee of a trust or a member of a partnership or other entity

formed to administer charitable gaming?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. Yes r- No

13

Indicate the percentage of gaming activity operated in

a

The organization ' s facility

13a

b

An outside facility

13b

14

Enter the name and address of the person who prepares the organization's gaming / special events books and records

Name

Address

15a

Does the organization have a contract with a third party from whom the organization receives gaming

revenue?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

r- Yes r- No

b

If "Yes," enter the amount of gaming revenue received by the organization

$

and the

amount of gaming revenue retained by the third party

$

c

If "Yes," enter name and address of the third party

Name '

Address '

---------------- ------------------------------ ------------------------------ ------------------------------------------------------------ ------------------------------ -

16

Gaming manager information

Name llik^

------------ ----------------------- ---------------------- ----------------------- ----------------------- ----------------------- ---------------------- -

Gaming manager compensation

$ _ --------------------------------------------

Description of services provided

---------- ------------------ ------------------ ------------------ ------------------- ------------------ ------------------ ------------------ ----------

r- Director/ officer

Employee

Independent contractor

17

Mandatory distributions

a

Is the organization required understate law to make charitable distributions from the gaming proceeds to

retain the state gaming license?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

r-Yes

r-No

b

Enter the amount of distributions required under state law distributed to other exempt organizations or spent

in the organization ' s own exempt activities during the tax year

$

Supplemental Information . Complete this part to provide the explanations required by Part I, line 2b,

columns ( iii) and (v ), and Part III, lines 9 , 9b, 10b , 15b, 15c, 16, and 17b , as applicable. Also complete this

part to provide any additional information ( see instructions).

I

Identifier

Return Reference

I

Explanation

Page 3 11

Schedule G (Form 990 or 990-EZ) 2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15