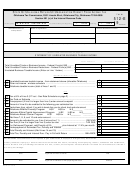

Form 990-Ez - Return Of Organization Exempt From Income Tax - 2012 Page 4

ADVERTISEMENT

Form 990-EZ (2012)

46

Did the organization engage, directly or indirectly, in political campaign activities on behalf of or in opposition to

candidates for public office? If "Yes," complete Schedule C, Part I

.

.

.

.

.

.

.

.

.

.

.

.

.

Page 4

No

No

Milil"i

Section 501 ( c)(3) organizations only

All section 501(c)(3) organizations must answer questions 47-49b and 52, and complete the tables for lines 50

and 51

Check if the organization used Schedule 0 to respond to any question in this Part VI

.1

. . . . . . . . . . . . . . .

Yes

No

47

Did the organization engage in lobbying activities or have a section 501(h) election in effect during the tax year?

If "Yes," complete Schedule C, Part II

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

47

No

48

Is the organization a school as described in section 170(b)(1)(A)(ii)? If "Yes," complete Schedule E

48

No

49a

Did the organization make any transfers to an exempt non-charitable related organization?

.

.

.

49a

No

b If "Yes," was the related organization a section 527 organization? .

.

.

.

.

.

.

.

.

.

.

.

.

49b

50

Complete this table for the organization's five highest compensated employees (other than officers, directors, trustees and key

employees) who each received more than $100,000 of compensation from the organization If there is none, enter "None "

(a) Name and title of each employee paid

more than $100,000

(b) Average

hours per week

devoted to position

(c) Reportable

compensation

(Forms W-2/1099-

MISC)

(d) Health benefits,

contributions to

employee benefit plans,

and deferred

compensation

(e) Estimated amount

of other compensation

NONE

f

Total number of other employees paid over $100,000

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. sk.

51

Complete this table for the organization's five highest compensated independent contractors who each received more than $100,000

of compensation from the organization If there is none, enter "None "

(a) Name and address of each independent contractor paid more than $100,000

(b) Type of service

(c) Compensation

NONE

d

Total number of other independent contractors each receiving over $10

52

Did the organization complete Schedule A? NOTE: All Section 501(c)(

nonexempt charitable trusts must attach a completed Schedule A

.

Under penalties of perjury, I declare that I have examined this return, including acco

knowledge and belief, it is true, correct , and complete . Declaration of preparer (othe

knowledge.

Sign

Signature of officer

Here

W ayne R Connell President

Type or print name and title

Print/Type preparer's name

Preparers signature

Judy 0 Huggins

Paid

Firm's name

1- Tax Solutions Inc

Pre pare r

Use Only

Firm's address 0-6200 S Syracuse Way Suite 125

Englewood, CO 80111

May the IRS discuss this return with the preparer shown above? See instructio

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15